Attorney-Verified Transfer-on-Death Deed Form for the State of Connecticut

The Connecticut Transfer-on-Death Deed form offers a straightforward way for property owners to designate beneficiaries who will inherit their real estate upon their passing, bypassing the often lengthy probate process. This form allows individuals to maintain control over their property during their lifetime while ensuring a smooth transition of ownership after death. By completing and recording this deed, property owners can specify who will receive their property, whether it be family members, friends, or charitable organizations. Importantly, the Transfer-on-Death Deed does not affect the owner’s rights to sell, lease, or mortgage the property while they are alive. Additionally, the form must be executed and recorded according to Connecticut law to be valid, which includes signing in the presence of a notary public. Understanding the nuances of this deed can help individuals make informed decisions about their estate planning and ensure their wishes are honored after they are gone.

Documents used along the form

The Connecticut Transfer-on-Death Deed form allows property owners to transfer real estate to beneficiaries upon their death without going through probate. This document is part of a broader estate planning strategy. Several other forms and documents often accompany this deed to ensure a smooth transition of property ownership and to address various aspects of estate management.

- Last Will and Testament: This document outlines how an individual wishes to distribute their assets upon death. It can include specific bequests, appoint guardians for minors, and name an executor to manage the estate.

- Living Trust: A living trust allows individuals to place assets into a trust during their lifetime. It can help avoid probate and provides detailed instructions on asset management and distribution.

- Durable Power of Attorney: This form designates an individual to manage financial and legal matters on behalf of the property owner if they become incapacitated. It ensures that decisions can be made without court intervention.

- Quitclaim Deed: A New York Quitclaim Deed form transfers property ownership rights from one person to another without any guarantee about the property's title. This form is often used among family members or to clear up title issues. Unlike other deed forms, it carries no warranties, making it crucial for the receiving party to conduct thorough due diligence. For further information, you can refer to the NY PDF Forms.

- Health Care Proxy: This document appoints someone to make medical decisions on behalf of the individual if they are unable to do so themselves. It is crucial for ensuring that health care wishes are respected.

- Beneficiary Designation Forms: These forms are used to designate beneficiaries for accounts such as life insurance policies, retirement accounts, and bank accounts. They ensure that assets pass directly to the named individuals upon death.

- Affidavit of Heirship: This document is used to establish the heirs of a deceased person, particularly when there is no will. It helps clarify the rightful heirs and can assist in the transfer of property ownership.

Utilizing these forms in conjunction with the Connecticut Transfer-on-Death Deed can facilitate a comprehensive estate plan. Each document serves a distinct purpose, contributing to the orderly management and transfer of assets in accordance with the property owner's wishes.

More Connecticut Templates

Connecticut Bill of Sale - This form can assist in proving ownership in case of theft or loss.

Understanding the importance of the Arizona Notice to Quit form is vital for landlords to ensure proper eviction procedures and tenant compliance.

Ct State Requirements for Homeschooling - A statement that signifies intentionality in the educational process.

Similar forms

The Connecticut Transfer-on-Death Deed (TOD) form shares similarities with a Last Will and Testament. Both documents serve the purpose of transferring property upon the death of the owner. However, while a will requires probate—a legal process that can be time-consuming and costly—a TOD deed allows for the direct transfer of property to the designated beneficiary without the need for probate. This simplicity can make the transfer process smoother and faster, benefiting the heirs who receive the property directly upon the owner's death.

An additional document comparable to the TOD deed is the Revocable Living Trust. Like the TOD deed, a living trust allows individuals to specify how their assets should be distributed after their death. The key difference lies in the management of assets during the grantor's lifetime. A revocable living trust can hold and manage assets while the grantor is still alive, providing flexibility and control. Upon the grantor’s death, the assets in the trust are distributed according to the terms laid out in the trust document, avoiding probate, much like the TOD deed.

In the realm of property transfer, understanding various documents is essential, and one such critical form in California is the California Form REG 262. This form plays a vital role in the ownership transfer of vehicles and vessels, ensuring that all necessary details are accurately recorded. For those looking to learn more about this form, further information is available at formcalifornia.com/editable-california-fotm-reg-262-form/, where users can find guidance on completing the form correctly to adhere to state regulations.

Lastly, the Life Estate Deed is another document that bears resemblance to the TOD deed. A life estate deed allows an individual to retain the right to use and occupy a property during their lifetime while designating a remainderman who will inherit the property upon their death. This arrangement provides a way to ensure that the property is transferred according to the owner’s wishes, similar to the TOD deed. Both documents facilitate a seamless transition of property ownership, reducing the complexities often associated with estate planning and probate.

Important Questions on This Form

What is a Transfer-on-Death Deed in Connecticut?

A Transfer-on-Death Deed (TOD Deed) is a legal document that allows an individual to transfer real property to a beneficiary upon the individual's death. This type of deed enables the property owner to retain full control of the property during their lifetime while designating a recipient for the property after their passing.

Who can use a Transfer-on-Death Deed?

Any individual who owns real property in Connecticut can utilize a Transfer-on-Death Deed. This includes homeowners and property owners who wish to designate a beneficiary for their property without going through probate.

What are the benefits of using a Transfer-on-Death Deed?

The primary benefit of a Transfer-on-Death Deed is that it allows property to pass directly to the designated beneficiary without the need for probate. This can save time and money. Additionally, the property owner retains full control of the property during their lifetime and can revoke or change the deed at any time before death.

How do I create a Transfer-on-Death Deed?

To create a Transfer-on-Death Deed, the property owner must complete the form, including the property description and the name of the beneficiary. The deed must then be signed in the presence of a notary public and recorded with the local town clerk's office where the property is located.

Can I revoke a Transfer-on-Death Deed?

Yes, a Transfer-on-Death Deed can be revoked at any time before the property owner's death. This can be done by executing a new deed that explicitly states the revocation or by creating a new TOD Deed that names a different beneficiary.

What happens if the beneficiary predeceases the property owner?

If the designated beneficiary passes away before the property owner, the Transfer-on-Death Deed will be ineffective. In such cases, the property owner may choose to create a new deed naming a different beneficiary or allow the property to pass according to their will or state law.

Is a Transfer-on-Death Deed subject to taxes?

Generally, a Transfer-on-Death Deed does not trigger immediate tax consequences for the property owner. However, the beneficiary may be responsible for property taxes after the property is transferred. It is advisable to consult a tax professional for specific guidance related to individual circumstances.

Can I use a Transfer-on-Death Deed for all types of property?

A Transfer-on-Death Deed can only be used for real property, such as land and buildings. It cannot be used for personal property, such as vehicles or bank accounts. Separate arrangements must be made for those types of assets.

Do I need an attorney to create a Transfer-on-Death Deed?

While it is not legally required to have an attorney to create a Transfer-on-Death Deed, consulting with a legal professional can help ensure that the deed is properly executed and meets all legal requirements. This may provide peace of mind and help avoid potential issues in the future.

Where do I file a Transfer-on-Death Deed?

The completed Transfer-on-Death Deed must be recorded with the town clerk's office in the municipality where the property is located. It is important to ensure that the deed is filed correctly to ensure the intended transfer of property upon death.

Misconceptions

Understanding the Connecticut Transfer-on-Death Deed (TOD) form can be challenging, and several misconceptions often arise. Here are eight common misunderstandings, clarified for better comprehension:

- It only applies to real estate. Many believe the TOD deed is limited to real property. However, it specifically pertains to real estate and does not cover personal property or financial accounts.

- It avoids probate entirely. While a TOD deed allows property to pass outside of probate, it does not eliminate the probate process for other assets or debts the deceased may have had.

- It can be revoked easily. Some think that revoking a TOD deed is straightforward. In reality, a formal revocation process must be followed, which involves filing a new deed with the appropriate authorities.

- Only individuals can be beneficiaries. There is a misconception that only individuals can receive property through a TOD deed. In fact, entities like trusts or organizations can also be named as beneficiaries.

- It guarantees a smooth transfer of property. Although the TOD deed simplifies the transfer process, complications may still arise, such as disputes among heirs or issues with the property title.

- It is effective immediately upon signing. Some individuals believe that once they sign the TOD deed, it is immediately effective. The deed must be recorded with the town clerk to be valid and enforceable.

- It can be used for any type of property. There is a common belief that the TOD deed can be applied to any real estate. However, it is not applicable to certain types of properties, such as those held in joint tenancy or properties subject to a mortgage.

- All states have the same laws regarding TOD deeds. Many assume that the rules governing TOD deeds are uniform across the country. In fact, each state has its own laws and requirements, making it essential to understand Connecticut's specific regulations.

By dispelling these misconceptions, individuals can make more informed decisions regarding the use of the Transfer-on-Death Deed in Connecticut.

Dos and Don'ts

When filling out the Connecticut Transfer-on-Death Deed form, it’s essential to approach the task with care. Here are some important do's and don'ts to keep in mind:

- Do ensure that you have the correct legal description of the property.

- Do clearly identify the beneficiary or beneficiaries.

- Do sign the deed in the presence of a notary public.

- Do record the deed with the town clerk where the property is located.

- Don't leave out any required information; incomplete forms may lead to issues.

- Don't use vague terms when describing the property or beneficiaries.

- Don't forget to review the deed for accuracy before submission.

Following these guidelines will help ensure that the Transfer-on-Death Deed is completed correctly and meets all legal requirements.

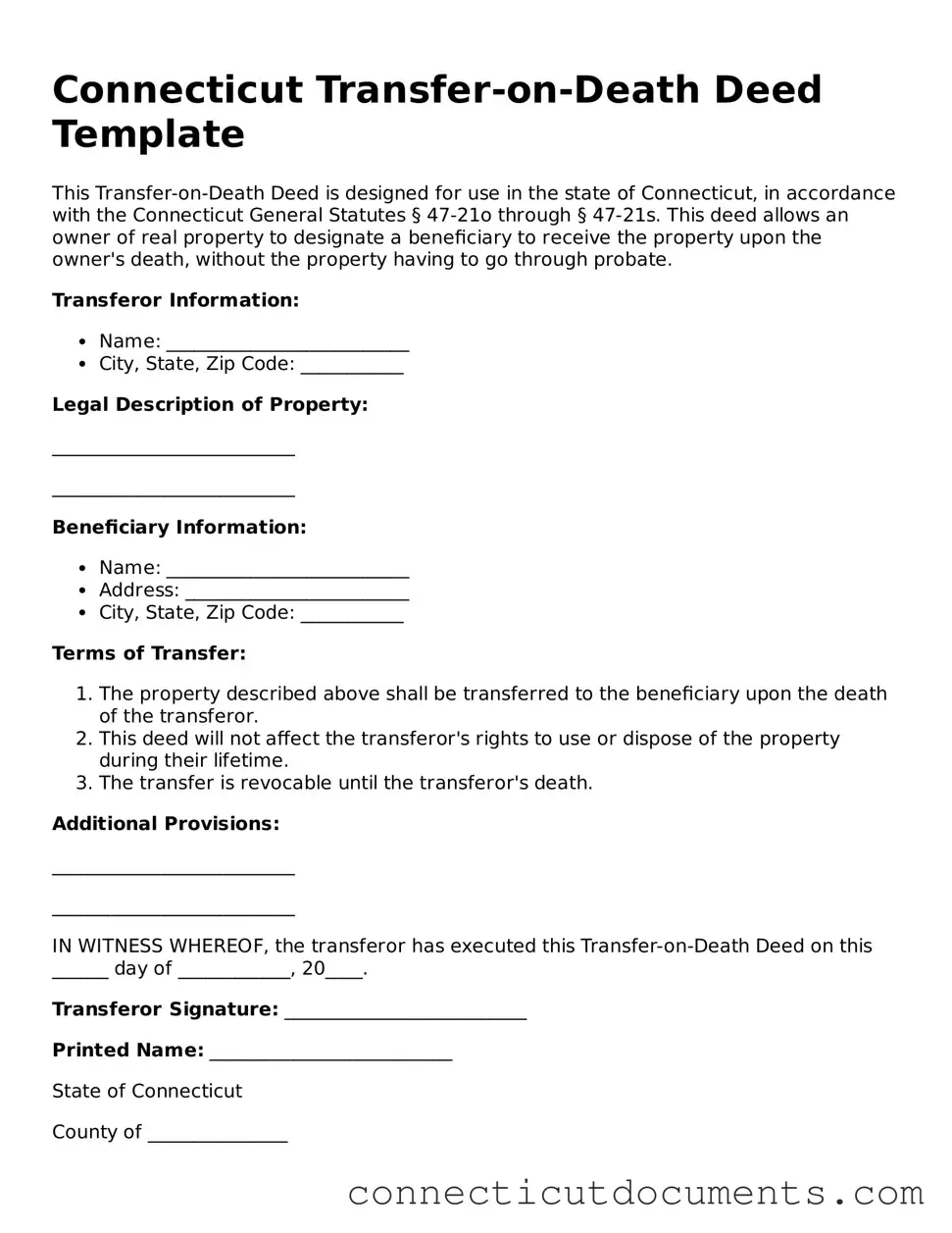

Detailed Guide for Writing Connecticut Transfer-on-Death Deed

After gathering the necessary information and documents, you can begin completing the Connecticut Transfer-on-Death Deed form. This deed allows property owners to transfer their real estate to designated beneficiaries upon their passing. Follow these steps carefully to ensure accuracy and compliance.

- Obtain the Connecticut Transfer-on-Death Deed form from a reliable source, such as the Connecticut Secretary of the State’s website or a legal stationery store.

- In the first section, provide the name and address of the property owner(s). Ensure that the names match the names on the property title.

- Next, include the name and address of the designated beneficiary or beneficiaries. You may list multiple beneficiaries if desired.

- Identify the property being transferred by providing a full legal description. This can often be found on the property deed or tax records.

- Fill in the date of execution. This is the date on which you are signing the deed.

- Sign the form in the presence of a notary public. The notary will verify your identity and witness your signature.

- Have the notary public complete their section, including their signature and seal.

- Make copies of the completed and notarized deed for your records.

- File the original deed with the appropriate town or city clerk’s office where the property is located. There may be a filing fee, so check with the local office for details.

Once the form is filed, it will be recorded in the public records. This ensures that your intentions regarding the property transfer are legally recognized and upheld after your passing.