Attorney-Verified Real Estate Purchase Agreement Form for the State of Connecticut

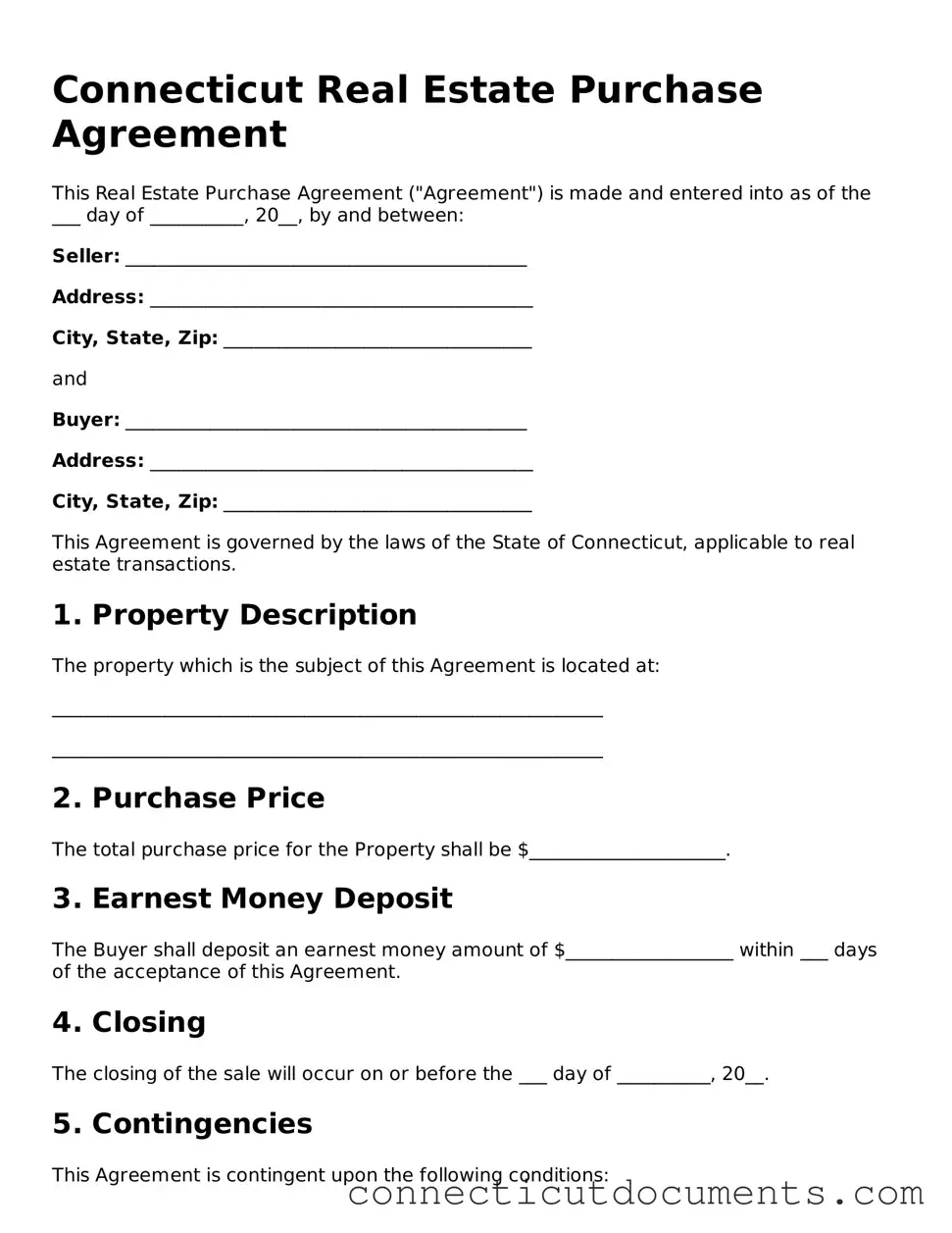

The Connecticut Real Estate Purchase Agreement is a crucial document in the process of buying or selling property in the state. It outlines the terms and conditions agreed upon by both the buyer and seller, ensuring that each party understands their rights and obligations. This form typically includes essential details such as the purchase price, the property description, and the closing date. Additionally, it addresses contingencies that might affect the sale, such as financing and inspections, providing a clear path for both parties to follow. The agreement also specifies the earnest money deposit, which demonstrates the buyer's commitment to the transaction. Furthermore, it may include provisions for repairs, title transfer, and any disclosures required by state law. By establishing a mutual understanding, this form helps to minimize disputes and fosters a smoother transaction process.

Documents used along the form

When engaging in a real estate transaction in Connecticut, several key documents accompany the Real Estate Purchase Agreement. Each of these forms plays a crucial role in ensuring that the transaction proceeds smoothly and legally. Below is a list of commonly used documents in conjunction with the Purchase Agreement.

- Property Disclosure Statement: This document provides potential buyers with information about the property's condition, including any known defects or issues. Sellers are required to disclose certain information to help buyers make informed decisions.

- California Form REG 262: This essential document is crucial for transferring ownership of a vehicle or vessel within California, accompanying the title or application for a Duplicate Title. For more information, visit https://formcalifornia.com/editable-california-fotm-reg-262-form/.

- Lead-Based Paint Disclosure: For homes built before 1978, this form informs buyers about the potential presence of lead-based paint. Federal law mandates that sellers provide this disclosure to protect buyers, particularly families with young children.

- Home Inspection Report: After an inspection, this report details the findings regarding the property's condition. Buyers often use this information to negotiate repairs or price adjustments before finalizing the sale.

- Title Search Report: This document verifies the ownership of the property and checks for any liens or encumbrances. A clear title is essential for a smooth transfer of ownership.

- Closing Disclosure: Provided at least three days before closing, this document outlines the final terms of the loan, including costs and fees. It ensures that both parties understand the financial aspects of the transaction.

- Deed: This legal document transfers ownership of the property from the seller to the buyer. It must be signed and recorded to be valid.

- Affidavit of Title: This sworn statement confirms that the seller has the right to sell the property and that there are no undisclosed claims against it. It protects the buyer from future disputes regarding ownership.

- Escrow Agreement: This document outlines the terms under which an escrow agent holds funds and documents until all conditions of the sale are met. It provides security for both the buyer and seller during the transaction.

Understanding these documents is essential for anyone involved in a real estate transaction. Each form serves a specific purpose, helping to protect the interests of all parties involved. Familiarity with these documents can lead to a smoother and more successful closing process.

More Connecticut Templates

How to Get Power of Attorney in Ct - It is important to inform the child about the purpose of this designation.

Having a reliable comprehensive guide to Power of Attorney documentation can greatly aid individuals in navigating the complexities of legal and financial decisions, ensuring that their interests are duly represented when they are unable to do so themselves.

Ct Dnr Form - Reflects the patient’s values and choices regarding end-of-life care.

Similar forms

The Connecticut Real Estate Purchase Agreement form shares similarities with the Residential Purchase Agreement, which is commonly used in various states. Both documents outline the terms and conditions under which a buyer agrees to purchase a property from a seller. They typically include essential elements such as the purchase price, closing date, and contingencies, ensuring that both parties have a clear understanding of their obligations and rights throughout the transaction process.

Another document that resembles the Connecticut Real Estate Purchase Agreement is the Commercial Purchase Agreement. While primarily used for commercial properties, this agreement also details the terms of sale, including price and conditions. Both agreements aim to protect the interests of buyers and sellers, although the commercial version may include additional clauses addressing zoning laws and business operations, reflecting the complexities of commercial real estate transactions.

The Option to Purchase Agreement is another document akin to the Connecticut Real Estate Purchase Agreement. This agreement grants the buyer the right, but not the obligation, to purchase the property within a specified timeframe. Similar to the Real Estate Purchase Agreement, it includes terms regarding price and duration. However, it differs in that it allows for flexibility, giving buyers the chance to evaluate the property before committing to a purchase.

The Lease Purchase Agreement also bears resemblance to the Connecticut Real Estate Purchase Agreement. This document combines elements of leasing and purchasing, allowing a tenant to rent a property with the option to buy it later. Like the Real Estate Purchase Agreement, it outlines the purchase price and terms, but it also includes lease terms, making it a hybrid agreement that serves dual purposes.

The Seller Financing Agreement is another document that shares characteristics with the Connecticut Real Estate Purchase Agreement. In this arrangement, the seller provides financing to the buyer, allowing them to purchase the property directly. Both agreements contain key terms such as the purchase price and payment schedule, but the Seller Financing Agreement will also detail the interest rate and repayment terms, reflecting the financial arrangement between the parties.

The Land Contract, also known as a Contract for Deed, is similar to the Connecticut Real Estate Purchase Agreement in that it allows a buyer to make payments directly to the seller while taking possession of the property. This document outlines the purchase price, payment terms, and conditions of sale. Unlike traditional purchase agreements, the seller retains the title until the buyer fulfills all payment obligations, providing a unique structure for the transaction.

The Real Estate Sales Agreement is another document that aligns closely with the Connecticut Real Estate Purchase Agreement. This agreement serves as a binding contract between the buyer and seller, detailing the terms of sale, including price and contingencies. Both documents aim to facilitate a smooth transaction and provide clarity on the responsibilities of each party involved in the sale.

The Purchase and Sale Agreement is also comparable to the Connecticut Real Estate Purchase Agreement. This document outlines the sale of real estate and includes essential details such as purchase price, closing date, and contingencies. Both agreements serve the same fundamental purpose of formalizing the transaction, ensuring that both parties are aware of their rights and obligations throughout the process.

For those navigating the New York rental market, utilizing a comprehensive Rental Application form is essential to streamline the tenant selection process. Landlords benefit greatly from this enforced clarity, as it ensures they gather all necessary information for assessment, ultimately contributing to better tenant-landlord relationships. For an easy-to-use template, you can refer to NY PDF Forms, which provides a structured approach to completing this crucial documentation.

Lastly, the Exclusive Right to Sell Agreement shares similarities with the Connecticut Real Estate Purchase Agreement. This document is typically used by real estate agents to secure a listing. While it focuses on the seller's commitment to work with a specific agent, it also outlines the terms of sale and can include provisions related to the eventual purchase agreement. Both documents are integral to the real estate transaction process, emphasizing the importance of clear communication and defined expectations.

Important Questions on This Form

What is a Connecticut Real Estate Purchase Agreement?

The Connecticut Real Estate Purchase Agreement is a legal document used in real estate transactions. It outlines the terms and conditions under which a buyer agrees to purchase a property from a seller. This agreement typically includes details such as the purchase price, property description, closing date, and any contingencies that may apply. It's a crucial step in ensuring that both parties understand their rights and obligations throughout the buying process.

What are the key components of the agreement?

A well-drafted Real Estate Purchase Agreement includes several important components. These typically consist of the names of the buyer and seller, a detailed description of the property, the agreed-upon purchase price, and the payment terms. Additionally, it may outline contingencies such as financing approval, home inspections, and any repairs that need to be made before closing. Other elements can include closing costs, property disclosures, and the timeline for completing the sale.

Do I need a lawyer to create or review this agreement?

What happens if either party does not fulfill their obligations?

If either the buyer or seller fails to meet their obligations as outlined in the agreement, it may be considered a breach of contract. The non-breaching party may have several options, including seeking damages or specific performance, which means they could ask the court to enforce the terms of the agreement. It's important to understand the potential consequences of a breach, which is why having a clear and comprehensive agreement is essential.

Can the agreement be modified after it has been signed?

Misconceptions

The Connecticut Real Estate Purchase Agreement form is a vital document in real estate transactions. However, several misconceptions surround its use and implications. Here are seven common misunderstandings:

- It is a legally binding contract immediately upon signing. Many believe that once both parties sign the agreement, it is binding. In reality, the agreement may be contingent upon various factors, such as financing or inspections, which must be satisfied before it becomes enforceable.

- All terms are negotiable. While many aspects of the agreement can be negotiated, certain legal requirements and standard practices must be adhered to. Buyers and sellers should be aware of these limitations.

- It is the same as a lease agreement. A purchase agreement is fundamentally different from a lease. The former involves the sale of property, while the latter pertains to renting. Understanding this distinction is crucial for both buyers and sellers.

- Once signed, there is no way to back out. Although backing out of a signed agreement can be challenging, it is not impossible. There are specific conditions under which a party may withdraw, often outlined in the contingencies of the agreement.

- Real estate agents are responsible for all legal aspects. While agents provide valuable guidance, they are not substitutes for legal advice. Buyers and sellers should consult an attorney to understand their rights and obligations fully.

- Only the buyer needs to sign the agreement. Both parties—the buyer and the seller—must sign the agreement for it to be valid. This mutual consent is essential for the contract to take effect.

- It does not require any additional documentation. The purchase agreement often requires accompanying documents, such as disclosures, title reports, and inspection results. Failing to provide these can lead to complications in the transaction.

Understanding these misconceptions can help both buyers and sellers navigate the complexities of real estate transactions in Connecticut more effectively.

Dos and Don'ts

When filling out the Connecticut Real Estate Purchase Agreement form, attention to detail is crucial. Here are ten important things to consider—both what to do and what to avoid.

- Do read the entire agreement carefully before starting to fill it out.

- Do ensure that all parties involved in the transaction are accurately identified.

- Do include the correct legal description of the property.

- Do specify the purchase price clearly and accurately.

- Do consult with a real estate professional if you have questions.

- Don't leave any blank spaces in the form; fill them in with “N/A” if necessary.

- Don't rush through the process; take your time to avoid mistakes.

- Don't ignore any contingencies that may protect your interests.

- Don't forget to include all necessary signatures and dates.

- Don't assume that verbal agreements are sufficient; everything must be in writing.

By following these guidelines, you can help ensure a smoother transaction process. Always prioritize clarity and accuracy to protect your interests in the real estate purchase.

Detailed Guide for Writing Connecticut Real Estate Purchase Agreement

Once you have the Connecticut Real Estate Purchase Agreement form in front of you, it's time to fill it out carefully. This document is essential for outlining the terms of your real estate transaction. Ensure you have all necessary information on hand before you begin.

- Start by entering the date at the top of the form.

- Fill in the names and addresses of both the buyer(s) and seller(s). Make sure to include full legal names.

- Provide the property address. This should include the street address, city, and zip code.

- Specify the purchase price. Clearly state the amount being offered for the property.

- Indicate the amount of the earnest money deposit. This is typically a percentage of the purchase price.

- Fill in the closing date. This is when the ownership of the property will officially transfer.

- Detail any contingencies. This could include financing, inspections, or other conditions that must be met.

- Include any additional terms or conditions that both parties have agreed upon.

- Sign and date the agreement. Ensure that all parties involved sign the document.

After completing the form, review it thoroughly to ensure all information is accurate and complete. It’s wise to keep a copy for your records and provide copies to all parties involved in the transaction.