Attorney-Verified Promissory Note Form for the State of Connecticut

The Connecticut Promissory Note form serves as a crucial legal document in financial transactions, establishing a clear agreement between a borrower and a lender. This form outlines the specific terms under which the borrower agrees to repay the borrowed amount, including the principal sum, interest rate, and repayment schedule. It also specifies the consequences of default, which protects the lender's interests. Furthermore, the document often includes provisions for prepayment and may outline any applicable fees or penalties. By clearly delineating the rights and responsibilities of both parties, the Connecticut Promissory Note form fosters transparency and helps to prevent misunderstandings. Whether used in personal loans, business financing, or real estate transactions, this form is an essential tool for ensuring that financial agreements are documented and enforceable under Connecticut law.

Documents used along the form

When creating a financial agreement in Connecticut, a Promissory Note is often used to outline the terms of a loan. However, several other forms and documents may accompany it to ensure clarity and legal compliance. Below are five common documents that are frequently utilized alongside a Promissory Note.

- Loan Agreement: This document details the terms of the loan, including interest rates, repayment schedules, and any collateral involved. It serves as a comprehensive guide to the expectations of both the lender and the borrower.

- Articles of Incorporation Form: To establish a corporation in New York, it is essential to use the official Articles of Incorporation form guidelines that outline the necessary legal requirements.

- Security Agreement: If the loan is secured by collateral, this document outlines the specific assets pledged by the borrower. It establishes the lender's rights to the collateral in case of default.

- Disclosure Statement: This form provides essential information about the loan, including fees, interest rates, and other costs. It ensures that the borrower understands the financial implications of the loan.

- Personal Guarantee: In cases where a business borrows money, a personal guarantee may be required. This document holds an individual personally responsible for the loan, adding an extra layer of security for the lender.

- Amortization Schedule: This document breaks down the repayment plan, showing how much of each payment goes toward principal and interest over time. It helps borrowers understand their payment obligations clearly.

Using these documents in conjunction with a Promissory Note can help both parties navigate the loan process more effectively. Each document serves a specific purpose, ensuring that the terms of the loan are clear and legally enforceable.

More Connecticut Templates

Ct Articles of Incorporation - Filing system effectiveness relies on comprehensive article preparation.

Having a well-drafted lease is crucial for both landlords and tenants, and for those looking to create a comprehensive agreement, utilizing resources like NY PDF Forms can simplify the process. This ensures that all necessary details are covered, providing clarity and protection for both parties involved in a rental situation.

Connecticut Landlord Tenant Law Month-to-month - Rules for property access, including notice periods for inspections or repairs by the landlord, are highlighted for tenant awareness.

Similar forms

The Connecticut Promissory Note is closely related to a Loan Agreement. Both documents serve as a formal record of a borrower’s obligation to repay borrowed money. A Loan Agreement, however, typically includes more detailed terms, such as interest rates, repayment schedules, and the rights of both parties in case of default. While a promissory note is often simpler and focuses primarily on the promise to pay, a Loan Agreement provides a comprehensive framework for the transaction, making it a more robust document for larger loans.

Another similar document is the Mortgage. A Mortgage is a specific type of promissory note that is secured by real property. In this case, the borrower pledges their property as collateral for the loan. If the borrower defaults, the lender has the right to foreclose on the property. While both documents involve a promise to repay, the Mortgage adds a layer of security for the lender, making it a crucial tool in real estate transactions.

Next, consider the Secured Promissory Note. This document is similar to the Connecticut Promissory Note but includes specific provisions that outline collateral backing the loan. By defining the collateral, the lender has additional protection in case the borrower fails to repay. This added security can make lenders more willing to extend credit, as they have a claim to the specified assets if necessary.

In considering the planning of your estate, creating a comprehensive Last Will and Testament is vital. This legal document ensures your assets are distributed according to your wishes, providing peace of mind. For more information, you can explore the details of creating a thorough Last Will and Testament that meets your needs.

The Unsecured Promissory Note also shares similarities with the Connecticut form. An Unsecured Promissory Note does not involve any collateral, meaning the lender relies solely on the borrower’s promise to repay. While both documents represent a loan agreement, the absence of collateral in the Unsecured Promissory Note increases the risk for the lender, often resulting in higher interest rates compared to secured notes.

A Demand Note is another document that resembles the Connecticut Promissory Note. This type of note allows the lender to request repayment at any time. Unlike a traditional promissory note, which typically has a set repayment schedule, a Demand Note provides flexibility for the lender. Borrowers should be cautious, as the lender can call for repayment without prior notice, potentially leading to financial strain.

The Installment Note is also worth mentioning. This document outlines a repayment plan that includes regular installments over a specified period. Like the Connecticut Promissory Note, it represents a borrower’s promise to repay, but the Installment Note provides a clear structure for repayment. This can help borrowers manage their finances more effectively by breaking the total amount into manageable payments.

The Convertible Note is another related document, often used in startup financing. This note allows the lender to convert the debt into equity in the company at a later date. While it shares the basic premise of a promissory note, the Convertible Note adds an investment component, appealing to lenders who are interested in potential equity ownership in addition to repayment.

Next, there is the Personal Guarantee. While not a note in itself, a Personal Guarantee is often associated with promissory notes, especially in business loans. This document involves a third party—usually a business owner—who agrees to repay the loan if the business defaults. This additional layer of security can make lenders more comfortable extending credit, as it decreases their risk.

Lastly, the Business Loan Agreement bears resemblance to the Connecticut Promissory Note. This document encompasses a range of terms and conditions related to a business loan, including repayment terms, interest rates, and covenants. While a promissory note is a straightforward promise to repay, a Business Loan Agreement provides a more detailed understanding of the obligations and rights of both the lender and borrower, making it essential for larger or more complex transactions.

Important Questions on This Form

What is a Connecticut Promissory Note?

A Connecticut Promissory Note is a written agreement in which one party promises to pay a specific amount of money to another party at a designated time or on demand. This document outlines the terms of the loan, including the interest rate, payment schedule, and any penalties for late payments. It serves as a legal record of the debt and can be enforced in court if necessary.

Who should use a Promissory Note?

Individuals or businesses that lend money or extend credit may use a Promissory Note. This includes personal loans between friends or family members, as well as formal loans between businesses. It is important for both the lender and borrower to have a clear understanding of the loan terms, which a Promissory Note can provide.

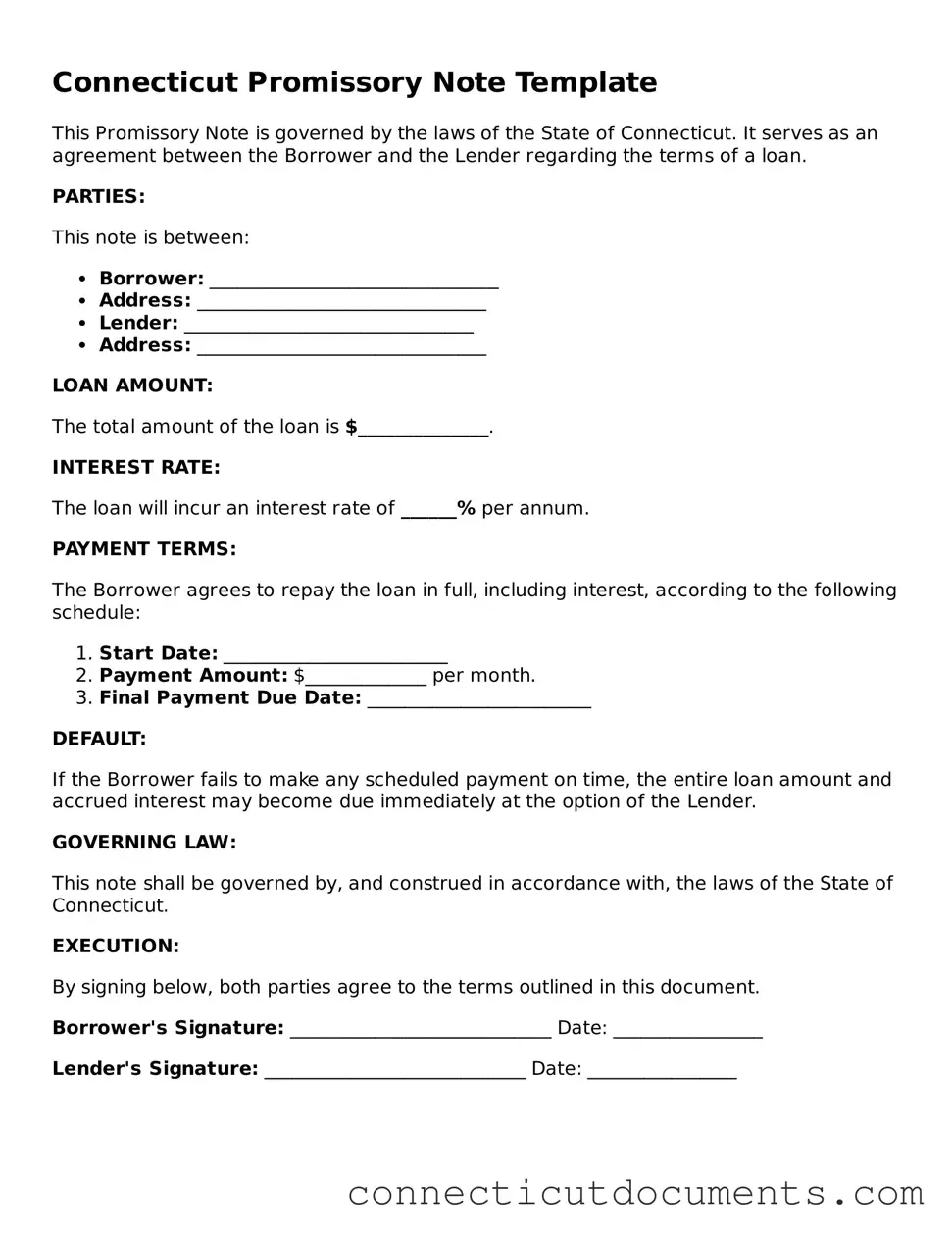

What are the key components of a Connecticut Promissory Note?

A typical Connecticut Promissory Note includes several important components: the names and addresses of the borrower and lender, the principal amount being borrowed, the interest rate, the repayment schedule, and any late fees or penalties. Additionally, it may include clauses regarding prepayment and default. All parties should review these terms carefully before signing.

Is a Promissory Note legally binding?

Yes, once signed by both parties, a Promissory Note is legally binding. This means that if the borrower fails to repay the loan according to the agreed terms, the lender has the right to take legal action to recover the owed amount. It is crucial for both parties to understand their rights and obligations outlined in the document.

Do I need a lawyer to create a Promissory Note?

While it is not legally required to have a lawyer draft a Promissory Note, it is often advisable, especially for larger loans or more complex agreements. A legal professional can help ensure that the document complies with Connecticut laws and adequately protects the interests of both parties. If you choose to create one on your own, make sure to follow the proper format and include all necessary details.

Can a Promissory Note be modified after it is signed?

Yes, a Promissory Note can be modified after it has been signed, but both parties must agree to the changes. It is best to create a written amendment that outlines the new terms and have both parties sign it. This ensures that there is a clear record of the modifications and helps prevent future misunderstandings.

What happens if the borrower defaults on the Promissory Note?

If the borrower defaults, meaning they fail to make payments as agreed, the lender can take several actions. First, they may attempt to communicate with the borrower to resolve the issue. If that does not work, the lender can pursue legal action to collect the debt. This may involve filing a lawsuit, and if successful, the court may order the borrower to repay the amount owed, potentially with additional fees or interest.

Misconceptions

Understanding the Connecticut Promissory Note form is essential for anyone involved in lending or borrowing money. However, several misconceptions can lead to confusion. Here are four common myths:

- Misconception 1: A Promissory Note is the same as a loan agreement.

- Misconception 2: A Promissory Note does not need to be in writing.

- Misconception 3: Only formal institutions can issue a Promissory Note.

- Misconception 4: A Promissory Note is not enforceable in court.

While both documents relate to borrowing money, they serve different purposes. A Promissory Note is a simple promise to pay back a specific amount, while a loan agreement outlines the terms and conditions of the loan, including interest rates, repayment schedules, and collateral.

Although verbal agreements can be legally binding, having a written Promissory Note is crucial. A written document provides clear evidence of the terms agreed upon and protects both parties in case of disputes.

This is not true. Individuals can also create Promissory Notes. As long as the document includes essential details like the amount, repayment terms, and signatures, it can be valid.

In fact, a properly executed Promissory Note is legally enforceable. If the borrower fails to repay, the lender can take legal action to recover the owed amount, provided the note meets all legal requirements.

Dos and Don'ts

When filling out the Connecticut Promissory Note form, it’s essential to get it right. Here are some key do's and don'ts to keep in mind:

- Do read the entire form carefully before you begin.

- Don't leave any required fields blank.

- Do provide accurate information about the borrower and lender.

- Don't use unclear language; be straightforward.

- Do specify the loan amount clearly.

- Don't forget to include the interest rate, if applicable.

- Do outline the repayment schedule in detail.

- Don't skip the date; it’s crucial for legal purposes.

- Do sign the document in the presence of a witness, if required.

- Don't ignore local laws; ensure compliance with Connecticut regulations.

Detailed Guide for Writing Connecticut Promissory Note

Once you have the Connecticut Promissory Note form in hand, you will need to provide specific information to complete it accurately. This document will outline the terms of the loan agreement between the lender and the borrower. Follow these steps to fill out the form correctly.

- Identify the Parties: Enter the full names and addresses of both the borrower and the lender at the top of the form.

- Loan Amount: Clearly state the total amount of money being borrowed.

- Interest Rate: Specify the interest rate that will apply to the loan. Make sure to indicate whether it is fixed or variable.

- Payment Schedule: Outline the payment terms, including the frequency of payments (e.g., monthly, quarterly) and the due dates.

- Maturity Date: Indicate the date by which the loan must be fully repaid.

- Signatures: Both the borrower and lender must sign and date the form to make it legally binding.

- Witness or Notary: If required, have a witness sign or have the document notarized to add an extra layer of validity.

After completing the form, keep a copy for your records and provide a copy to the other party. This ensures that both sides have access to the agreed-upon terms of the loan.