Attorney-Verified Small Estate Affidavit Form for the State of Connecticut

In Connecticut, the Small Estate Affidavit serves as a valuable tool for individuals managing the estates of deceased loved ones with limited assets. This form simplifies the process of transferring property without the need for a formal probate proceeding, which can often be time-consuming and costly. To qualify for this streamlined procedure, the total value of the estate must not exceed a specific threshold, making it accessible for many families. The affidavit allows the affiant, typically an heir or beneficiary, to assert their right to the decedent's assets and facilitates the distribution of those assets to the rightful heirs. Key components of the form include details about the decedent, a declaration of the estate's value, and a list of the individuals entitled to inherit. Additionally, the affidavit must be notarized to ensure its validity. By understanding the Small Estate Affidavit process, individuals can navigate the complexities of estate management more effectively, ensuring that the wishes of the deceased are honored and that beneficiaries receive their rightful inheritance in a timely manner.

Documents used along the form

When dealing with the Connecticut Small Estate Affidavit, several other forms and documents may be necessary to ensure a smooth process. These documents help establish the identity of heirs, clarify asset distribution, and fulfill legal requirements. Below is a list of commonly used forms that may accompany the Small Estate Affidavit.

- Death Certificate: This official document confirms the death of the individual whose estate is being settled. It is required to initiate the probate process.

- Will: If the deceased left a will, it must be presented. The will outlines the distribution of assets and may affect how the Small Estate Affidavit is completed.

- List of Assets: A detailed inventory of the deceased's assets is essential. This list helps to determine whether the estate qualifies as a small estate under Connecticut law.

- Affidavit of Heirship: This document may be used to establish the legal heirs of the deceased. It provides proof of relationship and can be critical in asset distribution.

- California LLC-1 Form: To establish a limited liability company in California, it is essential to file the California LLC-1 form, also known as Articles of Organization. Detailed instructions can be found at https://formcalifornia.com/editable-california-llc-1-form/.

- Notice to Creditors: This notice informs creditors of the deceased's passing and provides them with an opportunity to make claims against the estate.

- Tax Returns: The deceased's final income tax returns may need to be filed. This ensures that any outstanding tax obligations are settled before asset distribution.

- Bank Statements: Recent bank statements for accounts held by the deceased may be required to verify asset values and ownership.

- Property Deeds: If real estate is part of the estate, property deeds will need to be submitted to establish ownership and facilitate transfer.

- Financial Statements: These documents provide a comprehensive overview of the deceased's financial situation, including liabilities and assets.

- Consent Forms: If there are multiple heirs, consent forms may be necessary to confirm agreement on the distribution of the estate.

Each of these documents plays a critical role in the estate settlement process in Connecticut. Ensuring that all necessary forms are completed and submitted can help avoid delays and legal complications. It is advisable to gather these documents early to facilitate a smoother transition during this challenging time.

More Connecticut Templates

Connecticut Durable Power of Attorney Form - Your selected agent should be someone you trust completely.

One helpful resource to get started with this process is the website texasformspdf.com/, where you can find a fillable Durable Power of Attorney form tailored for Texas residents, ensuring you can delegate authority in a simple and efficient manner.

Connecticut Landlord Tenant Law Month-to-month - The agreement often includes information about parking arrangements, addressing how many vehicles can be parked on the property.

Bill of Sale Ct Dmv - This form captures essential details including the vehicle's make, model, and VIN.

Similar forms

The Connecticut Small Estate Affidavit is similar to a Will in that both documents are used to distribute a deceased person's assets. A Will outlines the wishes of the deceased regarding how their property should be handled after death. However, a Small Estate Affidavit is typically used when the estate's value is below a certain threshold, allowing for a simpler process to transfer assets without going through probate. This makes it a more accessible option for smaller estates, while a Will requires formal execution and may involve more legal complexities.

Understanding the various legal documents that facilitate asset distribution in the wake of a loved one's passing is crucial. For instance, the Small Estate Affidavit, while effective for smaller estates, is just one option. Landlords and tenants in the rental market also have important forms to utilize, such as the New York Rental Application form, which is essential for assessing potential tenants. To further assist in the rental process, you can find a useful resource at NY PDF Forms, providing templates that ensure clarity and support in creating rental agreements.

Another document similar to the Small Estate Affidavit is the Letter of Administration. This letter is issued by the probate court to appoint an administrator to manage the estate of someone who has died without a Will. Like the Small Estate Affidavit, the Letter of Administration helps facilitate the distribution of assets. However, it is generally used in situations where there is no Will, whereas the Small Estate Affidavit can be used when the deceased left behind a Will but the estate qualifies as small.

The Small Estate Affidavit also shares similarities with a Power of Attorney (POA). A POA allows an individual to make financial or legal decisions on behalf of someone else while they are still alive. In contrast, the Small Estate Affidavit is used after death to settle an estate. Both documents empower individuals to manage another person's affairs, but they operate in different contexts—one during life and the other after death.

Lastly, the Small Estate Affidavit can be compared to a Trust. A Trust is a legal arrangement where a trustee holds and manages assets for the benefit of beneficiaries. While a Trust can help avoid probate and streamline asset distribution, it requires more formal setup and ongoing management. The Small Estate Affidavit, on the other hand, is a straightforward tool for settling smaller estates without the need for ongoing oversight, making it a simpler alternative for many families.

Important Questions on This Form

What is the Connecticut Small Estate Affidavit?

The Connecticut Small Estate Affidavit is a legal document that allows individuals to claim the assets of a deceased person without going through the full probate process. This form is typically used when the total value of the estate is below a certain threshold, making it a simpler and quicker option for settling an estate.

Who can use the Small Estate Affidavit?

Generally, any individual who is entitled to inherit from the deceased can use the Small Estate Affidavit. This includes heirs like spouses, children, or other relatives. However, the estate must meet the specific value limits set by Connecticut law to qualify for this process.

What is the value limit for using the Small Estate Affidavit?

As of now, the value limit for a small estate in Connecticut is $40,000. If the total value of the estate is less than this amount, the Small Estate Affidavit can be used. It's important to check for any updates to this limit, as it may change over time.

What assets can be claimed using the Small Estate Affidavit?

Assets that can be claimed include bank accounts, personal property, and other items owned by the deceased. However, real estate typically cannot be transferred using this affidavit. For real estate, a different legal process must be followed.

How do I complete the Small Estate Affidavit?

To complete the Small Estate Affidavit, you will need to provide information about the deceased, the heirs, and the assets of the estate. The form must be signed under oath, which means you are affirming that the information provided is true. It’s advisable to have a notary public witness your signature.

Do I need to file the Small Estate Affidavit with the court?

No, the Small Estate Affidavit does not need to be filed with the court. Instead, you present it directly to the financial institutions or other entities holding the deceased’s assets. They will use the affidavit to release the assets to you.

Can creditors make claims against the estate after using the Small Estate Affidavit?

Yes, creditors can still make claims against the estate even after you have used the Small Estate Affidavit. It is wise to ensure that all debts are settled before distributing any assets to the heirs. This helps avoid potential legal issues later on.

What should I do if the estate exceeds the value limit?

If the estate exceeds the $40,000 limit, you will need to go through the regular probate process. This process is more complex and may require the assistance of a lawyer. It involves filing a petition with the probate court and following specific legal procedures to settle the estate.

Misconceptions

Many people have misunderstandings about the Connecticut Small Estate Affidavit form. Here are six common misconceptions:

- Only estates under a certain value qualify. While there is a value limit for using the Small Estate Affidavit, it is important to check the current threshold, as it can change. Not all small estates automatically qualify.

- The form can be used for any type of asset. The Small Estate Affidavit is limited to specific types of assets. Real estate, for instance, cannot be transferred using this form.

- All heirs must agree to use the Small Estate Affidavit. While it is beneficial for heirs to agree, it is not a requirement. However, the affidavit must be signed by the person claiming the estate.

- Filing the affidavit is the same as going through probate. The Small Estate Affidavit is an alternative to probate, but it does not involve the same legal process. It simplifies the transfer of assets without court involvement.

- There is no need for documentation. Supporting documentation is required when submitting the Small Estate Affidavit. This may include death certificates and proof of asset ownership.

- The Small Estate Affidavit can be filed at any time. There are time limits for filing the affidavit after the death of the estate owner. It is important to be aware of these deadlines to ensure compliance.

Dos and Don'ts

When completing the Connecticut Small Estate Affidavit form, it is important to follow certain guidelines to ensure accuracy and compliance. Below is a list of dos and don'ts to consider.

- Do read the instructions carefully before starting the form.

- Do provide accurate information about the decedent's estate.

- Do include all necessary documentation to support your affidavit.

- Do sign the affidavit in the presence of a notary public.

- Do ensure that the total value of the estate does not exceed the limit set by Connecticut law.

- Don't leave any sections of the form blank; fill in all required fields.

- Don't provide false information, as this can lead to legal consequences.

- Don't submit the affidavit without verifying all calculations and totals.

- Don't forget to include your contact information for any follow-up.

- Don't rush the process; take your time to ensure everything is correct.

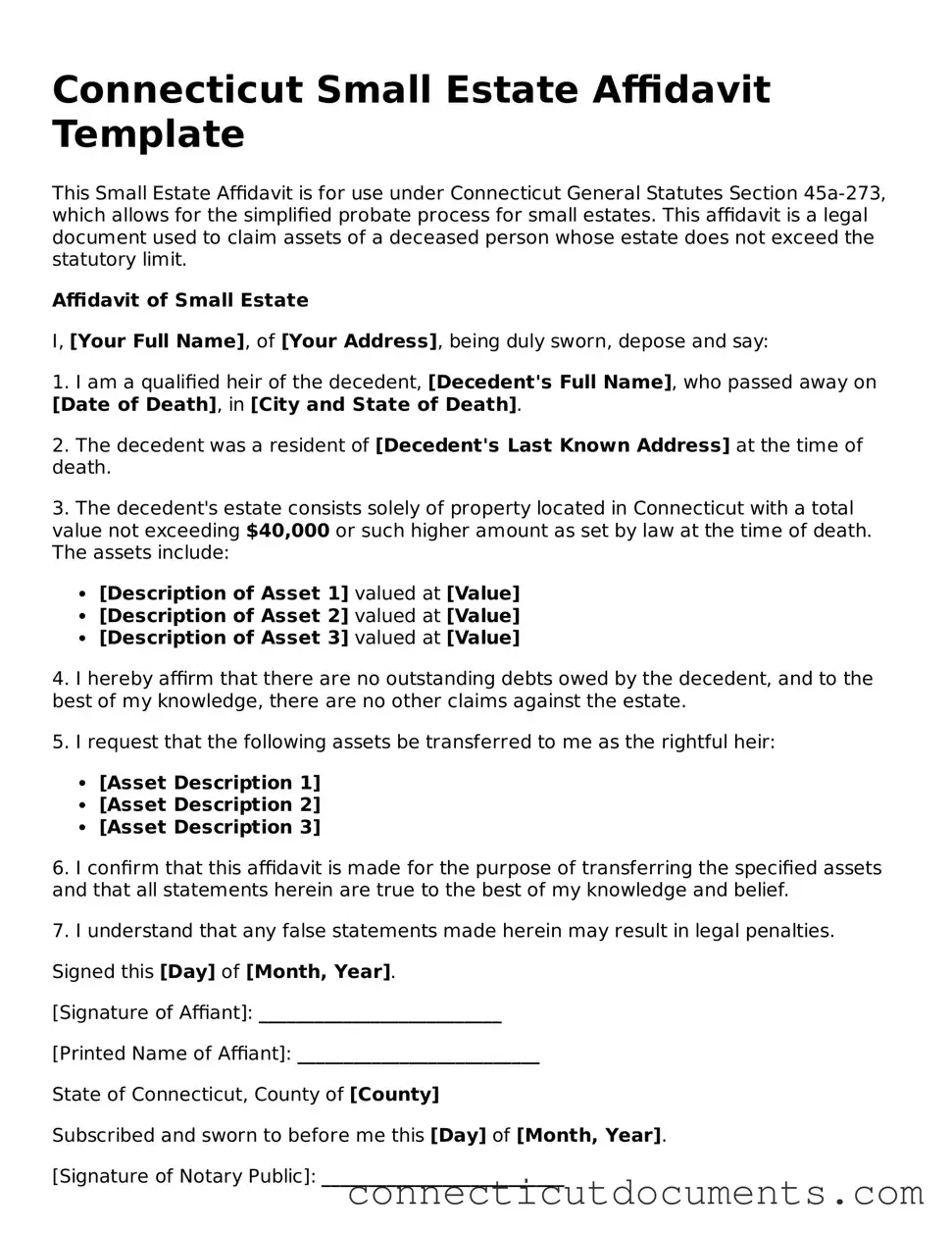

Detailed Guide for Writing Connecticut Small Estate Affidavit

After gathering the necessary information and documents, you are ready to fill out the Connecticut Small Estate Affidavit form. This process requires careful attention to detail to ensure that all information is accurate and complete. Once the form is filled out, it will need to be submitted to the appropriate court along with any required documentation.

- Begin by obtaining the Connecticut Small Estate Affidavit form. You can find this form online or at your local probate court.

- Read the instructions provided with the form carefully. Understanding the requirements will help you fill it out correctly.

- In the first section, enter the name of the deceased individual. Make sure to spell the name correctly and include any middle names.

- Next, provide the date of death. This information is crucial for establishing the timeline of the estate.

- Fill in the address of the deceased. This should be the last known address where the individual resided.

- Identify the heirs of the estate. List their names, relationships to the deceased, and addresses. Ensure that you include all relevant heirs.

- Indicate whether the estate is valued at less than the state limit for small estates. This is an important criterion for eligibility.

- In the appropriate section, describe the assets of the estate. Be specific about the types of assets and their approximate values.

- Sign the affidavit in the designated area. Your signature confirms that the information provided is true and accurate to the best of your knowledge.

- Have the affidavit notarized. A notary public will verify your identity and witness your signature.

- Make copies of the completed affidavit and any supporting documents for your records before submission.

- Submit the original affidavit and any required documents to the probate court. Be sure to keep track of any filing fees that may be required.