Fill a Valid Uc 2 Connecticut Template

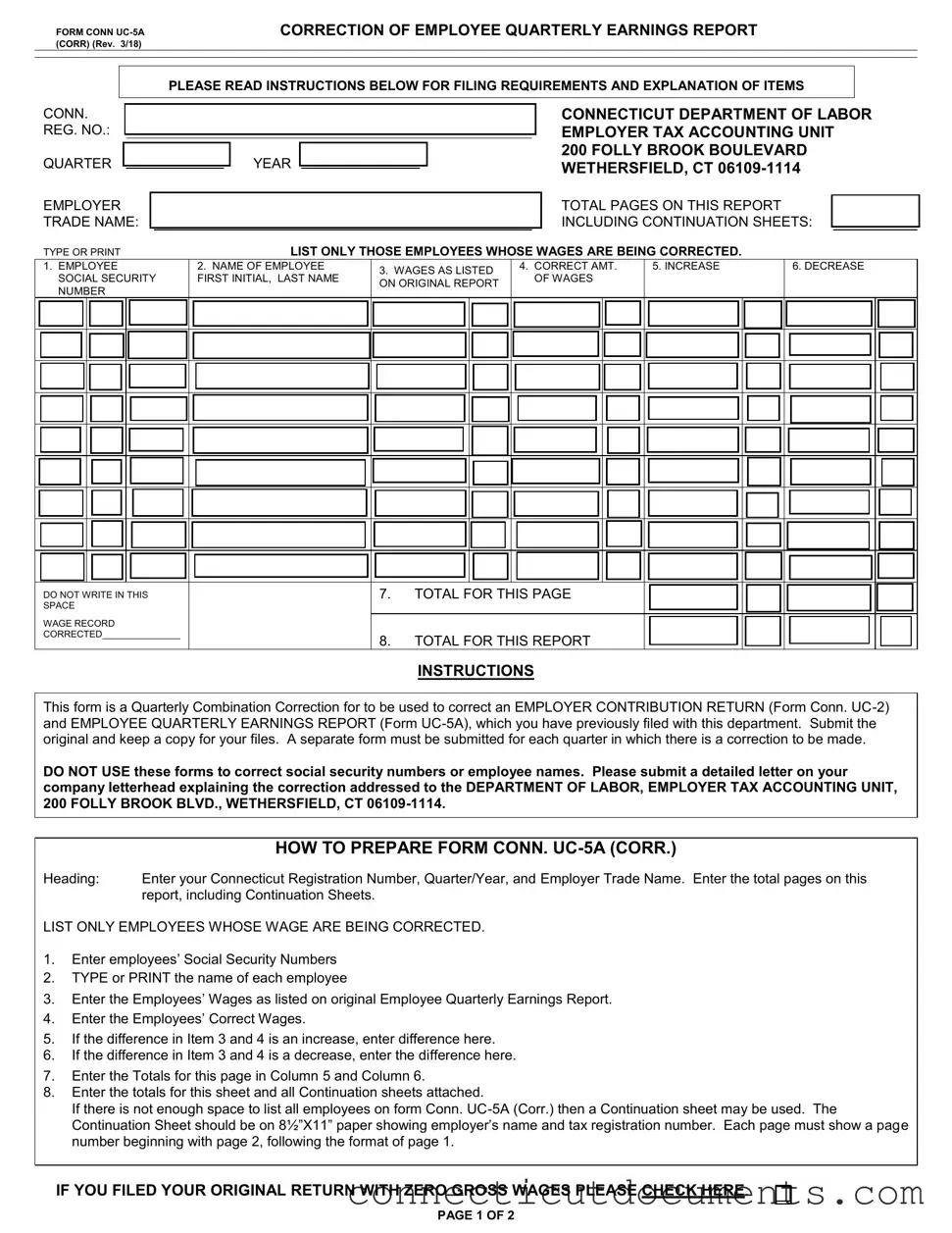

The UC-2 Connecticut form is an essential tool for employers looking to correct previously submitted earnings reports and contribution returns. This form serves a dual purpose: it allows employers to amend their Employer Contribution Return (Form UC-2) and the Employee Quarterly Earnings Report (Form UC-5A). When discrepancies arise in reported wages or contributions, using the UC-2 form is crucial to ensure compliance with state regulations. Each quarter requiring corrections mandates a separate submission, emphasizing the importance of accuracy in payroll reporting. Notably, this form should not be used for correcting social security numbers or employee names; instead, employers must submit a detailed letter to the Department of Labor explaining the nature of the correction. Properly completing the form involves entering specific information, such as the Connecticut Registration Number, quarter and year, and the correct wages for affected employees. Employers must also calculate any differences in contributions due and potential penalties for late filings. Understanding how to navigate the UC-2 form can help employers avoid costly mistakes and ensure their payroll records are up to date.

Documents used along the form

When dealing with the UC-2 Connecticut form, it's essential to understand other related documents that may be required. These forms help ensure compliance with state regulations and maintain accurate records for both employers and employees. Below is a list of forms commonly used alongside the UC-2.

- Form UC-5A: This is the Employee Quarterly Earnings Report. It details the wages paid to employees during a quarter and is crucial for calculating employer contributions.

- California Affidavit of Service Form: Ensure proper legal notification with our essential guide to the Affidavit of Service form for California proceedings.

- Form UC-5A (Corr): A correction form specifically for the Employee Quarterly Earnings Report. Use it to amend any errors in previously reported employee wages.

- Form UC-2: The Employer Contribution Return, which outlines the total contributions owed based on reported wages. This is a primary document for employers.

- Form UC-2 (Corr): Similar to the UC-2, this correction form is used to amend any inaccuracies in the employer contribution return.

- Continuation Sheet: If additional space is needed to list employees or wages, this sheet should be used. It must include the employer’s name and tax registration number.

- Form CT-941: This is the Connecticut Employer's Quarterly Tax Return. It summarizes the total wages paid and taxes withheld for state income tax purposes.

- Form CT-W3: The Annual Reconciliation of Withholding, which compiles all quarterly withholding reports into one annual summary.

- Form W-2: This form reports an employee's annual wages and the taxes withheld. Employers must provide this to their employees by January 31 each year.

- Form 1099-MISC: Used to report payments made to independent contractors or freelancers. This form is necessary for tax purposes if payments exceed a certain threshold.

- Form 941: The Employer's Quarterly Federal Tax Return, which reports income taxes, social security tax, and Medicare tax withheld from employee paychecks.

Understanding these forms is crucial for maintaining compliance with state and federal regulations. Ensure you have all necessary documents ready and accurate to avoid potential issues with tax authorities. Taking prompt action can save time and prevent complications down the road.

Additional PDF Templates

Ct Change of Address Form - Make sure to copy your current registration details accurately.

To fully understand your rights as a landlord or tenant, it's essential to consult the Arizona Notice to Quit form guide, which outlines the necessary steps and legal implications of eviction proceedings.

License Suspension Ct - Punctual execution and submission of this bond can expedite the licensing process.

Fake Accident Report - Special features of the roadway, such as bridges and ramps, are included for context.

Similar forms

The UC-2 Connecticut form is similar to the IRS Form 941, which is used by employers to report income taxes, Social Security tax, and Medicare tax withheld from employee paychecks. Both forms require employers to provide detailed information about their employees' wages and the corresponding tax contributions. Like the UC-2, the IRS Form 941 allows for corrections to be made, ensuring that accurate information is reported to the respective tax authorities. This process helps maintain compliance with federal and state tax regulations.

Another document similar to the UC-2 is the IRS Form 944. This form is designed for small employers to report annual payroll taxes instead of quarterly. While the UC-2 focuses on state unemployment contributions, both forms require employers to report wages and taxes withheld. The UC-2 allows for corrections, just as the IRS Form 944 does, ensuring that employers can amend their reports if discrepancies arise throughout the year.

The Connecticut Form UC-5A also shares similarities with the IRS Form W-2, which reports annual wages and taxes withheld for each employee. Both forms require detailed information about employee earnings and deductions. While the UC-5A is specifically for quarterly corrections, the W-2 serves as an annual summary. Both documents play crucial roles in ensuring that employees receive accurate tax information for their filings.

The Connecticut Form UC-5A (Corr) is akin to the IRS Form 1099-MISC, which is used to report payments made to independent contractors. Both forms require reporting of earnings, but they differ in that the UC-5A focuses on corrections for employees’ wages, while the 1099-MISC is for non-employee compensation. However, both documents are essential for maintaining accurate financial records and tax compliance.

Understanding the nuances of various state and federal tax forms is essential for employers navigating compliance; for instance, the New York Rental Application form is a critical document used by landlords to assess and evaluate potential tenants before signing a lease agreement. It collects comprehensive information to ensure the applicant is a good fit for the property, similar to how the form is pivotal in the New York housing process, as detailed in NY PDF Forms, setting the stage for a successful landlord-tenant relationship.

Similar to the UC-2 is the Connecticut Employer Contribution Return (Form UC-2), which is used for reporting unemployment contributions. While the UC-2 form is specifically for contributions, it is closely related to the UC-5A in that both forms are utilized to ensure accurate reporting of employee wages and employer contributions. Corrections on either form help maintain the integrity of the unemployment insurance system.

The UC-2 form also resembles the IRS Form 940, which is used for reporting annual Federal Unemployment Tax Act (FUTA) taxes. Both forms require employers to report their contributions to unemployment insurance, though the UC-2 focuses on state-level contributions. Corrections can be made on both forms to address any discrepancies, ensuring that employers remain compliant with unemployment tax obligations.

Another comparable document is the Connecticut Form CT-941, which is used for reporting Connecticut income tax withheld from employees. Similar to the UC-2, the CT-941 requires employers to submit accurate information about wages and tax withholdings. Both forms allow for corrections to be made, ensuring that employers can rectify any errors in their reports promptly.

Lastly, the UC-2 is similar to the IRS Form 720, which is used to report and pay certain federal excise taxes. While the focus of the UC-2 is on unemployment contributions, both forms require detailed financial reporting. Corrections can be made on both forms to ensure that the correct amounts are reported and paid, helping to maintain compliance with tax regulations.

Important Questions on This Form

What is the purpose of the UC-2 Connecticut form?

The UC-2 Connecticut form serves as a Correction of Employer Contribution Return. It is specifically designed for employers who need to amend previously filed reports regarding their contributions and employee wages. By using this form, employers can rectify errors in their Employer Contribution Return and Employee Quarterly Earnings Report. This ensures that all information is accurate and up-to-date, which is crucial for compliance with state regulations.

How do I fill out the UC-2 form correctly?

To complete the UC-2 form, begin by entering your Connecticut Registration Number, the relevant quarter and year, and your employer trade name at the top of the form. Each section requires specific information: for example, you must provide the gross wages as listed on the original return and the corrected amounts. If there are discrepancies, you will need to indicate whether there is an increase or decrease. It's important to double-check each entry for accuracy. If you need additional space, you may use a continuation sheet, ensuring it includes your employer name and tax registration number. Finally, the form must be signed by a responsible and authorized individual before submission.

What should I do if I need to correct employee names or Social Security numbers?

The UC-2 form is not intended for correcting employee names or Social Security numbers. If you need to make such corrections, you should submit a detailed letter on your company letterhead. This letter should explain the correction and be addressed to the Department of Labor, Employer Tax Accounting Unit, at the specified Wethersfield address. This separate process ensures that name and Social Security number corrections are handled appropriately and do not interfere with the correction of wage reports.

What happens if I submit the form late?

If the UC-2 form is submitted after the due date, you may incur penalties and interest on the additional contributions due. Interest accrues at a rate of 1% for each month, or part of a month, that the return is late. For example, if you file your return late for the first quarter, interest begins to accrue starting May 1st. Additionally, a penalty of 10% or $50, whichever is greater, may apply if contributions are not paid within thirty days of the due date. It is crucial to file and pay on time to avoid these additional costs.

Misconceptions

Misconception 1: The UC-2 form can be used to correct employee names or Social Security numbers.

This is not true. The UC-2 form is specifically for correcting employer contribution returns and employee quarterly earnings reports. For corrections related to names or Social Security numbers, a detailed letter on company letterhead must be submitted instead.

Misconception 2: You only need to submit one form for all corrections across multiple quarters.

In reality, a separate form must be submitted for each quarter where corrections are needed. This ensures that each correction is properly documented and processed by the Department of Labor.

Misconception 3: It is acceptable to list all employees on a single UC-5A form without a continuation sheet.

This is incorrect. You should only list employees whose wages are being corrected on the UC-5A form. If there are too many employees to fit on one form, a continuation sheet is required. This sheet must include the employer’s name and tax registration number.

Misconception 4: You do not need to provide a reason for the corrections.

This is a misunderstanding. The UC-2 form requires an explanation for the correction in Item 9. Providing a clear reason helps the Department of Labor understand the context of the changes being made.

Dos and Don'ts

Things to Do When Filling Out the UC-2 Connecticut Form:

- Ensure all information is typed or printed clearly to avoid confusion.

- List only those employees whose wages are being corrected.

- Double-check Social Security Numbers for accuracy.

- Include a detailed letter on company letterhead explaining the correction.

- Use a separate form for each quarter that requires a correction.

- Sign the correction return with an authorized signature before submission.

- Keep a copy of the completed form and any correspondence for your records.

Things Not to Do When Filling Out the UC-2 Connecticut Form:

- Do not use this form to correct social security numbers or employee names.

- Avoid submitting incomplete forms; ensure all required sections are filled out.

- Do not forget to include totals for each page and continuation sheets.

- Never submit corrections without a clear explanation letter if needed.

- Do not delay in filing; penalties may apply for late submissions.

- Do not ignore the specific instructions for each section of the form.

- Refrain from using any form of shorthand or abbreviations that may cause misunderstanding.

Detailed Guide for Writing Uc 2 Connecticut

Completing the UC 2 Connecticut form involves careful attention to detail to ensure accuracy in reporting corrections. Follow the steps outlined below to fill out the form correctly. Ensure that all necessary information is provided and that you submit the original form while keeping a copy for your records.

- Heading: Enter your Connecticut Registration Number, the Quarter/Year, and your Employer Trade Name. Also, indicate the total number of pages for this report.

- Employee Information: List only those employees whose wages are being corrected.

- For each employee, enter their Social Security Number.

- Type or print the name of each employee.

- Enter the Employees’ Wages as listed on the original Employee Quarterly Earnings Report.

- Enter the Employees’ Correct Wages.

- If the difference between the original and corrected wages is an increase, enter the difference in the designated column.

- If the difference is a decrease, enter that difference in the appropriate column.

- Calculate and enter the totals for this page in Columns 5 and 6.

- For additional employees, use a Continuation Sheet if necessary. Ensure it includes your employer’s name and tax registration number, and label pages sequentially.

- Correction Reason: If you filed your original return with zero gross wages, check the appropriate box.

Once you have completed the form, review all entries for accuracy. After verifying the information, submit the form along with any required attachments to the Employer Tax Accounting Unit at the specified address. Keep in mind that any corrections should be submitted promptly to avoid penalties or interest charges.