Attorney-Verified Durable Power of Attorney Form for the State of Connecticut

In the realm of estate planning and financial management, the Connecticut Durable Power of Attorney (DPOA) form serves as a crucial tool for individuals seeking to ensure their financial affairs are handled according to their wishes, even in the event of incapacity. This legal document empowers a designated agent, often referred to as an attorney-in-fact, to make decisions on behalf of the principal, the person granting the authority. The DPOA remains effective even if the principal becomes mentally or physically unable to manage their own affairs, providing a safeguard against potential financial mismanagement during vulnerable times. Key aspects of this form include the scope of authority granted to the agent, which can encompass a wide range of financial decisions, from managing bank accounts and real estate transactions to handling tax matters. Additionally, the form must be executed with specific requirements, including the necessity for the principal's signature and the presence of witnesses or a notary public, ensuring that the document is legally binding and recognized by financial institutions. Understanding the nuances of the Connecticut DPOA is essential for individuals looking to secure their financial future and provide peace of mind for themselves and their loved ones.

Documents used along the form

When creating a Connecticut Durable Power of Attorney (DPOA), there are several other forms and documents that can complement it. These documents help clarify your wishes and ensure that your financial and medical decisions are handled according to your preferences. Below is a list of common forms that are often used alongside the DPOA.

- Advance Healthcare Directive: This document outlines your medical treatment preferences in case you become unable to communicate them yourself. It designates someone to make healthcare decisions on your behalf.

- Living Will: A living will specifies the types of medical treatment you would or would not want in situations where you cannot express your wishes. It often addresses end-of-life care.

- HIPAA Release Form: This form allows designated individuals to access your medical records and information, ensuring they can make informed healthcare decisions on your behalf.

- Financial Power of Attorney: Similar to a DPOA, this document grants someone the authority to manage your financial affairs, but it may not be durable, meaning it could become invalid if you become incapacitated.

- Will: A will outlines how you want your assets distributed after your death. It can also name guardians for your minor children and specify your funeral arrangements.

- Residential Lease Agreement: A NY PDF Forms is essential for outlining the terms between landlord and tenant, ensuring clarity in the rental process.

- Trust Document: A trust allows you to place assets in a legal entity that can manage them for your beneficiaries. It can help avoid probate and provide more control over asset distribution.

- Property Deed: This document transfers ownership of real estate. It can be used to place property into a trust or to change ownership details, which may be important for estate planning.

- Beneficiary Designation Forms: These forms are used for life insurance policies, retirement accounts, and other financial products. They specify who will receive benefits upon your death.

- Guardianship Designation: If you have minor children, this document allows you to name a guardian for them in case you are unable to care for them.

Incorporating these documents into your planning can provide clarity and peace of mind. Each plays a unique role in ensuring your wishes are honored and that your loved ones are prepared to act on your behalf when necessary.

More Connecticut Templates

Ct Boat Bill of Sale - Provides a space to document the sale price agreed upon by both parties.

Filling out the Texas Affidavit of Correction form is a crucial step in rectifying any discrepancies in your property records, and you can find the necessary documentation by accessing the Affidavit of Correction form. This ensures the integrity and accuracy of your legal documents, safeguarding your interests in property matters.

What Is a Wife Entitled to in a Divorce in Ct - Offers a way to negotiate without court intervention.

Connecticut Living Will - A Living Will outlines your preferences for medical treatment if you become unable to communicate.

Similar forms

The Connecticut Durable Power of Attorney form shares similarities with the General Power of Attorney. Both documents grant an individual the authority to act on behalf of another person in legal and financial matters. However, the General Power of Attorney typically becomes invalid if the principal becomes incapacitated, while the Durable Power of Attorney remains effective even in such situations. This distinction is crucial for individuals seeking to ensure that their financial affairs are managed regardless of their mental or physical state.

Another document similar to the Connecticut Durable Power of Attorney is the Medical Power of Attorney. While the Durable Power of Attorney focuses on financial and legal decisions, the Medical Power of Attorney specifically addresses health care decisions. Both documents empower an agent to make decisions on behalf of the principal, but the Medical Power of Attorney is limited to medical situations, ensuring that health care preferences are honored when the principal cannot communicate them.

Creating a dynamic last will and testament outline is essential for ensuring that your wishes regarding asset distribution and guardianship for minor children are clearly articulated and legally binding.

The Healthcare Proxy is also akin to the Durable Power of Attorney, as it designates someone to make medical decisions for an individual. Like the Medical Power of Attorney, the Healthcare Proxy is limited to health-related matters. However, it often comes into play when the individual is unable to express their wishes regarding medical treatment, ensuring that their preferences are respected in critical situations.

The Living Will shares similarities with the Durable Power of Attorney in that both documents address the principal's wishes regarding end-of-life care. A Living Will specifically outlines the types of medical treatment an individual does or does not want if they become terminally ill or incapacitated. While the Durable Power of Attorney allows an agent to make decisions, the Living Will provides clear instructions for medical professionals, ensuring that the principal's desires are known and followed.

The Revocable Trust is another document that bears resemblance to the Durable Power of Attorney. Both are used for managing assets and can help avoid probate. A Revocable Trust allows individuals to place their assets into a trust during their lifetime, providing flexibility and control over their estate. In contrast, the Durable Power of Attorney grants authority to an agent to manage assets on behalf of the principal, making it a useful tool for financial management during incapacity.

The Irrevocable Trust is similar to the Durable Power of Attorney in that both can be used to manage assets, but they differ in terms of control. Once established, an Irrevocable Trust cannot be changed or dissolved without the consent of the beneficiaries. This makes it a more permanent solution for asset management compared to the Durable Power of Attorney, which can be revoked or altered by the principal at any time while they are competent.

The Assignment of Benefits is another document that can be compared to the Durable Power of Attorney. This document allows an individual to assign benefits, such as insurance claims or retirement benefits, to another person. While the Durable Power of Attorney grants broader authority to manage various financial matters, the Assignment of Benefits is specific to the transfer of certain benefits, streamlining the process for receiving payments on behalf of the principal.

The Guardianship Agreement is similar to the Durable Power of Attorney in that both involve the appointment of an individual to make decisions for another. However, a Guardianship Agreement is typically established through a court process and is often used for individuals who are unable to care for themselves due to incapacity. In contrast, the Durable Power of Attorney is a voluntary arrangement that allows individuals to choose their agent without court intervention, providing a more straightforward approach to managing affairs.

Lastly, the Trust Agreement can be compared to the Durable Power of Attorney in the context of asset management. A Trust Agreement establishes a fiduciary relationship where one party holds assets for the benefit of another. While the Durable Power of Attorney allows an agent to manage assets directly, a Trust Agreement creates a separate legal entity that can provide more structured management and distribution of assets according to the principal's wishes.

Important Questions on This Form

What is a Durable Power of Attorney in Connecticut?

A Durable Power of Attorney (DPOA) is a legal document that allows an individual, known as the principal, to designate another person, called the agent, to make decisions on their behalf. This document remains effective even if the principal becomes incapacitated. It is an important tool for ensuring that someone you trust can manage your financial and legal affairs when you are unable to do so yourself.

How do I create a Durable Power of Attorney in Connecticut?

To create a Durable Power of Attorney in Connecticut, you must complete the appropriate form, which can be obtained from legal resources or online. The document must clearly state that it is a Durable Power of Attorney. After filling out the form, it must be signed by the principal in the presence of a notary public. It is advisable to keep copies of the signed document for your records and provide one to your designated agent.

Can I revoke my Durable Power of Attorney in Connecticut?

Yes, you can revoke your Durable Power of Attorney at any time as long as you are mentally competent. To do this, you should create a written revocation document, sign it, and notify your agent and any institutions or individuals that may have relied on the original DPOA. It is important to ensure that the revocation is clear and unequivocal to avoid any confusion.

What powers can I grant to my agent under a Durable Power of Attorney?

You can grant your agent a wide range of powers under a Durable Power of Attorney. These may include managing bank accounts, paying bills, filing taxes, and making investment decisions. However, you can also limit the powers by specifying what the agent can and cannot do. It is essential to clearly outline these powers in the document to ensure your wishes are followed.

What happens if I do not have a Durable Power of Attorney?

If you do not have a Durable Power of Attorney and become incapacitated, the court may appoint a guardian or conservator to manage your affairs. This process can be lengthy and costly, and the appointed individual may not be someone you would have chosen. Having a DPOA in place allows you to select a trusted person to act on your behalf and can help avoid potential legal complications.

Misconceptions

Many people have misunderstandings about the Connecticut Durable Power of Attorney form. Here are six common misconceptions:

- It only applies to financial matters. Some believe that a Durable Power of Attorney is solely for financial decisions. In reality, it can also cover health care decisions, depending on how it is drafted.

- It becomes effective only when the principal is incapacitated. While it is called "durable," this document can be effective immediately upon signing, unless specified otherwise. This means the agent can act on behalf of the principal right away.

- All powers are automatically granted. Not every power is included by default. The principal must clearly outline what powers the agent will have, such as managing investments or making medical decisions.

- It is permanent and cannot be revoked. A Durable Power of Attorney can be revoked at any time, as long as the principal is still competent. This allows for flexibility as circumstances change.

- Only lawyers can create a Durable Power of Attorney. While it is advisable to consult a lawyer, individuals can create this document themselves using templates, provided they meet Connecticut's legal requirements.

- It is the same as a standard Power of Attorney. A Durable Power of Attorney remains in effect even if the principal becomes incapacitated, unlike a standard Power of Attorney, which typically becomes void in such situations.

Understanding these misconceptions can help individuals make informed decisions about their legal planning needs.

Dos and Don'ts

When filling out the Connecticut Durable Power of Attorney form, it is crucial to approach the process with care. This document grants someone the authority to act on your behalf in financial matters, so accuracy and clarity are essential. Here are six important considerations to keep in mind:

- Do clearly identify the principal and agent. Ensure that names and addresses are correct to avoid any confusion.

- Don't use vague language. Be specific about the powers you are granting to the agent to prevent misunderstandings.

- Do sign the document in the presence of a notary public. This step adds an important layer of validity and can help prevent future disputes.

- Don't forget to date the form. An undated document can lead to complications regarding its enforceability.

- Do keep a copy of the completed form for your records. This ensures you have access to the document if needed in the future.

- Don't overlook the need for updates. Review and revise the document as necessary, especially if your circumstances change.

By following these guidelines, you can help ensure that your Durable Power of Attorney form is completed correctly and serves its intended purpose effectively.

Detailed Guide for Writing Connecticut Durable Power of Attorney

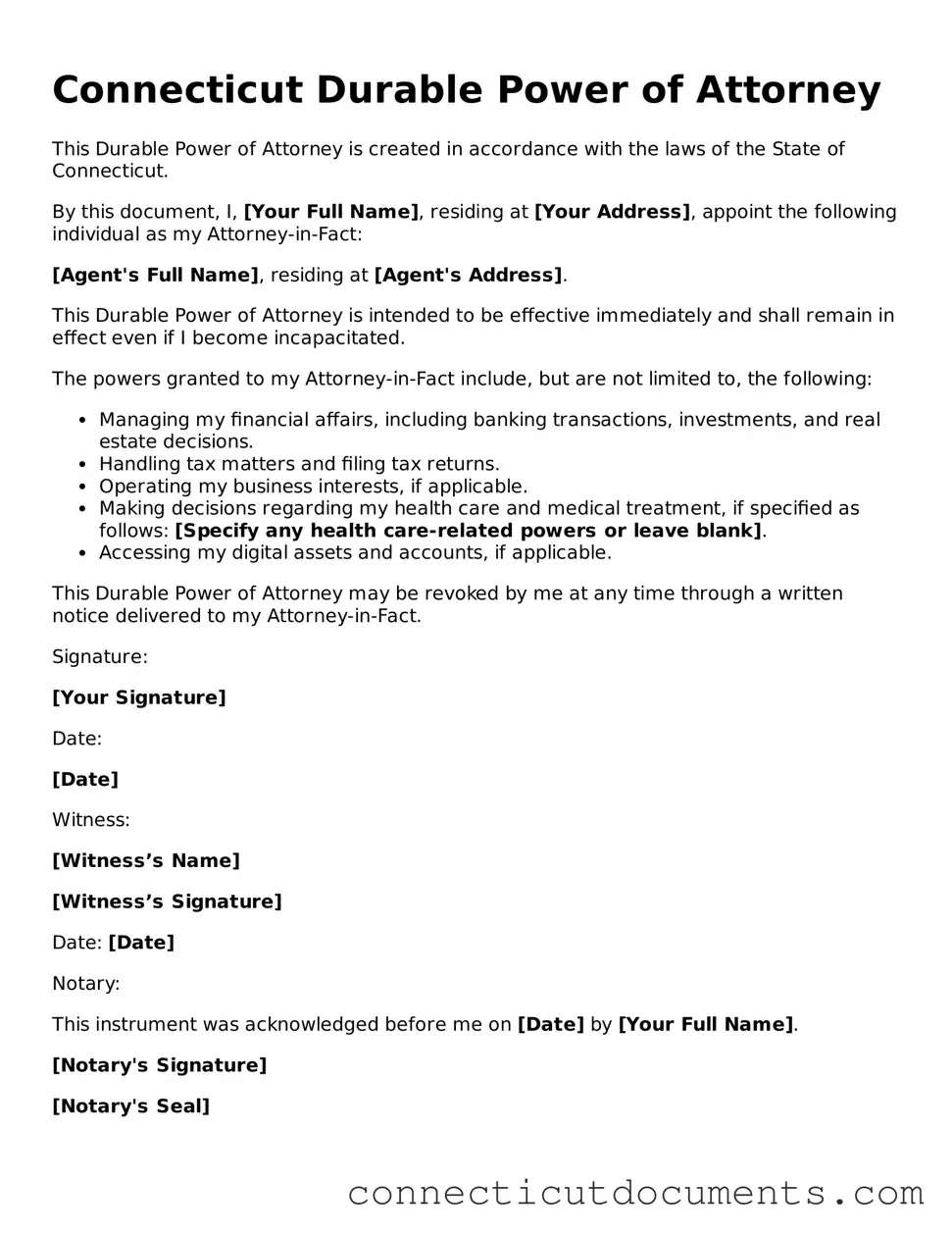

Completing the Connecticut Durable Power of Attorney form is an important step in ensuring that your financial and legal matters are managed according to your wishes. The following steps will guide you through the process of filling out the form accurately.

- Obtain the Durable Power of Attorney form. You can find it online or request it from a legal office.

- Read through the entire form to familiarize yourself with its sections and requirements.

- Fill in your full legal name and address in the designated areas at the top of the form.

- Identify the person you are appointing as your attorney-in-fact. Include their full name and address.

- Decide if you want to grant your attorney-in-fact general powers or specific powers. If specific powers are chosen, list them clearly in the appropriate section.

- Consider whether you want to appoint an alternate attorney-in-fact in case the primary cannot serve. If so, provide their name and address.

- Sign and date the form in the presence of a notary public. Ensure that the notary acknowledges your signature.

- Make copies of the completed form for your records and for your attorney-in-fact.

Once you have filled out the form and had it notarized, it is advisable to discuss your decisions with your attorney-in-fact. This will help ensure that they understand your wishes and can act accordingly when needed.