Attorney-Verified Prenuptial Agreement Form for the State of Connecticut

In Connecticut, a prenuptial agreement serves as a crucial tool for couples preparing for marriage, allowing them to outline their financial rights and responsibilities in the event of divorce or separation. This legally binding document can address various aspects, including the division of assets, spousal support, and debt allocation. By clearly delineating these matters before tying the knot, couples can foster open communication and reduce potential conflicts in the future. The form typically requires both parties to provide full financial disclosures, ensuring transparency and fairness. Additionally, it must be signed voluntarily and without coercion, and both individuals should ideally seek independent legal counsel to safeguard their interests. Understanding the nuances of the Connecticut Prenuptial Agreement form can empower couples to make informed decisions that align with their values and financial goals.

Documents used along the form

A prenuptial agreement is an important document for couples planning to marry. Along with this agreement, several other forms and documents may be necessary to ensure that both parties are protected and that their intentions are clearly outlined. Here are some commonly used documents that often accompany a Connecticut prenuptial agreement:

- Financial Disclosure Statement: This document provides a detailed overview of each party's financial situation, including assets, debts, income, and expenses. Transparency is key in a prenuptial agreement.

- Property Settlement Agreement: This outlines how property will be divided in the event of a divorce. It can help clarify ownership and prevent disputes later on.

- Marriage Certificate: This official document is required to legally recognize the marriage. It may be needed to validate the prenuptial agreement.

- Postnuptial Agreement: Similar to a prenuptial agreement, this document is created after marriage. It can address changes in circumstances or clarify financial arrangements.

- Power of Attorney: For ensuring your wishes are respected, consider the comprehensive Power of Attorney form resources to facilitate important decisions if needed.

- Will: A will outlines how a person's assets will be distributed upon their death. It can be important to ensure that the terms of the prenuptial agreement align with the will.

- Trust Documents: If either party has established a trust, these documents will detail how assets are managed and distributed, which can impact the prenuptial agreement.

- Power of Attorney: This document allows one person to make decisions on behalf of another in financial or medical matters. It can be crucial in situations where one partner cannot make decisions for themselves.

- Debt Acknowledgment Agreement: This agreement specifies how debts incurred before or during the marriage will be handled. It can help prevent misunderstandings regarding financial responsibilities.

- Legal Representation Agreement: This document confirms that each party has had the opportunity to seek independent legal advice regarding the prenuptial agreement.

Each of these documents serves a specific purpose and can help clarify the intentions of both parties. Having these documents prepared and reviewed can lead to a smoother process and greater peace of mind for couples entering into marriage.

More Connecticut Templates

Warranty Deed Connecticut - A deed remains in effect until another deed is executed to transfer ownership again.

The New York Rental Application form is a critical document used by landlords to assess and evaluate potential tenants before signing a lease agreement. It collects comprehensive information to ensure the applicant is a good fit for the property. For those looking for a convenient option, the NY PDF Forms provide a streamlined way to access these important forms, playing a pivotal role in the New York housing process and setting the stage for a successful landlord-tenant relationship.

Rental Application Ct - Inquire about utilities; detailing who covers them can clarify responsibilities.

Similar forms

The Connecticut Prenuptial Agreement is similar to a Cohabitation Agreement, which is designed for couples who choose to live together without marrying. Like a prenuptial agreement, a cohabitation agreement outlines the rights and responsibilities of each partner regarding financial matters and property ownership. It can address issues such as how to handle shared expenses, the division of assets acquired during the relationship, and what happens if the couple separates. Both documents aim to provide clarity and security, helping partners navigate their relationship with a clear understanding of each other's expectations.

Another document that shares similarities with the Connecticut Prenuptial Agreement is a Postnuptial Agreement. This agreement is created after a couple has married and serves a purpose akin to that of a prenuptial agreement. It outlines how assets and debts will be managed during the marriage and what will happen in the event of a divorce or separation. Both agreements facilitate open communication about financial matters and can be tailored to meet the specific needs of the couple, ensuring that both partners feel protected and understood.

In situations involving real estate transactions, individuals may find themselves in need of essential documents like a Quitclaim Deed form, which allows for the transfer of property ownership without a guarantee of title validity, further ensuring clarity in property ownership between parties.

The Separation Agreement is also comparable to the Connecticut Prenuptial Agreement. This document is typically used when a couple decides to separate but not yet divorce. It details how the couple will manage their assets, debts, and responsibilities during the separation period. Similar to a prenuptial agreement, it helps to clarify expectations and can prevent misunderstandings. Both documents aim to establish a fair arrangement, ensuring that both parties are aware of their rights and obligations.

Lastly, the Marital Settlement Agreement bears resemblance to the Connecticut Prenuptial Agreement. This document is created during the divorce process and outlines the terms of asset division, alimony, and child custody arrangements. Like a prenuptial agreement, it seeks to protect the interests of both parties and can help to minimize conflict during a difficult time. Both agreements emphasize the importance of clear communication and mutual respect, providing a framework for couples to navigate their financial and personal relationships.

Important Questions on This Form

What is a prenuptial agreement in Connecticut?

A prenuptial agreement, often called a "prenup," is a legal document that couples create before they get married. It outlines how assets and debts will be divided in the event of a divorce or separation. In Connecticut, prenups can also cover issues like spousal support and property rights, helping to clarify expectations and protect both parties’ interests.

Do I need a lawyer to create a prenuptial agreement in Connecticut?

While it’s not legally required to have a lawyer when drafting a prenuptial agreement, it is highly recommended. A lawyer can help ensure that the agreement is fair, legally sound, and tailored to your specific needs. Having independent legal advice can also help prevent future disputes about the agreement's validity.

What should be included in a Connecticut prenuptial agreement?

A comprehensive prenuptial agreement typically includes details about each party's assets and debts, how property will be divided in case of divorce, and any provisions for spousal support. It may also address how future income or property acquired during the marriage will be treated. Being thorough can help avoid misunderstandings later on.

Can I modify a prenuptial agreement after marriage?

Yes, you can modify a prenuptial agreement after you get married. However, both parties must agree to the changes, and it’s best to document any modifications in writing. Again, consulting with a lawyer during this process is advisable to ensure that the changes are legally enforceable.

Are prenuptial agreements enforceable in Connecticut?

Yes, prenuptial agreements are generally enforceable in Connecticut, provided they meet certain legal requirements. For instance, both parties must voluntarily sign the agreement, and it should be fair and reasonable at the time it was created. If there are issues of coercion or if one party was not fully informed about the other’s financial situation, the agreement may be challenged in court.

How do I start the process of creating a prenuptial agreement?

To start creating a prenuptial agreement, both partners should openly discuss their financial situations and what they hope to achieve with the agreement. Once you have a clear understanding, consult with a lawyer who specializes in family law. They can guide you through the drafting process and help ensure that the agreement meets Connecticut’s legal standards.

Is a prenuptial agreement only for wealthy individuals?

No, prenuptial agreements are not just for wealthy individuals. They can be beneficial for anyone entering a marriage, regardless of financial status. A prenup can help protect personal assets, clarify financial responsibilities, and provide peace of mind for both partners. It’s about ensuring that both parties feel secure and understood in their financial arrangement.

Misconceptions

When considering a prenuptial agreement in Connecticut, many people hold misconceptions that can lead to confusion and misinformation. Here are five common myths, along with clarifications to help you understand this important legal document.

-

Prenuptial agreements are only for the wealthy.

This is a widespread belief, but prenuptial agreements can benefit couples of all financial backgrounds. They help clarify financial responsibilities and protect assets, regardless of wealth.

-

Once signed, a prenuptial agreement cannot be changed.

In reality, prenuptial agreements can be modified or revoked if both parties agree. Changes can be made as circumstances evolve, such as after having children or experiencing significant financial changes.

-

Prenuptial agreements are only necessary for second marriages.

This misconception overlooks the fact that first-time marriages can also benefit from these agreements. They can help set expectations and protect individual assets, regardless of marital history.

-

A prenuptial agreement is not legally binding.

When properly drafted and executed, prenuptial agreements are legally enforceable in Connecticut. It's essential to follow the correct legal procedures to ensure the agreement holds up in court.

-

Prenuptial agreements are unromantic and imply distrust.

While some may view them as negative, prenuptial agreements can actually promote open communication about finances. Discussing these topics can strengthen a relationship by establishing transparency and mutual understanding.

Understanding these misconceptions can help couples make informed decisions about prenuptial agreements. By addressing these myths, individuals can approach the topic with clarity and confidence.

Dos and Don'ts

When filling out the Connecticut Prenuptial Agreement form, it's important to approach the process with care. Here are seven essential dos and don'ts to consider:

- Do ensure that both parties fully understand the terms of the agreement.

- Do disclose all assets and debts honestly to avoid potential disputes later.

- Do consult with separate legal counsel to ensure that both parties' interests are protected.

- Do review the agreement thoroughly before signing to ensure clarity and mutual agreement.

- Don't rush the process; take the time needed to discuss and negotiate terms.

- Don't use vague language that could lead to misunderstandings in the future.

- Don't forget to update the agreement if there are significant changes in circumstances, such as the birth of children or changes in assets.

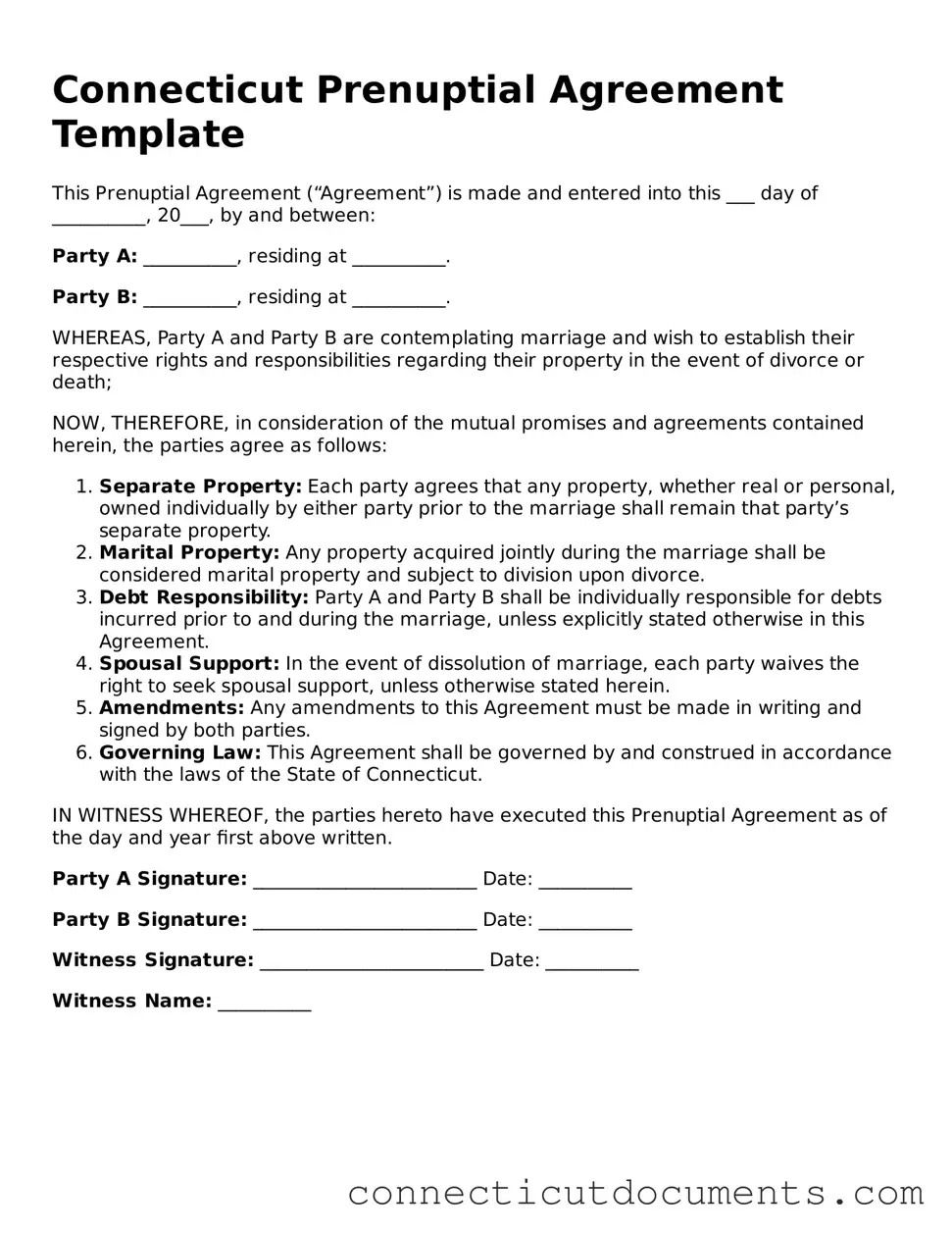

Detailed Guide for Writing Connecticut Prenuptial Agreement

Filling out a prenuptial agreement form in Connecticut is an important step for couples planning to marry. It helps clarify financial expectations and responsibilities. To ensure everything is completed correctly, follow these steps carefully.

- Begin by obtaining the Connecticut Prenuptial Agreement form. You can find it online or through a legal office.

- At the top of the form, enter the full names of both parties. Make sure to include any middle names.

- Next, provide the current addresses for both individuals. This should reflect where you both reside at the time of filling out the form.

- Detail the date of the marriage. Be specific about the month, day, and year.

- In the designated section, list all assets and liabilities for each party. This includes property, bank accounts, debts, and any other financial obligations.

- Discuss and outline how you both want to handle financial matters during the marriage and in the event of a divorce. Write this clearly in the appropriate section of the form.

- Once all information is filled in, both parties should review the document carefully to ensure accuracy.

- Sign and date the form in the presence of a notary public. This step is crucial for the agreement to be legally binding.

- Make copies of the signed agreement for both parties and store them in a safe place.

After completing the form, consider consulting with a lawyer to review the agreement. This ensures that both parties fully understand their rights and obligations, and that the document meets all legal requirements.