Attorney-Verified Deed Form for the State of Connecticut

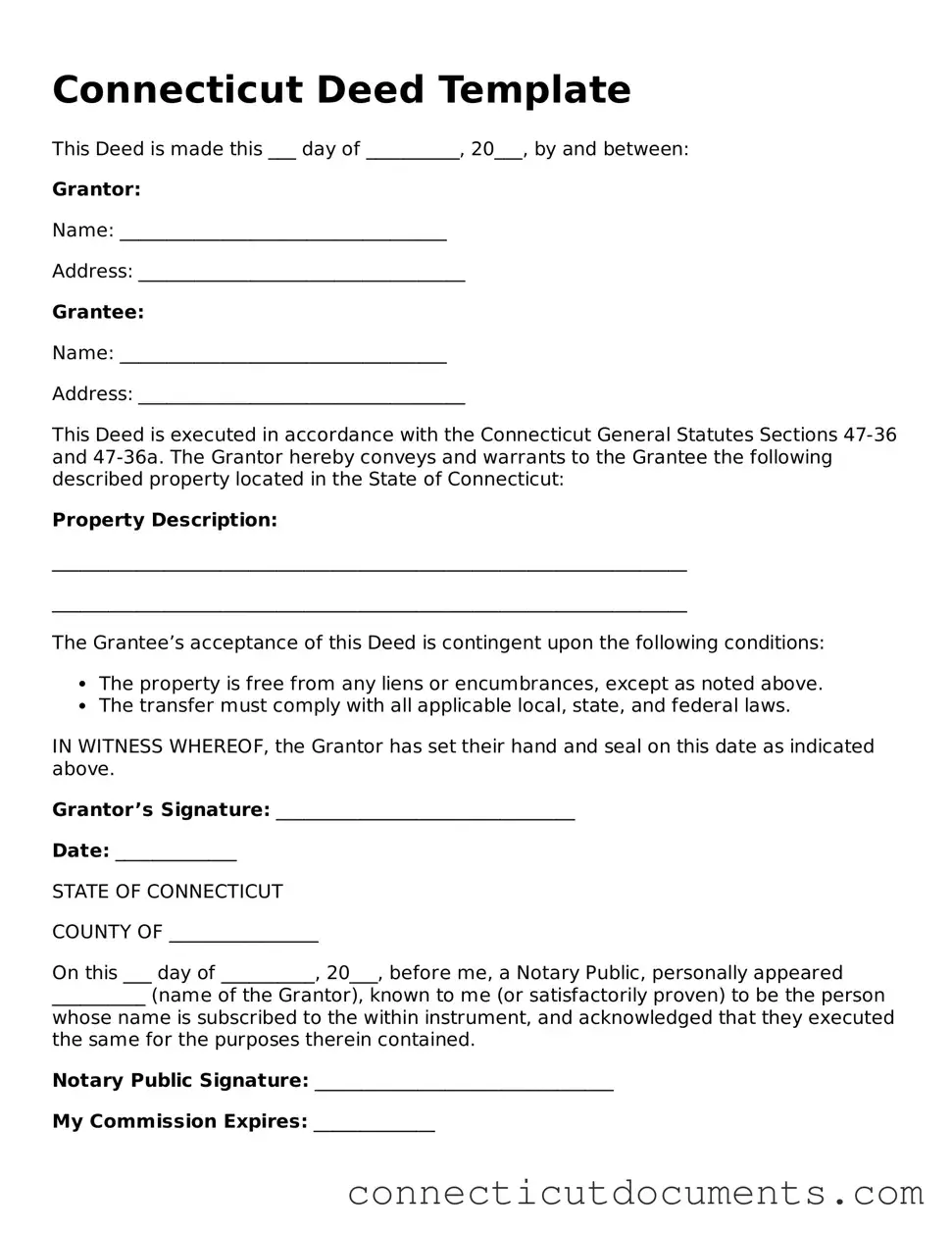

In Connecticut, the deed form serves as a crucial document in the transfer of real property ownership. It outlines the specifics of the transaction, including the names of the parties involved, a legal description of the property, and any pertinent details regarding the sale or transfer. The deed must be signed by the grantor, the person transferring the property, and typically requires notarization to ensure its authenticity. Additionally, the form may include various covenants, which are promises regarding the property, and it is essential for establishing the rights and responsibilities of both the grantor and the grantee, the person receiving the property. Understanding the components of the Connecticut deed form is vital for anyone involved in a real estate transaction, as it helps protect the interests of all parties and ensures compliance with state laws.

Documents used along the form

When transferring property in Connecticut, several forms and documents accompany the Deed form to ensure a smooth transaction. Each document serves a specific purpose in the process of property transfer, providing necessary information and legal protections.

- Property Transfer Tax Return: This form is required to report the sale of real estate and calculate any applicable transfer taxes. It must be submitted to the Connecticut Department of Revenue Services.

- Affidavit of Title: This document affirms that the seller has clear title to the property and that there are no outstanding liens or claims against it. It helps protect the buyer from potential disputes.

- Title Insurance Policy: This policy protects the buyer and lender against any future claims or issues related to the property’s title. It is typically issued after a title search is conducted.

- California Form REG 262: This essential document, the Vehicle/Vessel Transfer and Reassignment Form, is crucial for transferring ownership of vehicles or vessels within the state. For detailed information, visit formcalifornia.com/editable-california-fotm-reg-262-form/.

- Bill of Sale: Although not always necessary, this document can be used to transfer personal property that may be included in the sale, such as appliances or fixtures.

- Closing Disclosure: This form outlines the final terms and costs of the mortgage loan, including all fees and charges. It ensures that both parties understand their financial obligations before closing the transaction.

Using these documents in conjunction with the Deed form helps facilitate a legally sound and efficient property transfer process in Connecticut. Ensuring all necessary paperwork is completed can prevent future complications for both buyers and sellers.

More Connecticut Templates

How to Get Power of Attorney in Ct - This document should include emergency contacts for quicker responses.

Trailer Registration Ct - Indicates the trailer’s identification number for clarity.

To create a comprehensive understanding of the rental relationship, it is essential to utilize a Lease Agreement form that clearly lists all obligations and terms. This document acts as a protective measure for both the landlord and tenant, ensuring clarity and preventing future disputes. For your convenience, you can download the pdf here to help draft your agreement effectively.

How Long Does It Take to Get Legally Separated - May include agreements about pet custody in a separation scenario.

Similar forms

The Connecticut Deed form is similar to a Warranty Deed, which is commonly used in real estate transactions. A Warranty Deed guarantees that the seller has clear title to the property and the right to sell it. It also provides a promise that the property is free from any liens or claims, offering a level of protection to the buyer. This document ensures that if any issues arise regarding ownership, the seller is responsible for resolving them, thereby providing peace of mind to the buyer.

Another document similar to the Connecticut Deed form is the Quitclaim Deed. Unlike a Warranty Deed, a Quitclaim Deed does not guarantee that the seller has clear title to the property. Instead, it simply transfers whatever interest the seller may have in the property to the buyer. This type of deed is often used among family members or in situations where the parties know each other well, as it carries more risk for the buyer due to the lack of guarantees.

The Special Warranty Deed is also comparable to the Connecticut Deed form. This type of deed provides some assurances to the buyer, but only for the time that the seller owned the property. It guarantees that the seller has not done anything to harm the title during their ownership. This is different from a full Warranty Deed, which covers the entire history of the property. Buyers should consider this limitation when evaluating their protections under a Special Warranty Deed.

A Bargain and Sale Deed is another document that shares similarities with the Connecticut Deed form. This deed conveys the property from the seller to the buyer but does not include any warranties regarding the title. It implies that the seller has the right to sell the property but offers no guarantees about its condition or title. This type of deed is often used in foreclosure sales or other situations where the seller may not want to assume liability for the property's title.

The Grant Deed is also relevant when discussing documents similar to the Connecticut Deed form. A Grant Deed conveys property ownership and includes some implied warranties, such as the assurance that the property has not been sold to someone else and that it is free from undisclosed encumbrances. While it does not offer the same level of protection as a Warranty Deed, it provides more assurance than a Quitclaim Deed, making it a middle ground option for buyers.

The Deed of Trust is another document that can be compared to the Connecticut Deed form. While it serves a different purpose, as it is used to secure a loan with real estate, it still involves the transfer of property rights. In a Deed of Trust, the borrower conveys the property to a trustee, who holds the title until the loan is repaid. This document is essential in the context of real estate financing, as it protects the lender's interests while allowing the borrower to retain possession of the property.

The Affidavit of Title is similar in that it provides information regarding the ownership and status of a property, though it is not a deed itself. This document is often used in conjunction with a deed to assure the buyer that the seller has the legal right to transfer the property. It typically includes statements about the seller's ownership and any liens or encumbrances that may affect the title. While it does not transfer ownership, it plays a crucial role in establishing the legitimacy of the transaction.

In real estate transactions, understanding various legal documents is crucial for both buyers and sellers to navigate their rights and responsibilities effectively. One such important document is the Hold Harmless Agreement, which serves to protect parties from liabilities that may arise during transactions. For those looking for a template, resources can be found at https://nyforms.com, ensuring that individuals are well-informed and prepared to deal with any potential legal issues that may occur.

The Bill of Sale is another document that can be likened to the Connecticut Deed form, particularly in transactions involving personal property. A Bill of Sale serves as a written record of the transfer of ownership from one party to another. While it is typically used for items like vehicles or equipment, it shares the core function of documenting a change in ownership, similar to how a deed does for real estate.

Lastly, the Easement Agreement is relevant when discussing property rights. While it does not transfer ownership, it grants a party the right to use a portion of another person's property for a specific purpose, such as access or utility installation. This document outlines the rights and responsibilities of both parties and can be essential for property owners to understand how their land can be used by others, similar to how a deed defines ownership rights.

Important Questions on This Form

What is a Connecticut Deed form?

A Connecticut Deed form is a legal document used to transfer ownership of real property in the state of Connecticut. This form serves as evidence of the transfer and outlines the details of the transaction, including the names of the parties involved, the property description, and any terms of the transfer. It is essential for establishing legal title to the property.

What types of Deeds are available in Connecticut?

In Connecticut, there are several types of deeds, including Warranty Deeds, Quitclaim Deeds, and Special Warranty Deeds. A Warranty Deed guarantees that the seller holds clear title to the property and has the right to sell it. A Quitclaim Deed transfers whatever interest the seller has in the property without any guarantees. A Special Warranty Deed provides limited assurances about the title, covering only the period during which the seller owned the property.

How do I complete a Connecticut Deed form?

To complete a Connecticut Deed form, you need to fill in the required information, including the names of the grantor (seller) and grantee (buyer), the legal description of the property, and any relevant terms of the transfer. It is crucial to ensure that all information is accurate and complete. After filling out the form, it must be signed by the grantor in the presence of a notary public.

Is notarization required for a Connecticut Deed?

Yes, notarization is required for a Connecticut Deed. The grantor must sign the deed in front of a notary public, who will then affix their seal to the document. This step ensures that the identity of the signer is verified and adds an additional layer of authenticity to the deed.

Where do I file a Connecticut Deed after it is completed?

Once the Connecticut Deed is completed and notarized, it must be filed with the town clerk's office in the municipality where the property is located. Filing the deed is essential for making the transfer of ownership public and officially recorded. There may be a filing fee, so it is advisable to check with the local town clerk for specific requirements.

Are there any taxes associated with transferring property in Connecticut?

Yes, there are taxes associated with transferring property in Connecticut. The state imposes a conveyance tax on the transfer of real estate. This tax is calculated based on the sale price of the property. Additionally, municipalities may impose their own conveyance tax. It is important to consult with a tax professional or local government office to understand the specific tax obligations related to your property transfer.

Can I use a standard template for a Connecticut Deed?

While it is possible to use a standard template for a Connecticut Deed, it is crucial to ensure that the template complies with state laws and includes all necessary information. Customizing the deed to reflect the specific details of your transaction is often advisable. Consulting with a legal professional can help ensure that the deed is properly drafted and executed.

What happens if a Connecticut Deed is not recorded?

If a Connecticut Deed is not recorded, the transfer of ownership may not be legally recognized against third parties. This means that someone could potentially claim ownership of the property, or a subsequent buyer may not be aware of the previous transfer. Recording the deed protects the rights of the grantee and provides public notice of the ownership change.

How can I obtain a copy of a recorded Connecticut Deed?

To obtain a copy of a recorded Connecticut Deed, you can visit the town clerk's office in the municipality where the property is located. Many town clerks also offer online access to property records. There may be a small fee for obtaining copies, and it is advisable to provide the property address or the names of the parties involved to facilitate the search.

What should I do if I encounter issues with a Connecticut Deed?

If you encounter issues with a Connecticut Deed, such as disputes over ownership or errors in the document, it is important to seek legal advice. A qualified attorney can help address any concerns and guide you through the process of resolving issues related to the deed. Early intervention can often prevent further complications down the line.

Misconceptions

Understanding the Connecticut Deed form can be challenging due to various misconceptions. Here are nine common misunderstandings, along with clarifications to help clear up any confusion.

- All deeds are the same. Many people believe that all deeds serve the same purpose. In reality, there are different types of deeds, such as warranty deeds and quitclaim deeds, each with its own implications and protections.

- A deed must be notarized to be valid. While notarization is important for many legal documents, a deed in Connecticut is valid even if it is not notarized. However, notarization can provide additional legal protection.

- Only attorneys can prepare a deed. It is a common belief that only licensed attorneys can draft a deed. In Connecticut, individuals can prepare their own deeds, but it is advisable to seek legal advice to ensure all requirements are met.

- Once a deed is signed, it cannot be changed. Some think that signing a deed is the final step and that it cannot be altered. However, deeds can be amended or revoked under certain conditions, depending on the type of deed and the circumstances.

- A deed transfer is the same as a title transfer. Many confuse the transfer of a deed with the transfer of title. While a deed conveys the ownership, the title represents the legal rights to the property. Both are important but distinct concepts.

- Deeds do not need to be recorded. Some believe that recording a deed is optional. In Connecticut, it is crucial to record the deed with the town clerk to protect ownership rights and provide public notice of the transfer.

- All property transfers require a deed. While most property transfers involve a deed, certain transactions, like those involving a lease or a life estate, may not require a traditional deed.

- Deeds are only necessary for residential properties. This misconception suggests that only residential property transfers require a deed. In reality, any transfer of real estate, whether residential, commercial, or agricultural, requires a deed.

- Once recorded, a deed cannot be challenged. Some assume that a recorded deed is immune to disputes. However, recorded deeds can still be contested in court, particularly if there are claims of fraud or other issues.

By addressing these misconceptions, individuals can better navigate the complexities of property transactions in Connecticut. Understanding the nuances of the deed form is essential for ensuring a smooth transfer of property ownership.

Dos and Don'ts

When filling out the Connecticut Deed form, it's essential to follow certain guidelines to ensure that the document is accurate and legally valid. Below is a list of things you should and shouldn't do during this process.

- Do double-check the property description to ensure it is accurate.

- Do include the full names of all parties involved in the transaction.

- Do use clear and concise language throughout the form.

- Do sign the deed in the presence of a notary public.

- Don't leave any sections of the form blank; fill out all required fields.

- Don't use abbreviations or shorthand that may cause confusion.

- Don't forget to include the date of the transaction.

- Don't overlook the need for a witness signature, if applicable.

Detailed Guide for Writing Connecticut Deed

After gathering all necessary information, you can begin filling out the Connecticut Deed form. This form requires specific details about the property and the parties involved. Make sure to have all relevant documents and information handy for a smooth process.

- Start by entering the date at the top of the form. This is the date when the deed will be executed.

- Provide the name of the grantor, the person transferring the property. Include their address and any relevant identification numbers.

- Next, enter the name of the grantee, the person receiving the property. Include their address as well.

- Describe the property being transferred. Include the street address, city, and any parcel identification numbers if available.

- Indicate the type of deed you are using. Common types include warranty deeds or quitclaim deeds. Select the one that applies to your situation.

- Include any additional terms or conditions that may apply to the transfer of the property. This may include any special agreements between the parties.

- Sign the deed in the designated area. The grantor must sign, and it may need to be witnessed or notarized, depending on local requirements.

- Finally, make copies of the completed deed for your records and for the grantee.