Attorney-Verified Operating Agreement Form for the State of Connecticut

In the world of business, particularly for those venturing into the realm of limited liability companies (LLCs), having a solid foundation is essential for success. One crucial document that plays a pivotal role in establishing this foundation is the Connecticut Operating Agreement form. This form serves as a blueprint for how an LLC will function, outlining the roles and responsibilities of its members, the management structure, and the distribution of profits and losses. By detailing procedures for decision-making and dispute resolution, it helps to mitigate misunderstandings among members. Furthermore, the Operating Agreement can specify the process for adding new members or handling the departure of existing ones, ensuring that transitions are smooth and well-managed. It not only protects the rights of members but also reinforces the company's limited liability status, shielding personal assets from business liabilities. Understanding the nuances of this form is vital for any LLC in Connecticut, as it not only fosters clarity and cooperation among members but also enhances the overall credibility of the business in the eyes of potential investors and partners.

Documents used along the form

When forming a limited liability company (LLC) in Connecticut, the Operating Agreement is a crucial document. However, it is often accompanied by other important forms and documents that help establish the legal and operational framework of the business. Below is a list of commonly used documents alongside the Connecticut Operating Agreement.

- Articles of Organization: This document is filed with the Connecticut Secretary of State to officially create the LLC. It includes essential information such as the company name, address, and registered agent.

- Employer Identification Number (EIN): An EIN is obtained from the IRS and is necessary for tax purposes. It allows the LLC to hire employees, open bank accounts, and file tax returns.

- Member Consent Forms: These forms are used to document decisions made by the members of the LLC. They are particularly useful for actions that require member approval, such as changes to the Operating Agreement or major business decisions.

- Articles of Incorporation: For anyone venturing into business formation, the essential guide to Articles of Incorporation provides crucial insights into the necessary steps and requirements.

- Bylaws: While not always required for an LLC, bylaws outline the internal rules and procedures for managing the business. They help clarify roles and responsibilities among members and can aid in conflict resolution.

- Business Licenses and Permits: Depending on the nature of the business, various licenses and permits may be required at the local, state, or federal level. These documents ensure compliance with regulations and legal requirements.

- Bank Account Resolution: This document authorizes the opening of a business bank account in the LLC's name. It typically includes the names of the members who have the authority to manage the account.

Each of these documents plays a vital role in establishing and maintaining the legal standing of an LLC in Connecticut. Together, they provide a comprehensive framework for operation, governance, and compliance, ensuring that the business can function smoothly and legally.

More Connecticut Templates

Rental Application Ct - Timeliness in submitting your application can give you an advantage in competitive markets.

For those looking to buy or sell a trailer, it is crucial to utilize the proper documentation to ensure a smooth transaction; thus, a Bill of Sale for a Trailer is necessary to officially record the transfer of ownership and protect the interests of both parties involved.

Ct Boat Bill of Sale - Often required to access warranties or service agreements post-sale.

Similar forms

The Connecticut Operating Agreement is similar to the Limited Liability Company (LLC) Agreement, which serves as a foundational document for LLCs across the United States. Both documents outline the structure, management, and operational procedures of the business entity. They establish the rights and responsibilities of members, detailing how profits and losses will be distributed. Just as the Connecticut Operating Agreement provides clarity and guidance for its members, the LLC Agreement ensures that all parties understand their roles and obligations, reducing the potential for conflicts in the future.

Another comparable document is the Partnership Agreement. This agreement is crucial for partnerships, as it delineates the terms under which partners will operate together. Like the Connecticut Operating Agreement, it specifies how profits and losses are shared among partners and outlines the decision-making processes. Both documents aim to create a clear framework that governs the relationship between members or partners, fostering cooperation and minimizing misunderstandings.

The Corporate Bylaws document also shares similarities with the Connecticut Operating Agreement. Bylaws govern the internal management of a corporation, much like how an operating agreement does for an LLC. Both documents address issues such as the roles of officers, meetings, and voting procedures. They serve to ensure that the entity operates smoothly and in accordance with its stated goals and legal requirements, providing a roadmap for governance and decision-making.

A Shareholder Agreement is another document that parallels the Connecticut Operating Agreement. This agreement is essential for corporations with multiple shareholders, as it outlines the rights and obligations of shareholders. Similar to the operating agreement, it covers aspects such as profit distribution, transfer of shares, and conflict resolution. Both documents are designed to protect the interests of the parties involved and provide a clear understanding of each party’s rights within the organization.

In the context of property management and rental agreements, having the right documentation is crucial to ensure clarity and compliance with the law. For landlords and tenants, a well-structured lease agreement is fundamental, similar to the frameworks established by various business contracts. For those looking for a reliable resource, the NY PDF Forms can provide essential templates that simplify the process of creating a legally binding lease agreement, safeguarding the interests of both parties involved.

The Joint Venture Agreement also bears resemblance to the Connecticut Operating Agreement. This document is used when two or more parties come together for a specific business purpose. Like the operating agreement, it defines the roles of each party, how profits will be shared, and the duration of the venture. Both documents are essential for establishing clear expectations and responsibilities, helping to prevent disputes and ensuring that all parties are aligned in their objectives.

The Nonprofit Bylaws document is similar in function to the Connecticut Operating Agreement, especially for nonprofit organizations. Nonprofit bylaws outline the governance structure, including the roles of board members and the procedures for meetings and decision-making. Both documents serve to provide clarity and structure, ensuring that the organization operates effectively and in compliance with applicable laws. They help maintain accountability and transparency within the organization.

Finally, the Franchise Agreement shares characteristics with the Connecticut Operating Agreement. This document governs the relationship between a franchisor and franchisee, detailing the rights and responsibilities of each party. Like the operating agreement, it includes provisions on fees, operational procedures, and dispute resolution. Both documents aim to establish a clear understanding of the relationship, ensuring that both parties know what is expected of them and how to handle potential conflicts.

Important Questions on This Form

What is a Connecticut Operating Agreement?

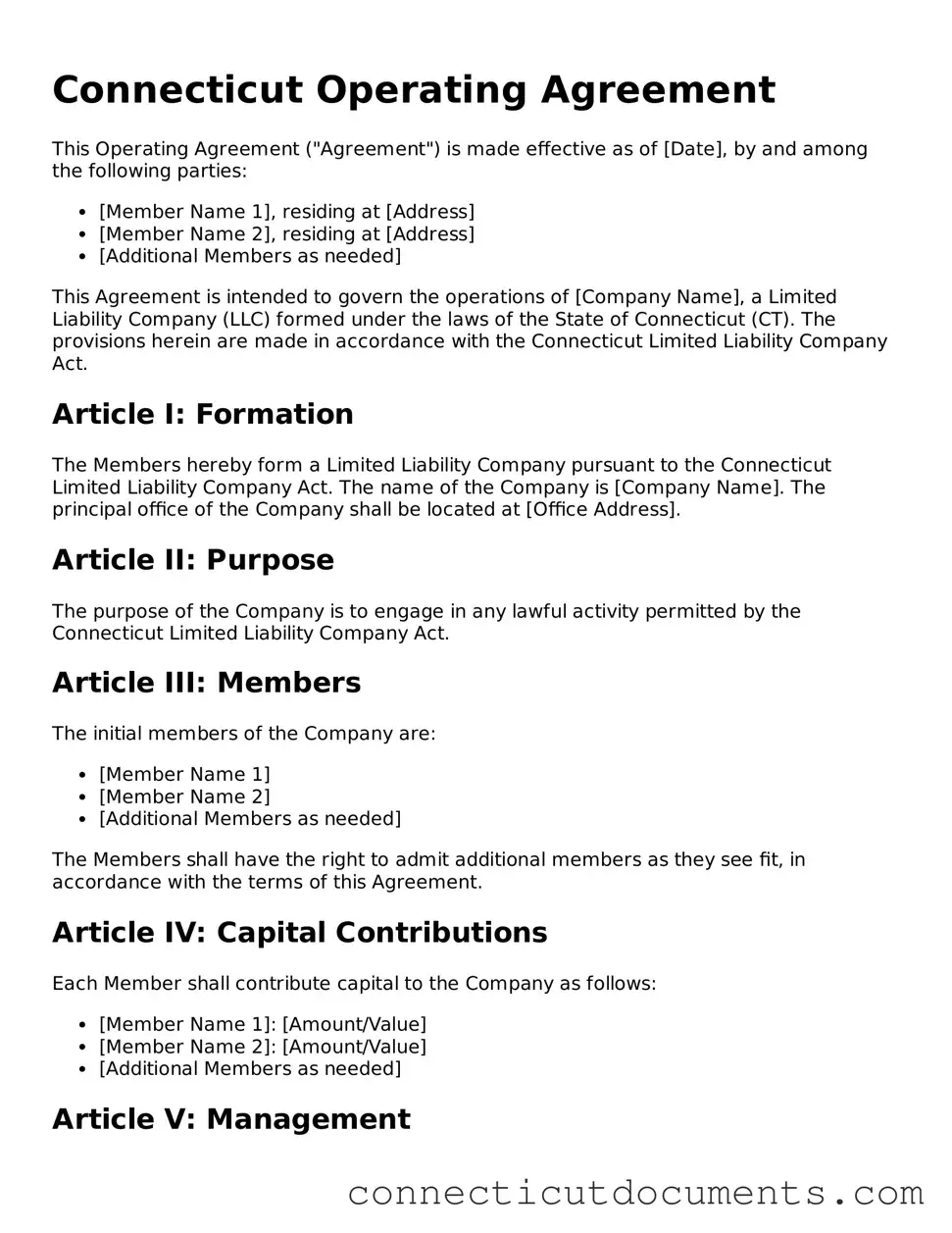

A Connecticut Operating Agreement is a legal document that outlines the ownership and operating procedures of a Limited Liability Company (LLC) in Connecticut. It serves as an internal document that details how the LLC will be managed, the rights and responsibilities of its members, and the procedures for making decisions within the company.

Why do I need an Operating Agreement for my LLC?

Having an Operating Agreement is crucial for several reasons. It helps establish clear guidelines for the management of the LLC, which can prevent misunderstandings among members. Additionally, it can protect your personal assets by reinforcing the limited liability status of the LLC. While Connecticut does not legally require an Operating Agreement, it is highly recommended.

What should be included in a Connecticut Operating Agreement?

Your Operating Agreement should include key information such as the LLC's name, address, and purpose. It should outline the ownership structure, including each member's percentage of ownership. Additionally, detail the management structure, voting rights, and procedures for adding or removing members. Including provisions for profit distribution and handling disputes is also advisable.

Can I create an Operating Agreement on my own?

Yes, you can draft your own Operating Agreement. There are many templates available online that can help guide you. However, it’s wise to consult with a legal professional to ensure that your document complies with state laws and adequately protects your interests.

How do I amend my Operating Agreement?

Amending your Operating Agreement is usually a straightforward process. Most agreements will include a section that outlines how amendments can be made. Typically, this requires a vote among the members. Make sure to document any changes in writing and keep them with your original Operating Agreement.

Is the Operating Agreement filed with the state?

No, the Operating Agreement is not filed with the state of Connecticut. It is an internal document that should be kept with your business records. However, it is important to have it readily available in case of any legal disputes or for reference in business operations.

What happens if I don’t have an Operating Agreement?

Without an Operating Agreement, your LLC will be governed by Connecticut's default laws. This can lead to unintended consequences, such as disputes over management and profit distribution. It may also expose you to greater liability risks, as the Operating Agreement helps reinforce the separation between personal and business assets.

How often should I review my Operating Agreement?

It's a good practice to review your Operating Agreement at least annually or whenever there are significant changes in your business, such as adding new members or changing the management structure. Regular reviews ensure that the document remains relevant and reflects the current state of your LLC.

Misconceptions

Misconceptions about the Connecticut Operating Agreement form can lead to confusion for business owners. Here are six common misunderstandings:

- It’s optional for all businesses. Many believe that an Operating Agreement is not necessary for all types of businesses. However, while it is not required for single-member LLCs, having one is beneficial for multi-member LLCs to outline management and ownership details.

- It is only for large businesses. Some think that only large corporations need an Operating Agreement. In reality, even small businesses benefit from having a clear agreement to prevent disputes and clarify roles.

- It must be filed with the state. A common myth is that the Operating Agreement needs to be submitted to the state of Connecticut. In fact, this document is internal and does not need to be filed, but it should be kept on record.

- It can’t be changed once created. Many assume that once an Operating Agreement is established, it cannot be altered. In truth, amendments can be made as the business evolves, provided all members agree.

- It covers all legal aspects of the business. Some believe that an Operating Agreement is a comprehensive legal document. However, it primarily focuses on the internal workings of the LLC and does not replace other legal requirements or documents.

- It’s the same as the Articles of Organization. There is a misconception that the Operating Agreement and Articles of Organization are interchangeable. They serve different purposes; the Articles of Organization are filed with the state to form the LLC, while the Operating Agreement governs its operations.

Dos and Don'ts

When filling out the Connecticut Operating Agreement form, it's important to approach the task with care. Here are some essential do's and don'ts to keep in mind:

- Do read the instructions carefully before starting. Understanding the requirements can save you time and confusion.

- Do provide accurate information. Ensure that all details about the business and its members are correct.

- Do include all required signatures. An unsigned document may not be considered valid.

- Do consult with a legal expert if you have questions. Getting professional advice can help clarify complex issues.

- Do keep a copy of the completed form for your records. This can be useful for future reference.

- Don't rush through the form. Taking your time helps avoid mistakes that could lead to delays.

- Don't leave any fields blank unless instructed. Missing information can lead to processing issues.

- Don't use jargon or unclear language. Clear communication is key to ensuring everyone understands the agreement.

- Don't overlook state-specific requirements. Each state has unique regulations that must be followed.

Detailed Guide for Writing Connecticut Operating Agreement

Once you have gathered all necessary information, you can begin filling out the Connecticut Operating Agreement form. This form is crucial for establishing the operational framework of your business. Completing it accurately will help ensure that all members are on the same page regarding the management and financial arrangements of the company.

- Start by entering the name of your LLC at the top of the form. Make sure it matches the name registered with the state.

- Provide the principal office address. This should be the primary location where your business operates.

- List the names and addresses of all members involved in the LLC. Each member should be identified clearly.

- Detail the purpose of the LLC. This section should describe what your business does or intends to do.

- Specify the management structure. Indicate whether the LLC will be member-managed or manager-managed.

- Outline the voting rights of each member. Clearly state how decisions will be made within the LLC.

- Include provisions for profit and loss distribution. Describe how profits and losses will be shared among members.

- Address any additional provisions that are relevant to your business. This can include rules for admitting new members or handling disputes.

- Have all members sign and date the agreement. This ensures that everyone acknowledges and agrees to the terms laid out in the document.

After completing the form, review it carefully for accuracy. Any mistakes could lead to complications in the future. Once confirmed, keep a copy for your records and distribute copies to all members involved.