Attorney-Verified Last Will and Testament Form for the State of Connecticut

Creating a Last Will and Testament is an essential step in ensuring that your wishes are honored after your passing. In Connecticut, this legal document outlines how your assets will be distributed and can designate guardians for any minor children. The form typically includes sections for identifying the testator, who is the person making the will, as well as the appointed executor, responsible for managing the estate. Additionally, it allows for the naming of beneficiaries, specifying who will receive particular assets or portions of the estate. It’s crucial to ensure that the will is signed in accordance with state laws, which generally require witnesses to validate the document. By understanding the major components of the Connecticut Last Will and Testament form, individuals can take proactive steps to secure their legacy and provide peace of mind for their loved ones.

Documents used along the form

When preparing a Last Will and Testament in Connecticut, several other forms and documents may also be necessary to ensure your wishes are carried out effectively. These documents can help clarify your intentions and provide guidance for your loved ones. Below is a list of commonly used forms that complement a Last Will and Testament.

- Living Will: This document outlines your preferences for medical treatment in the event that you become unable to communicate your wishes. It helps guide healthcare providers and family members in making decisions about your care.

- Durable Power of Attorney: This form allows you to designate someone to make financial and legal decisions on your behalf if you become incapacitated. It ensures that your financial matters are managed according to your wishes.

- Healthcare Proxy: A healthcare proxy allows you to appoint someone to make medical decisions for you if you are unable to do so. This document is crucial for ensuring that your healthcare preferences are respected.

- Revocable Living Trust: A trust can hold your assets during your lifetime and dictate how they are distributed after your death. This can help avoid probate and provide privacy regarding your estate.

- Residential Lease Agreement: When renting property in Arizona, it's crucial to understand the essential aspects of the Residential Lease Agreement to protect both landlord and tenant rights.

- Beneficiary Designation Forms: These forms are used for accounts like life insurance, retirement plans, and bank accounts. They specify who will receive these assets upon your death, bypassing the will process.

- Pet Trust: If you have pets, a pet trust ensures they are cared for after your passing. This document specifies how your pets should be looked after and who will be responsible for their care.

- Affidavit of Heirship: This document can help establish the heirs of your estate if you die without a will. It provides a legal statement regarding your family relationships and can assist in the distribution of your assets.

Each of these documents serves a specific purpose and can work in conjunction with your Last Will and Testament. Taking the time to prepare these forms can provide peace of mind and ensure that your wishes are clearly communicated and honored.

More Connecticut Templates

Ct Quit Claim Deed - Does not require a real estate agent, making it a cost-effective option.

When entering into a rental agreement, it's crucial to utilize a comprehensive document like the New York Residential Lease Agreement, which ensures clarity between the landlord and tenant regarding rental terms. To streamline this process, you can access a template through NY PDF Forms, which provides a structured format to cover essential details such as rent, deposits, and lease duration, ultimately safeguarding the interests of both parties involved.

Ct Probate Fees - Ensuring all signatures and dates are correct is vital for the form's acceptance.

Similar forms

The Connecticut Last Will and Testament is similar to a Living Will, which outlines a person's wishes regarding medical treatment in case they become unable to communicate. While a Last Will focuses on distributing assets after death, a Living Will addresses healthcare decisions during a person's lifetime. Both documents serve to express individual preferences, ensuring that one's desires are honored, whether in matters of property or health care.

Another document that shares similarities is the Durable Power of Attorney. This legal tool allows someone to designate another person to make financial or legal decisions on their behalf if they become incapacitated. Like a Last Will, it provides clarity and direction, ensuring that someone trusted manages affairs according to the individual’s wishes. Both documents are crucial for planning and protecting one's interests.

The Revocable Trust is also akin to a Last Will. It allows individuals to place their assets into a trust during their lifetime, which can then be distributed to beneficiaries after their death. While a Last Will goes through probate, a Revocable Trust typically bypasses this process, providing a more private and efficient way to manage and distribute assets. Both documents aim to facilitate the transfer of property according to the individual's desires.

Similarly, a Healthcare Proxy grants a trusted person the authority to make medical decisions on behalf of someone who is unable to do so. This document complements a Living Will by designating a specific individual to ensure that healthcare choices align with the person's values and preferences. Both are essential for making sure that healthcare decisions reflect an individual's wishes.

The Codicil is another document related to a Last Will. It serves as an amendment or addition to an existing will, allowing individuals to update their wishes without creating an entirely new document. This can be useful for minor changes, such as adding or removing beneficiaries. Both documents ensure that a person's final intentions are clear and up-to-date.

In situations involving property transfers, understanding different legal documents is essential, and for those interested in real estate transactions, utilizing a Quitclaim Deed form can simplify the process, especially when dealing with family-related property issues or to clear title defects.

A Letter of Instruction is also similar, though it is not a legal document. It provides guidance to loved ones about personal matters, funeral arrangements, and the distribution of sentimental items. While a Last Will addresses the legal distribution of assets, a Letter of Instruction offers a more personal touch, ensuring that important details are communicated effectively.

Lastly, a Prenuptial Agreement can be compared to a Last Will in that both documents deal with the distribution of assets. A Prenuptial Agreement is created before marriage to outline how assets will be divided in the event of a divorce or separation. While a Last Will focuses on post-death asset distribution, both documents help individuals clarify their intentions regarding property and financial matters.

Important Questions on This Form

What is a Last Will and Testament in Connecticut?

A Last Will and Testament is a legal document that outlines how a person wants their assets distributed after their death. In Connecticut, this document allows you to specify who will receive your property, name guardians for minor children, and appoint an executor to manage your estate. It ensures that your wishes are honored and can help avoid disputes among family members.

Do I need a lawyer to create a Last Will and Testament in Connecticut?

No, you do not necessarily need a lawyer to create a Last Will and Testament in Connecticut. While having legal assistance can be beneficial, especially for complex estates, you can draft your own will as long as you follow state laws. It’s important to ensure that your will is properly signed and witnessed to be valid.

What are the requirements for a valid will in Connecticut?

For a will to be valid in Connecticut, it must be in writing and signed by the person making the will (the testator). Additionally, it must be witnessed by at least two individuals who are present at the same time. These witnesses should not be beneficiaries of the will to avoid any potential conflicts of interest. Following these steps helps ensure that your will is legally enforceable.

Can I change or revoke my will after it is created?

Yes, you can change or revoke your will at any time while you are still alive. To make changes, you can create a new will that explicitly states it revokes any previous wills. Alternatively, you can make amendments through a codicil, which is an official addition or change to your existing will. Just remember that any changes must also meet the same legal requirements as the original will.

What happens if I die without a will in Connecticut?

If you die without a will, your estate will be distributed according to Connecticut’s intestacy laws. This means that the state will determine how your assets are divided, which may not align with your wishes. Typically, your property will go to your closest relatives, such as a spouse or children. To avoid this situation, it is advisable to create a will to ensure your wishes are followed.

Misconceptions

Understanding the Connecticut Last Will and Testament form is crucial for effective estate planning. However, several misconceptions can lead to confusion. Here are eight common misconceptions:

- A will only takes effect after death. Many people believe that a will has no legal standing until the person passes away. In reality, a will is a legal document that outlines wishes and can guide decisions even before death, especially regarding healthcare and finances if the individual becomes incapacitated.

- All wills must be notarized. While notarization can add an extra layer of authenticity, Connecticut does not require a will to be notarized to be valid. A will must be signed by the testator and witnessed by two individuals who are not beneficiaries.

- Handwritten wills are not valid. In Connecticut, handwritten wills, also known as holographic wills, can be valid if they meet specific criteria. They must be signed by the testator and clearly express their intentions.

- Only lawyers can draft a will. While it is advisable to seek legal counsel, individuals can prepare their own wills. Using a template or form can help, as long as it adheres to Connecticut laws.

- Wills can be changed only through a new will. Some people think that once a will is created, it cannot be altered. In fact, a testator can make changes through a codicil, which is an amendment to the existing will.

- All assets must go through probate. Not all assets are subject to probate. Certain assets, such as those held in a trust or joint ownership properties, can bypass the probate process.

- Beneficiaries must be family members. There is a misconception that only relatives can be named as beneficiaries in a will. In reality, anyone can be designated as a beneficiary, including friends and charitable organizations.

- A will can cover all aspects of estate planning. Some believe a will is the only document needed for estate planning. However, additional documents like trusts, powers of attorney, and advance healthcare directives are also important for comprehensive planning.

Dos and Don'ts

When filling out the Connecticut Last Will and Testament form, it is important to follow certain guidelines to ensure that your wishes are clearly expressed and legally binding. Below is a list of things you should and shouldn't do.

- Do ensure that you are of sound mind and at least 18 years old when completing the form.

- Do clearly identify yourself and your beneficiaries to avoid any confusion.

- Do sign the document in the presence of two witnesses who are not beneficiaries.

- Do keep the original document in a safe place and inform your executor of its location.

- Do review and update your will regularly to reflect any changes in your life circumstances.

- Don't use vague language that could lead to misinterpretation of your wishes.

- Don't forget to date the will, as this helps establish its validity.

- Don't attempt to fill out the form under duress or while influenced by others.

- Don't neglect to consider any debts or obligations when distributing your assets.

- Don't assume that a verbal agreement will suffice; always have a written will.

Detailed Guide for Writing Connecticut Last Will and Testament

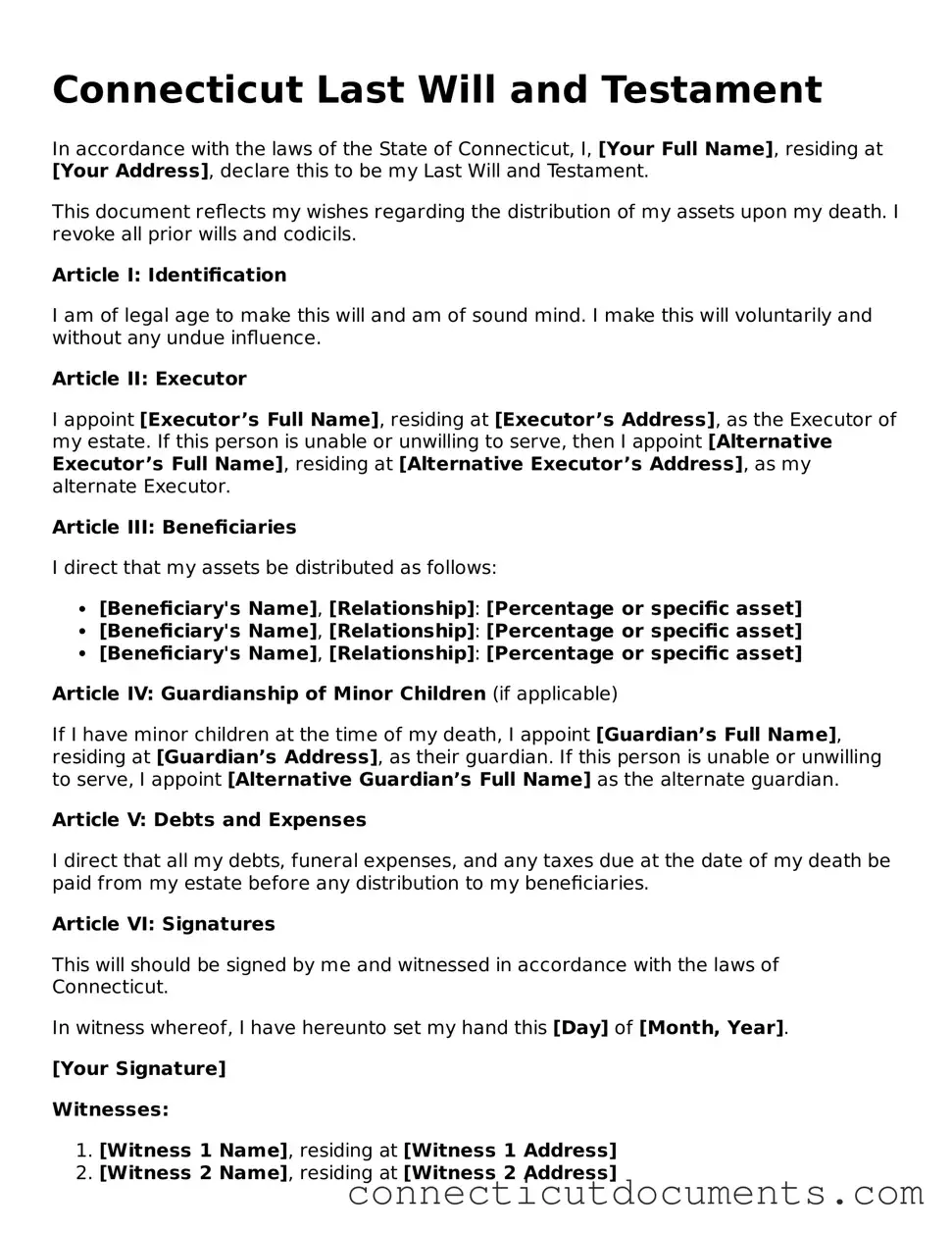

After you have gathered the necessary information, you are ready to fill out the Connecticut Last Will and Testament form. This document will guide your wishes regarding the distribution of your assets after your passing. Follow these steps carefully to ensure everything is completed correctly.

- Begin with your personal information. Write your full name, address, and date of birth at the top of the form.

- Clearly state that this document is your Last Will and Testament. You may write this at the beginning of the document.

- Designate an executor. Choose a trusted individual to carry out your wishes. Include their name and contact information.

- List your beneficiaries. Write down the names of the people or organizations you wish to inherit your assets. Be specific about what each person will receive.

- Include any specific bequests. If you want to leave particular items or amounts of money to certain individuals, detail these requests clearly.

- Address any debts or expenses. Specify how you want your debts and final expenses to be handled, including funeral costs.

- Sign and date the document. Your signature must be included at the end of the will, along with the date you signed it.

- Have witnesses sign the document. In Connecticut, you need at least two witnesses who are not beneficiaries to sign your will. They should also include their addresses.

Once you have completed the form, consider storing it in a safe place and informing your executor of its location. This will help ensure that your wishes are honored when the time comes.