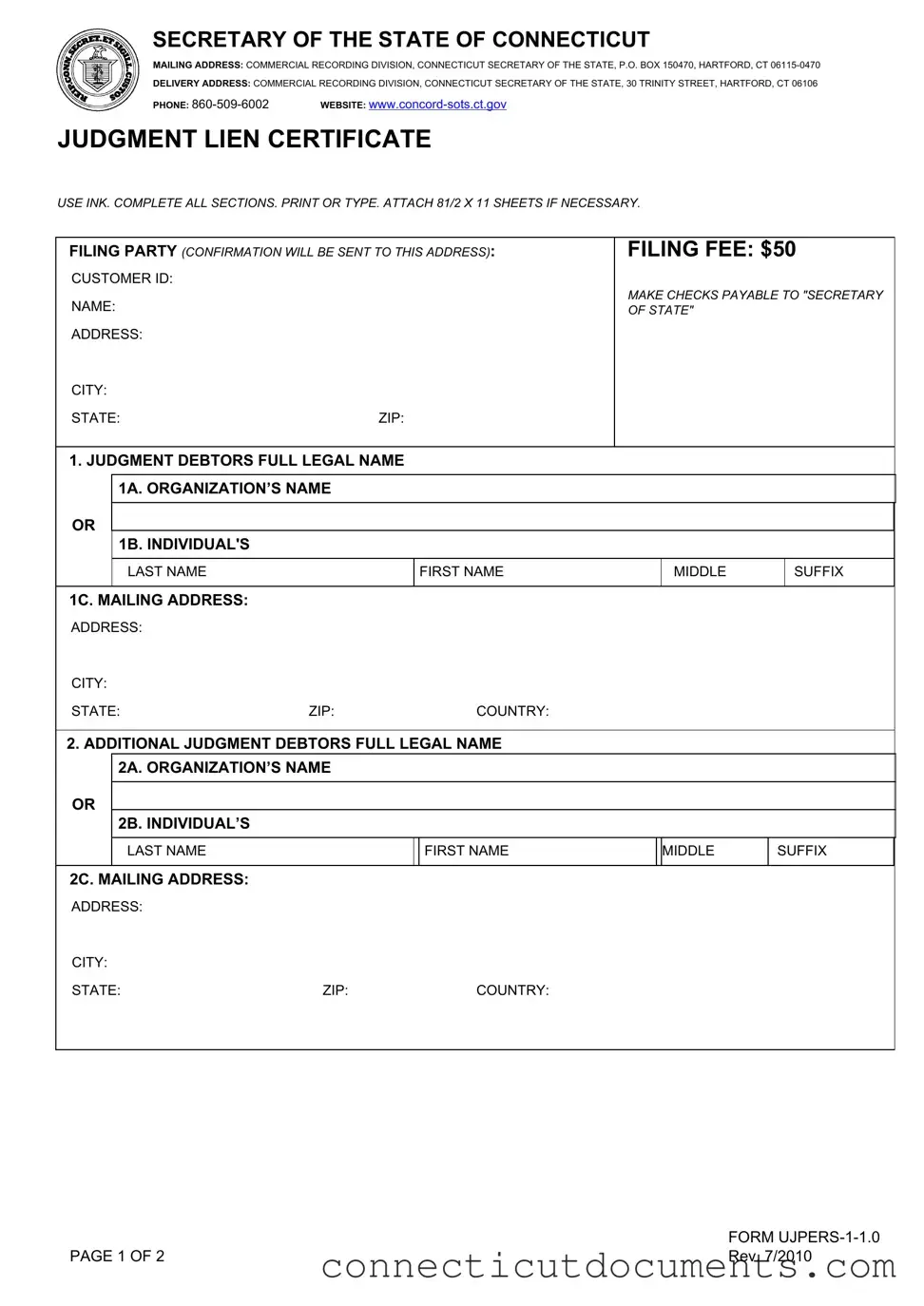

Fill a Valid Judgment Lien Certificate Connecticut Template

The Judgment Lien Certificate in Connecticut serves as an essential legal document for individuals and organizations seeking to establish a lien against a debtor’s property following a court judgment. This form is used to officially record the judgment and secure the creditor's claim against the debtor's assets. It requires accurate and complete information, including the full legal names and addresses of both the judgment debtor and creditor, as well as details about the court that rendered the judgment and the amounts involved. The form must be filled out using ink, and it allows for additional sheets if necessary to provide all required information. A filing fee of $50 is applicable, and payment should be made to the Secretary of State. The completed certificate must be submitted to the Commercial Recording Division of the Connecticut Secretary of the State, either by mail or in person. Proper completion of this form is crucial, as it ensures that the creditor's rights are protected and that the lien is enforceable against the debtor's personal property.

Documents used along the form

The Judgment Lien Certificate is a key document in securing a creditor's interest in a debtor's property in Connecticut. However, several other forms and documents are often used in conjunction with this certificate to ensure proper legal standing and compliance. Below is a list of these documents, along with brief descriptions of each.

- Judgment: This is the court's official decision that establishes the amount owed by the debtor to the creditor. It serves as the basis for the lien.

- Notice of Lien: This document formally notifies the public and the debtor that a lien has been placed on the debtor's property. It is often filed with the local land records office.

- Affidavit of Service: This document provides proof that the debtor was properly served with the judgment and any related documents. It is essential for establishing that the debtor was aware of the proceedings.

- Request for Hearing: If the debtor contests the lien, this document can be filed to request a court hearing to address the validity of the lien.

- Release of Lien: Once the debt is satisfied, this document is filed to officially remove the lien from the debtor's property, clearing the title.

- General Power of Attorney: This form allows an individual to appoint an agent to act on their behalf in financial matters, providing broad powers similar to those found in the documents listed above. For further details, you may refer to nyforms.com.

- Certificate of Judgment: This document certifies that a judgment has been entered and is often required to enforce the lien in other jurisdictions.

- Financial Affidavit: This form provides a detailed account of the debtor's financial situation, which may be relevant if the debtor seeks to negotiate payment terms or contest the lien.

These documents collectively support the enforcement of a judgment lien and ensure that all legal requirements are met. Proper management of these forms can significantly impact the effectiveness of the lien and the overall collection process.

Additional PDF Templates

Inheritance Tax Ct - Average miles per gallon needs to be computed as part of the refund claim process.

Family Court Petition for Custody - The form seeks to ensure the welfare of the child during legal proceedings.

To facilitate a smooth understanding of the financial responsibilities, it is crucial to familiarize oneself with the Child Support Texas form and the accompanying guidelines. For those looking for resources, Texas PDF Forms provides convenient access to the necessary documents to ensure compliance with legal standards and the proper completion of the required forms.

How to Transfer Ownership of a Car to a Family Member in Ct - This form supports municipalities in maintaining clean and safe environments.

Similar forms

The Judgment Lien Certificate in Connecticut shares similarities with a UCC Financing Statement. Both documents serve to establish a public record of a financial obligation. A UCC Financing Statement is filed to perfect a security interest in personal property, while the Judgment Lien Certificate is used to secure a creditor's claim against a debtor's property following a court judgment. Each document requires specific information about the debtor and creditor, including names and addresses, and serves to inform third parties about the existence of a financial obligation.

The California Form REG 262, known as the Vehicle/Vessel Transfer and Reassignment Form, is a key document in ensuring the proper transition of ownership for vehicles or vessels within California. This form is critical for thoroughly documenting details related to the sale or transfer and is required alongside the title or in applications for a Duplicate Title. For those looking to access or complete this form, you can find it at formcalifornia.com/editable-california-fotm-reg-262-form.

Another related document is the Notice of Lien. This document is typically filed to notify the public that a lien exists against a property, similar to how the Judgment Lien Certificate informs of a judgment debt. The Notice of Lien often outlines the amount owed and the parties involved, ensuring transparency in financial transactions. Both documents aim to protect the interests of creditors by establishing a legal claim over a debtor's assets.

The Certificate of Judgment also bears resemblance to the Judgment Lien Certificate. A Certificate of Judgment is an official document issued by the court that confirms a judgment has been rendered. While the Judgment Lien Certificate focuses on the lien aspect, the Certificate of Judgment provides proof of the judgment itself. Both documents require detailed information about the judgment debtor and creditor, reinforcing the legal standing of the creditor's claim.

A similar document is the Abstract of Judgment. This document summarizes the judgment and is often used to create a lien on real property. Like the Judgment Lien Certificate, the Abstract of Judgment includes key details such as the names of the parties involved and the amount of the judgment. Both documents serve to formalize the creditor's right to collect the owed amount by establishing a lien against the debtor's property.

The Satisfaction of Judgment is another document that relates to the Judgment Lien Certificate. Once a judgment has been paid or settled, a Satisfaction of Judgment is filed to indicate that the debt has been fulfilled. While the Judgment Lien Certificate establishes the creditor's claim, the Satisfaction of Judgment serves to release that claim, ensuring that the debtor's property is no longer encumbered by the lien.

Additionally, the Claim of Lien is similar in purpose to the Judgment Lien Certificate. This document is filed to assert a claim against a property due to unpaid debts. Both documents create a public record of the creditor's interest in the debtor's property. The Claim of Lien can be used in various contexts, such as construction or mechanic's liens, but fundamentally serves the same goal of protecting creditor rights.

The Notice of Default is another document that can be compared to the Judgment Lien Certificate. This document is often used in mortgage situations to inform the borrower that they are in default on their loan. While the Judgment Lien Certificate is focused on the outcome of a court judgment, both documents serve to alert the parties involved about financial obligations and potential consequences if those obligations are not met.

Lastly, the Lis Pendens is akin to the Judgment Lien Certificate in that it serves as a public notice regarding a pending legal action affecting a property. While the Judgment Lien Certificate arises from a finalized judgment, a Lis Pendens is filed to notify potential buyers or lenders that a legal claim is being asserted against the property. Both documents aim to protect the interests of creditors and ensure that all parties are aware of existing claims against a debtor’s assets.

Important Questions on This Form

What is a Judgment Lien Certificate in Connecticut?

A Judgment Lien Certificate is a legal document that establishes a lien on a debtor's property following a court judgment. This certificate serves to protect the creditor's interest by ensuring that the debtor's assets can be used to satisfy the judgment amount owed.

How do I file a Judgment Lien Certificate in Connecticut?

To file a Judgment Lien Certificate, complete the form provided by the Connecticut Secretary of State. Ensure all sections are filled out accurately. You can submit the form by mail or deliver it in person to the Commercial Recording Division. The filing fee is $50, payable by check to the "Secretary of State."

What information is required on the form?

The form requires details such as the full legal names and addresses of the judgment debtor(s) and creditor(s), the court where the judgment was rendered, the date of judgment, the original judgment amount, and any personal property on which the lien is placed. Be thorough to avoid any processing delays.

What is the filing fee for the Judgment Lien Certificate?

The filing fee is $50. This fee must be included with your submission and can be paid by check made out to the "Secretary of State." Ensure that the check is attached to your completed form.

How will I receive confirmation of my filing?

Confirmation of your filing will be sent to the address provided in the "Filing Party" section of the form. Make sure this address is accurate to ensure you receive all necessary correspondence.

Can I attach additional sheets to the form?

Yes, if you need more space to provide information, you can attach additional 8½ x 11 sheets. Just ensure that all attached sheets are clearly labeled and organized to match the sections of the form.

What happens if I make a mistake on the form?

If you make a mistake, it’s best to correct it before submitting the form. Cross out the error neatly and write the correct information. If the mistake is significant, consider filling out a new form to avoid confusion during processing.

How long does it take to process the Judgment Lien Certificate?

Processing times can vary, but typically, you can expect confirmation within a few weeks. If you have concerns about the status of your filing, you can contact the Commercial Recording Division at 860-509-6002 for updates.

Is there a time limit for filing a Judgment Lien Certificate?

Yes, there is a time limit. In Connecticut, a Judgment Lien Certificate must be filed within 20 years from the date of the judgment. It’s crucial to file within this timeframe to ensure your lien remains valid.

Where can I find more information about the Judgment Lien Certificate?

For more information, visit the Connecticut Secretary of State's website at www.concord-sots.ct.gov. You can find additional resources and contact details if you have specific questions regarding your filing.

Misconceptions

Here are six common misconceptions about the Judgment Lien Certificate in Connecticut:

- It is only for businesses. Many believe that only organizations can file a Judgment Lien Certificate. In reality, both individuals and businesses can use this form to secure their claims.

- Filing is optional. Some think that filing a Judgment Lien Certificate is not necessary. However, filing is crucial to protect the creditor's rights and ensure the lien is enforceable.

- There is no fee associated with filing. A common misconception is that filing the certificate is free. In fact, there is a filing fee of $50 that must be paid at the time of submission.

- The form can be submitted in any format. Some people believe they can submit the form handwritten or in any style. The form must be completed in ink and should be printed or typed for clarity.

- Only the original judgment amount needs to be reported. Many assume that only the original judgment amount is relevant. However, the amount due must also be specified to accurately reflect the current status of the debt.

- Filing guarantees payment. Some individuals think that filing a Judgment Lien Certificate ensures they will receive payment. While it secures a legal claim, it does not guarantee that the debtor will pay.

Dos and Don'ts

When filling out the Judgment Lien Certificate in Connecticut, follow these guidelines to ensure a smooth process.

- Use ink. Always fill out the form using blue or black ink.

- Complete all sections. Make sure every part of the form is filled out completely.

- Print or type. Your entries should be clear and legible.

- Attach additional sheets if needed. If you require more space, include 8½ x 11 sheets.

- Double-check names. Ensure that the names of judgment debtors and creditors are accurate and spelled correctly.

- Do not leave blanks. If a section does not apply, write "N/A" instead of leaving it empty.

- Pay the correct filing fee. Include a check for $50 made payable to "Secretary of State."

- Do not forget your signature. Sign and date the form before submission.

By adhering to these dos and don'ts, you can help ensure that your Judgment Lien Certificate is processed without unnecessary delays.

Detailed Guide for Writing Judgment Lien Certificate Connecticut

After completing the Judgment Lien Certificate form, the next step involves submitting it to the appropriate office for processing. Ensure that all information is accurate and that the filing fee is included to avoid any delays. Once submitted, confirmation of your filing will be sent to the address provided.

- Begin by using ink to fill out the form. Ensure that all sections are completed.

- In the first section, provide the filing party's name, address, city, state, and ZIP code. This is where confirmation will be sent.

- Write the filing fee of $50 and include your customer ID if applicable.

- For the judgment debtor's full legal name, fill in either the organization’s name or the individual's last name, first name, middle name, and suffix.

- Complete the mailing address for the judgment debtor, including address, city, state, ZIP code, and country.

- If there are additional judgment debtors, repeat the previous two steps for their information.

- Next, provide the judgment creditor's full legal name in the same format as above.

- Fill out the mailing address for the judgment creditor, including all required details.

- Include any additional judgment creditors by repeating the previous two steps as necessary.

- Specify the court in which the judgment was rendered.

- Indicate the date of judgment.

- Fill in the original judgment amount and the amount due.

- Detail the personal property on which the lien is placed.

- Sign the form as the judgment creditor.

- Finally, date the form.