Attorney-Verified Quitclaim Deed Form for the State of Connecticut

In Connecticut, the Quitclaim Deed serves as a vital tool for property transfers, offering a straightforward way for individuals to convey their interest in real estate without making any guarantees about the title. This form is particularly useful in situations such as transferring property between family members, settling estates, or rectifying title issues. By utilizing a Quitclaim Deed, the grantor, or seller, relinquishes their rights to the property, while the grantee, or buyer, receives whatever interest the grantor holds—if any. Unlike other types of deeds, a Quitclaim Deed does not provide warranties or assurances regarding the property's title, making it essential for both parties to understand the implications. The process involves specific requirements, including the need for the document to be signed in the presence of a notary public, and it must be recorded with the local town clerk to ensure public notice of the transfer. Understanding these key aspects can help individuals navigate property transactions more effectively, ensuring a smoother transfer process and minimizing potential disputes down the line.

Documents used along the form

The Connecticut Quitclaim Deed is a crucial document for transferring property ownership. However, it is often used alongside other forms and documents to ensure a smooth transaction. Below is a list of commonly associated forms that may be required during the property transfer process in Connecticut.

- Warranty Deed: This document guarantees that the seller holds clear title to the property and has the right to sell it. It offers more protection to the buyer compared to a quitclaim deed.

- Power of Attorney: For alternative representation in legal matters, consult the essential Power of Attorney form guidelines to ensure proper execution and validity.

- Property Transfer Tax Return: This form is required by the state to report the transfer of property and calculate any applicable taxes. It must be filed with the local tax assessor.

- Title Search Report: This document provides a detailed history of the property's ownership. It helps identify any liens or claims against the property before the transfer occurs.

- Affidavit of Title: This sworn statement confirms the seller's ownership and the absence of any undisclosed issues affecting the title. It is often used to reassure the buyer.

- Closing Statement: Also known as a HUD-1, this document outlines all financial aspects of the transaction, including costs and fees. It is presented at the closing meeting.

- Power of Attorney: If the seller cannot be present for the closing, this document allows another person to act on their behalf. It must be properly executed to be valid.

- Real Estate Purchase Agreement: This contract outlines the terms of the sale, including the price and conditions. It serves as the foundation for the transaction.

- Homeowner’s Association (HOA) Documents: If the property is part of an HOA, these documents provide rules, regulations, and fees associated with the community. They are important for the buyer to review.

Understanding these documents can help ensure that property transfers in Connecticut proceed without complications. Each form plays a specific role in protecting the interests of both buyers and sellers.

More Connecticut Templates

Ct Court Forms - The Notice to Quit is a vital tool for landlords managing their properties responsibly.

The New York Rental Application form is a critical document used by landlords to assess and evaluate potential tenants before signing a lease agreement. It collects comprehensive information to ensure the applicant is a good fit for the property. For those seeking a streamlined process, templates such as the NY PDF Forms can be invaluable. This form plays a pivotal role in the New York housing process, setting the stage for a successful landlord-tenant relationship.

How to Get Power of Attorney in Ct - A complete form can prevent misunderstandings in guardianship situations.

Similar forms

A warranty deed is a document used in real estate transactions that provides a guarantee from the seller to the buyer. Unlike a quitclaim deed, which transfers ownership without any warranties, a warranty deed assures the buyer that the seller holds clear title to the property and has the right to sell it. This means that if any issues arise regarding the title after the sale, the seller is responsible for resolving them. This added layer of security makes warranty deeds more favorable in many transactions.

A grant deed is another type of property transfer document that is similar to a quitclaim deed but includes certain assurances. When a grant deed is executed, the seller confirms that they have not transferred the property to anyone else and that the property is free from any undisclosed encumbrances. While it does not provide the same level of protection as a warranty deed, it does offer more assurance than a quitclaim deed, making it a common choice in real estate transfers.

An easement deed grants a right to use a portion of another person's property for a specific purpose, such as utility access or a shared driveway. While a quitclaim deed transfers ownership, an easement deed does not convey ownership but rather allows limited use of the property. This distinction is crucial in understanding property rights, as easements can be permanent or temporary and can affect property value and usability.

A lease agreement is a legal document that outlines the terms under which one party agrees to rent property from another. While a quitclaim deed transfers ownership rights, a lease agreement grants temporary possession and use of the property without transferring title. This document is crucial in landlord-tenant relationships, establishing the rights and responsibilities of both parties during the lease term.

A life estate deed allows an individual to retain ownership of a property during their lifetime while transferring the remainder interest to another party upon their death. This type of deed is similar to a quitclaim deed in that it transfers an interest in property, but it does so with specific conditions regarding the duration of ownership. Life estate deeds can be a useful estate planning tool, allowing individuals to control their property while simplifying the transfer process after their passing.

A special warranty deed is a variation of a warranty deed that only guarantees the title against defects that occurred during the time the seller owned the property. This is different from a general warranty deed, which covers the entire history of the title. A special warranty deed provides some assurance to the buyer, similar to a quitclaim deed, but with a limited scope of protection regarding title issues.

For those involved in property transfers who seek a straightforward method, a Quitclaim Deed form can be invaluable, especially when ownership needs to be transferred without guarantees on the title. This document facilitates transactions such as transferring property among family members or correcting title discrepancies, making it a practical choice in various real estate situations.

A bill of sale is a document that transfers ownership of personal property, such as vehicles or equipment. While a quitclaim deed deals specifically with real estate, a bill of sale serves a similar purpose for personal property. Both documents formalize the transfer of ownership and provide evidence of the transaction, ensuring that both parties have a clear understanding of the terms involved.

A mortgage release is a document that indicates a mortgage has been paid off and the lender no longer has a claim on the property. This document is similar to a quitclaim deed in that it serves to clarify ownership rights. While a quitclaim deed transfers property ownership, a mortgage release confirms that the lender's interest in the property has been relinquished, allowing the owner to have clear title moving forward.

A partition deed is used when co-owners of a property decide to divide their interests in the property. This document formalizes the division of the property, allowing each owner to have a distinct portion. Similar to a quitclaim deed, a partition deed transfers ownership rights, but it specifically addresses the division of shared interests, making it essential in situations where multiple parties hold title to a single property.

Important Questions on This Form

What is a Quitclaim Deed in Connecticut?

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another without making any guarantees about the property title. This means the seller, or grantor, relinquishes any claim they may have to the property, but does not assure that the title is clear or free of liens. It is often used between family members or in situations where the parties know each other well.

When should I use a Quitclaim Deed?

This type of deed is commonly used in situations such as transferring property between family members, adding or removing a spouse from the title after marriage or divorce, or when a property is gifted. It is not typically recommended for sales involving unknown buyers or sellers, as it does not provide the buyer with any protection against title issues.

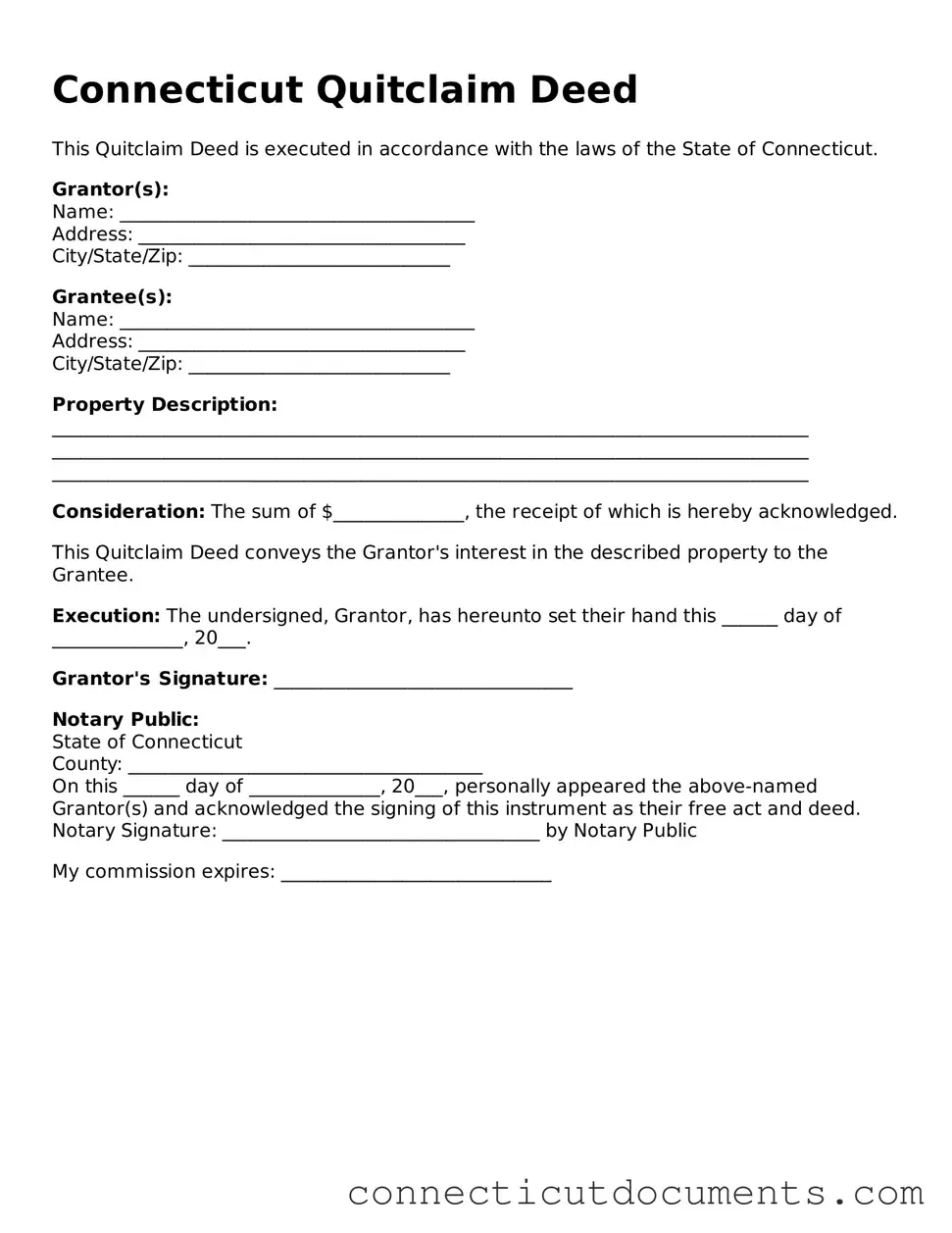

What information is required on a Connecticut Quitclaim Deed?

A Quitclaim Deed in Connecticut must include the names of the grantor and grantee, a description of the property, the date of the transfer, and the signature of the grantor. Additionally, it should state the consideration, or payment, for the transfer, even if that amount is nominal or zero.

Is a Quitclaim Deed the same as a Warranty Deed?

No, a Quitclaim Deed is not the same as a Warranty Deed. A Warranty Deed provides a guarantee that the grantor holds clear title to the property and has the right to transfer it. In contrast, a Quitclaim Deed offers no such assurances, making it a riskier option for buyers who want to ensure they are receiving a clear title.

Do I need to have the Quitclaim Deed notarized?

Yes, in Connecticut, a Quitclaim Deed must be signed in the presence of a notary public. This notarization helps verify the identity of the grantor and confirms that the signing was done voluntarily. It is also a requirement for the deed to be recorded with the town clerk.

How do I record a Quitclaim Deed in Connecticut?

To record a Quitclaim Deed, you must take the signed and notarized document to the town clerk's office in the municipality where the property is located. There may be a recording fee, and it is important to ensure that the deed is properly formatted and includes all necessary information to avoid any delays in recording.

What are the tax implications of using a Quitclaim Deed?

In Connecticut, transferring property using a Quitclaim Deed may trigger a conveyance tax. This tax is typically based on the sale price or the fair market value of the property. However, certain exemptions may apply, particularly for transfers between family members. It is advisable to consult with a tax professional to understand any potential tax liabilities.

Can I revoke a Quitclaim Deed after it has been executed?

Once a Quitclaim Deed has been executed and recorded, it generally cannot be revoked. The transfer of ownership is considered final. If there are concerns about the transfer, it may be necessary to pursue legal avenues to challenge the deed, which can be complex and may require legal assistance.

Where can I obtain a Quitclaim Deed form in Connecticut?

Quitclaim Deed forms can often be obtained from local town clerk's offices, legal stationery stores, or online legal document services. It is important to ensure that the form complies with Connecticut state laws and includes all required information for it to be valid.

Misconceptions

Many people have misunderstandings about the Connecticut Quitclaim Deed form. Here are nine common misconceptions:

- A quitclaim deed transfers ownership of property. This is misleading. A quitclaim deed transfers whatever interest the grantor has in the property, but it does not guarantee that the grantor actually owns the property or that there are no liens against it.

- Quitclaim deeds are only for transferring property between family members. While they are often used in family transactions, quitclaim deeds can be used in any situation where a property interest is being transferred.

- Using a quitclaim deed eliminates all property disputes. This is not true. A quitclaim deed does not resolve any existing disputes or claims against the property. It merely transfers the interest held by the grantor.

- A quitclaim deed is the same as a warranty deed. These are different. A warranty deed provides guarantees about the property’s title, while a quitclaim deed offers no such assurances.

- Quitclaim deeds are only valid if notarized. While notarization is important for the deed to be recorded, it is not the only requirement. The deed must also be signed by the grantor and meet specific state requirements.

- Once a quitclaim deed is signed, it cannot be revoked. This is incorrect. A quitclaim deed can be revoked or challenged in certain circumstances, such as fraud or lack of capacity.

- Quitclaim deeds are only for real estate transactions. This misconception overlooks the fact that quitclaim deeds can also be used to transfer interests in other types of property, such as personal property or business assets.

- Anyone can create a quitclaim deed without legal assistance. While it is possible to create one without a lawyer, it is advisable to seek legal guidance to ensure that the deed is valid and meets all legal requirements.

- Quitclaim deeds are a quick fix for title issues. This is misleading. While they can transfer interests quickly, they do not address underlying title issues and may complicate matters further.

Understanding these misconceptions can help individuals make informed decisions regarding property transfers in Connecticut.

Dos and Don'ts

When filling out the Connecticut Quitclaim Deed form, it's important to follow certain guidelines to ensure accuracy and compliance. Here are some dos and don'ts to keep in mind:

- Do provide accurate property details, including the legal description.

- Do include the names of all parties involved in the transaction.

- Do sign the form in the presence of a notary public.

- Do check for any outstanding liens or encumbrances on the property.

- Do ensure that the form is filled out completely before submission.

- Don't use vague or ambiguous language when describing the property.

- Don't forget to include the date of the transaction.

- Don't leave any required fields blank.

- Don't submit the form without verifying all information is correct.

Detailed Guide for Writing Connecticut Quitclaim Deed

Once you have gathered the necessary information and documents, you can begin filling out the Connecticut Quitclaim Deed form. Completing this form accurately is essential to ensure that the transfer of property rights is recognized legally. After filling out the form, it will need to be signed and recorded with the appropriate local authority.

- Begin by entering the date at the top of the form.

- In the section labeled "Grantor," write the full name of the person or entity transferring the property. Include any necessary identifying information, such as marital status.

- In the "Grantee" section, provide the full name of the person or entity receiving the property. Again, include relevant details that may clarify the identity of the grantee.

- Next, describe the property being transferred. Include the address, lot number, and any other identifying details that specify the property location.

- Indicate the consideration amount, which is the value exchanged for the property. This is often a nominal amount, such as $1, but can vary based on the agreement between the parties.

- In the section for "Signatures," the grantor must sign and date the form. If there are multiple grantors, each must sign.

- Have the signature of the grantor notarized. A notary public will confirm the identity of the grantor and witness the signing.

- Finally, submit the completed Quitclaim Deed to the local town or city clerk’s office for recording. Ensure you keep a copy for your records.