Attorney-Verified General Power of Attorney Form for the State of Connecticut

The Connecticut General Power of Attorney form serves as a vital legal tool that empowers individuals to designate someone they trust to manage their financial and legal affairs when they are unable to do so themselves. This form allows the appointed agent to make decisions on behalf of the principal, covering a broad range of responsibilities such as handling bank transactions, managing real estate, and dealing with insurance matters. One of the key features of this document is its flexibility; the principal can specify the powers granted to the agent, which may include everything from managing investments to signing documents. Additionally, the form can be tailored to be effective immediately or to become effective only under certain conditions, such as the principal's incapacitation. Understanding the nuances of this form is crucial, as it not only facilitates seamless management of affairs but also ensures that the principal’s wishes are honored. As individuals navigate the complexities of life and the potential for unforeseen circumstances, having a General Power of Attorney in place can provide peace of mind and clarity in decision-making.

Documents used along the form

When preparing a General Power of Attorney in Connecticut, it is often beneficial to accompany it with additional forms and documents to ensure comprehensive coverage of various legal and financial matters. Below is a list of commonly used documents that can enhance the effectiveness of a General Power of Attorney.

- Durable Power of Attorney: This document remains effective even if the principal becomes incapacitated. It allows the agent to continue making decisions on behalf of the principal during periods of inability to manage their own affairs.

- Health Care Proxy: This form appoints someone to make medical decisions on behalf of the principal if they are unable to do so. It is crucial for ensuring that healthcare preferences are honored in times of crisis.

- Living Will: A Living Will outlines the principal's wishes regarding end-of-life medical treatment. It provides clear instructions about the types of medical interventions desired or not desired in terminal situations.

- Financial Power of Attorney: This document specifically grants authority to the agent to handle financial matters, such as banking, investments, and real estate transactions, providing a focused approach to financial management.

- Child Support Texas Form: The Child Support Texas form is vital for delineating the financial responsibilities of the obligor in child support cases. For more information on filling this out, refer to Texas PDF Forms.

- Revocation of Power of Attorney: If the principal wishes to terminate the authority granted to the agent, this document formally revokes any previously established Power of Attorney. It is essential for ensuring that outdated powers are no longer in effect.

By utilizing these documents alongside the General Power of Attorney, individuals can better protect their interests and ensure that their wishes are respected in various circumstances. It is advisable to consult with a legal professional to tailor these documents to specific needs and situations.

More Connecticut Templates

Blank Promissory Note - The terms should clearly state any fees associated with late payments or defaults.

Ct Articles of Incorporation - The articles provide a foundational document for corporate governance.

In navigating the complexities of financial and legal decisions, individuals often find it beneficial to utilize a New York General Power of Attorney form. By granting this authority, the principal empowers an agent to handle a range of transactions on their behalf, ensuring that their interests are represented effectively. For those seeking a clear and comprehensive template for this form, resources are available online such as https://nyforms.com/, which can assist in understanding the intricacies involved.

Ct Dnr Form - Signifies a patient's informed decision not to pursue resuscitation efforts.

Similar forms

The Durable Power of Attorney is a document similar to the General Power of Attorney, but it remains effective even if the principal becomes incapacitated. This means that if you become unable to make decisions for yourself due to illness or injury, the Durable Power of Attorney allows your designated agent to continue managing your financial and legal matters. This feature provides peace of mind, knowing that your affairs will be handled according to your wishes, regardless of your health status.

The Limited Power of Attorney is another related document. Unlike the General Power of Attorney, which grants broad authority, the Limited Power of Attorney specifies particular tasks or decisions that the agent can handle. For example, you might use this document for a specific real estate transaction or to manage a single financial account. This targeted approach ensures that the agent's powers are confined to the defined tasks, offering more control over your affairs.

The Medical Power of Attorney, also known as a Healthcare Proxy, focuses solely on health care decisions. This document allows you to designate someone to make medical choices on your behalf if you are unable to do so. While the General Power of Attorney covers financial and legal matters, the Medical Power of Attorney is specifically tailored for health-related situations, ensuring your medical preferences are respected when you cannot voice them yourself.

The Springing Power of Attorney is a unique variation that only becomes effective under certain conditions, typically when the principal becomes incapacitated. This document is similar to the Durable Power of Attorney but adds an extra layer of protection by ensuring that your agent cannot act until a specific event occurs. This can provide reassurance that your agent will not have authority until it is truly necessary.

In addition to the various powers of attorney, it's also important to be aware of other significant legal documents, such as the California Form REG 262. This form plays a pivotal role in vehicle and vessel ownership transfers within the state, ensuring compliance with legal requirements. For more detailed information, you can visit https://formcalifornia.com/editable-california-fotm-reg-262-form/, which provides guidance on the necessary steps and documentation involved in this crucial process.

The Revocation of Power of Attorney document serves as a way to cancel any previously granted powers. If you decide that you no longer want someone to act on your behalf, this document formally terminates their authority. It is essential for maintaining control over your affairs, as it allows you to revoke a General Power of Attorney or any other similar documents whenever you choose.

Lastly, the Advance Healthcare Directive combines elements of the Medical Power of Attorney and living will. This document outlines your healthcare preferences and designates someone to make decisions if you cannot communicate. It ensures that your wishes regarding medical treatment are known and respected, offering a comprehensive approach to managing your healthcare in alignment with your values and desires.

Important Questions on This Form

What is a General Power of Attorney in Connecticut?

A General Power of Attorney is a legal document that allows one person, known as the "principal," to grant another person, referred to as the "agent" or "attorney-in-fact," the authority to act on their behalf. This authority can cover a wide range of financial and legal matters, including managing bank accounts, signing checks, and handling real estate transactions. The document is particularly useful when the principal is unable to manage their affairs due to absence, illness, or incapacity.

How do I create a General Power of Attorney in Connecticut?

To create a General Power of Attorney in Connecticut, you must complete a specific form that outlines the powers you wish to grant to your agent. While there is no official state form, it is essential to ensure that the document complies with state laws. You must sign the form in the presence of a notary public or two witnesses. It is advisable to consult with a legal professional to ensure that the document accurately reflects your intentions and adheres to all legal requirements.

Can I revoke a General Power of Attorney in Connecticut?

Yes, you can revoke a General Power of Attorney at any time, as long as you are mentally competent. To do this, you should create a written revocation document and notify your agent and any relevant institutions or individuals that may rely on the original power of attorney. It is also a good practice to destroy any copies of the original document to prevent confusion. If you have granted a power of attorney to multiple agents, you may need to revoke the authority of each one individually.

What happens if I become incapacitated and have not created a General Power of Attorney?

If you become incapacitated without having a General Power of Attorney in place, your loved ones may face challenges in managing your affairs. In such cases, they may need to seek a court-appointed guardian or conservator to handle your financial and personal matters. This process can be time-consuming and costly. To avoid this situation, it is advisable to create a General Power of Attorney while you are still able to make decisions about your future.

Misconceptions

When it comes to the Connecticut General Power of Attorney form, many people hold misconceptions that can lead to confusion or mismanagement of their affairs. Here are six common misconceptions:

- It only applies to financial matters. Many believe that a General Power of Attorney is limited to financial decisions. In reality, it can also cover health care decisions, depending on how it is drafted.

- It becomes invalid if I become incapacitated. This is not true. A General Power of Attorney remains valid even if you become incapacitated, unless it is specifically stated that it ends under such circumstances.

- Anyone can be my agent. While you can choose anyone you trust, it’s important to note that your agent must be a competent adult. This means they should be capable of making decisions on your behalf.

- I can’t change my mind once it’s signed. You absolutely can revoke or change your General Power of Attorney at any time, as long as you are mentally competent to do so.

- It’s a one-size-fits-all document. This form can be customized to fit your specific needs. You can specify which powers you grant and under what circumstances.

- It’s only necessary for older adults. People of all ages can benefit from having a General Power of Attorney. Unexpected situations can arise at any time, making it a wise choice for anyone.

Understanding these misconceptions can help you make informed decisions about your legal documents and ensure that your wishes are honored.

Dos and Don'ts

When filling out the Connecticut General Power of Attorney form, it is important to approach the task with care. Here are ten things to consider:

- Do read the entire form carefully before starting.

- Don't leave any sections blank unless instructed to do so.

- Do ensure that the person you are designating as your agent understands their responsibilities.

- Don't choose an agent who may have conflicting interests.

- Do provide clear and specific instructions for your agent.

- Don't use vague language that could lead to misunderstandings.

- Do sign the form in the presence of a notary public.

- Don't forget to date the form when signing.

- Do keep a copy of the completed form for your records.

- Don't assume that your agent will know your wishes without clear communication.

Detailed Guide for Writing Connecticut General Power of Attorney

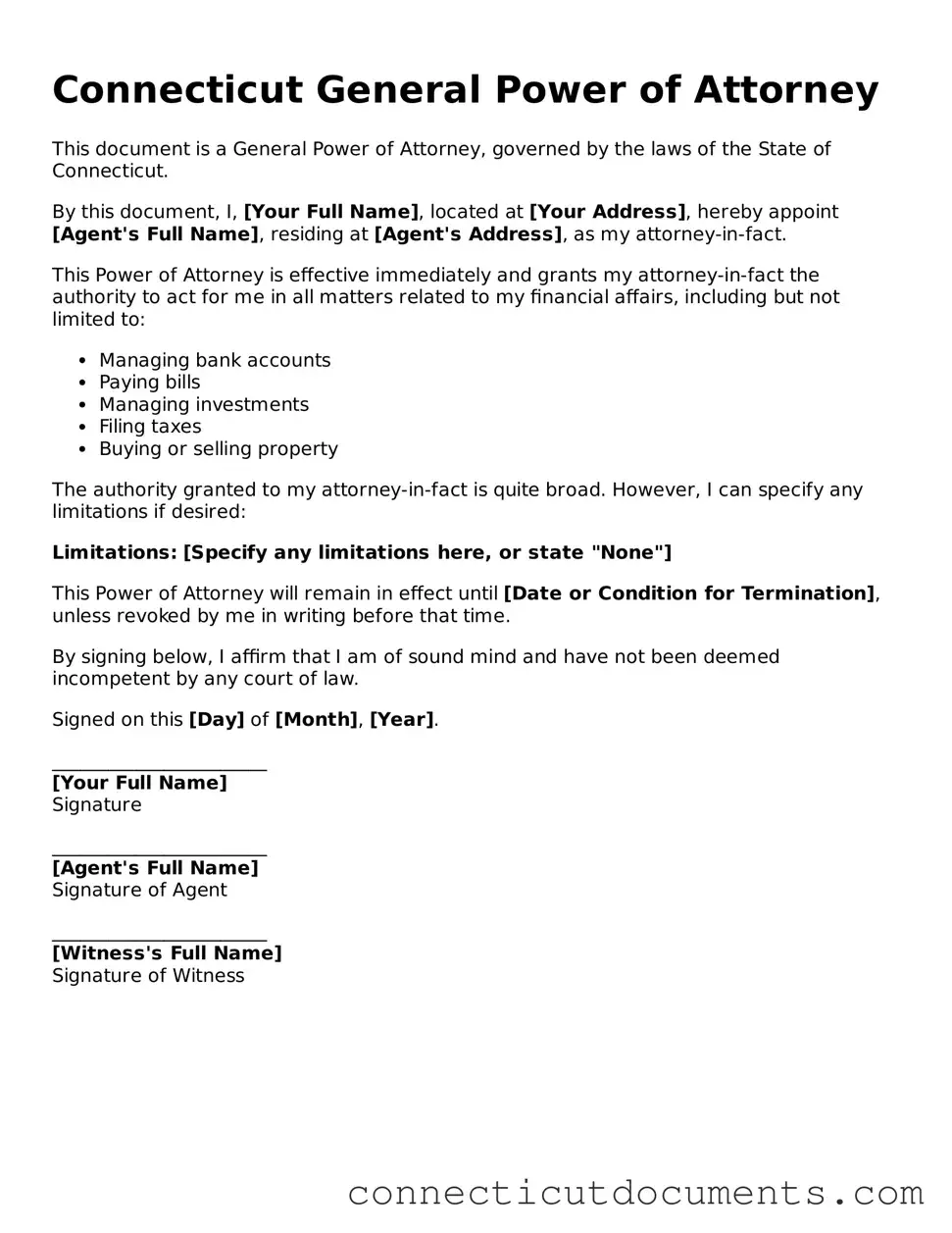

After obtaining the Connecticut General Power of Attorney form, it is essential to fill it out accurately to ensure it meets your needs. Following the steps below will guide you through the process of completing the form effectively.

- Start by downloading the Connecticut General Power of Attorney form from a reliable source or obtain a physical copy.

- Read the instructions carefully to understand the requirements and the information needed.

- Begin filling out the form by entering your name, address, and contact information in the designated sections.

- Identify the person you are appointing as your agent. Provide their full name, address, and contact information.

- Clearly outline the powers you wish to grant your agent. You may choose to provide general powers or specify certain tasks.

- Include any limitations or specific conditions related to the powers granted, if applicable.

- Sign and date the form in the appropriate section. Ensure that your signature matches the name you provided at the beginning.

- Have the form notarized. This step is crucial for validating the document in Connecticut.

- Provide copies of the completed form to your agent and any relevant institutions or individuals.

Once the form is filled out and notarized, it is advisable to keep a copy for your records. The next steps involve communicating with your agent and ensuring they understand their responsibilities under the power of attorney.