Fill a Valid Ct 1040 Connecticut Template

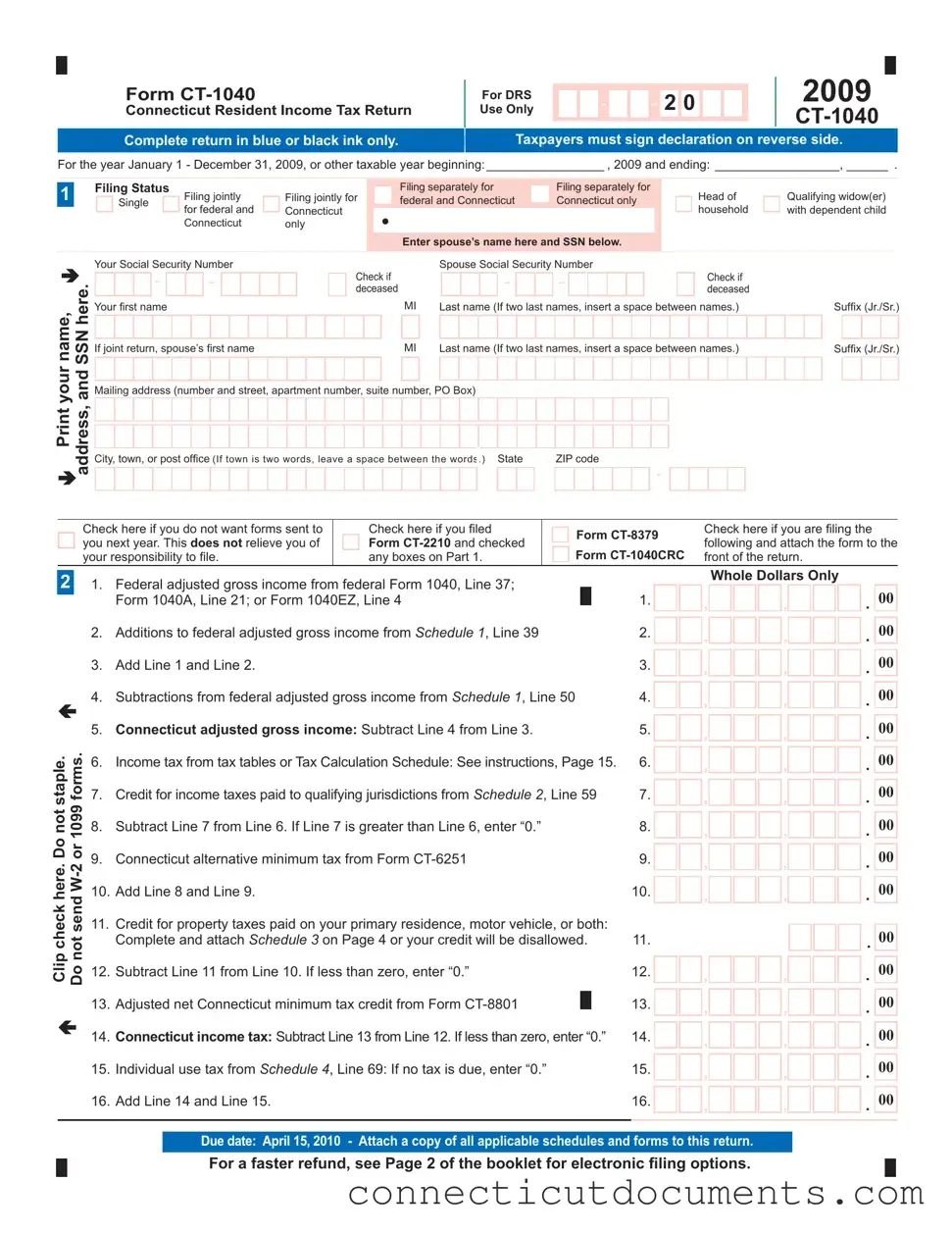

The CT-1040 form serves as the primary income tax return for residents of Connecticut, allowing individuals to report their income and calculate their tax liability for a given year. For the tax year ending December 31, 2009, or any other specified taxable year, taxpayers must complete the form using blue or black ink. The form requires individuals to select their filing status, which can include options such as single, married filing jointly, or head of household. Personal information, including names, Social Security numbers, and mailing addresses, must be accurately provided. Taxpayers must report their federal adjusted gross income and make necessary adjustments through various schedules that detail additions and subtractions to income. Additionally, the CT-1040 allows for credits, such as those for property taxes paid and income taxes paid to other jurisdictions. The form also includes sections for reporting withholding amounts and calculating any potential overpayment or tax due. It is essential for taxpayers to sign the declaration on the reverse side, affirming the accuracy of their submitted information. Timely filing is crucial, with a due date set for April 15, 2010, ensuring compliance with state tax regulations.

Documents used along the form

When filing your Connecticut income tax return using Form CT-1040, several additional forms and documents may be required or beneficial to ensure accuracy and compliance. Understanding these documents can help streamline the process and maximize your potential tax benefits. Below is a list of some commonly used forms alongside the CT-1040.

- Form CT-2210: This form is used to calculate any penalties for underpayment of estimated tax. If you did not pay enough tax throughout the year, this form helps determine the amount of penalty you may owe.

- Form CT-8379: If you are filing jointly and your spouse has outstanding debts, this form allows you to request a portion of your refund to be allocated to you instead of being used to pay your spouse's debts.

- Form CT-6251: This form is for calculating the Connecticut alternative minimum tax (AMT). If your income is above a certain threshold, you may need to complete this form to determine if you owe AMT.

- Form CT-8801: If you are eligible for a credit for prior year minimum tax, use this form to calculate your adjusted net Connecticut minimum tax credit.

- Form CT-1040: This is the main income tax return form for residents of Connecticut. To enhance your filing process, consider additional resources such as the NY PDF Forms for related documentation.

- Schedule 1: This document lists modifications to your federal adjusted gross income. It includes additions and subtractions that affect your taxable income in Connecticut.

- Schedule 3: This schedule is necessary for claiming a property tax credit. It requires details about property taxes paid on your primary residence or motor vehicle.

By familiarizing yourself with these forms and documents, you can ensure a smoother filing experience. Properly completing and submitting all necessary paperwork not only helps you avoid potential issues with the Department of Revenue Services but may also lead to beneficial tax credits and deductions. Always keep copies of your submitted forms for your records.

Additional PDF Templates

Connecticut Ed 177 - It is vital to check all parts of the application to ensure nothing is overlooked before submission.

When considering your estate planning options, obtaining a strategic Power of Attorney is crucial. This document empowers a trusted individual to make decisions on your behalf, thus safeguarding your interests in legal and financial matters during times when you may be unable to advocate for yourself.

New Haven Department of Health - The form is readily available from the Department of Revenue Services for interested wineries.

How to Transfer Ownership of a Car to a Family Member in Ct - Vehicle identification is critical for resolving ownership and liability issues.

Similar forms

The Form 1040, used for federal income tax returns, is the most comparable document to the CT-1040. Both forms require taxpayers to report their income, deductions, and credits to determine their tax liability. The federal Form 1040 is a comprehensive document that serves as the foundation for most individual tax filings across the United States, while the CT-1040 specifically addresses Connecticut residents, incorporating state-specific tax regulations and credits. Both forms require careful attention to detail and accurate reporting of financial information.

Another similar document is the Form 1040A, which is a simplified version of the federal Form 1040. This form is designed for taxpayers with straightforward tax situations, allowing them to report income and claim certain credits without the complexity of itemizing deductions. While the CT-1040 requires residents to report their Connecticut-specific income, the Form 1040A streamlines the process for those who qualify, making it easier to file while still ensuring compliance with federal tax laws.

The CT-1040 is also akin to the Form 1040EZ, which is the simplest federal tax return form available. Like the CT-1040, the Form 1040EZ is intended for individuals with uncomplicated tax situations, such as those who do not have dependents or itemized deductions. The primary difference lies in the fact that the CT-1040 incorporates state-specific rules and calculations, while the 1040EZ focuses solely on federal income tax. Both forms emphasize clarity and ease of use for taxpayers.

Form CT-2210 is another document that shares similarities with the CT-1040. This form is used to calculate penalties for underpayment of estimated tax. Taxpayers who may owe penalties for not paying enough tax throughout the year can use this form to determine their liability. While the CT-1040 focuses on the overall income tax return, the CT-2210 is an essential tool for ensuring compliance with estimated tax payment requirements, highlighting the importance of proactive tax management.

The CT-8379 is related to the CT-1040 in that it is used for claiming a refund of Connecticut income tax withheld for injured spouses. This form allows individuals who file jointly to protect their share of the refund from being applied to their spouse's tax debts. While the CT-1040 calculates the overall tax liability, the CT-8379 specifically addresses situations where a taxpayer's refund may be at risk, thus providing a layer of protection for eligible individuals.

Form CT-6251 is similar to the CT-1040 as it deals with the Connecticut alternative minimum tax (AMT). Taxpayers who may be subject to AMT must complete this form in conjunction with their CT-1040. The CT-6251 helps determine if a taxpayer's income exceeds the AMT thresholds, which can affect their overall tax liability. This connection underscores the importance of understanding both forms to ensure accurate tax reporting and compliance.

Form CT-8801 is another document that relates to the CT-1040, specifically concerning the Connecticut income tax credit for prior year minimum tax. Taxpayers who have previously paid AMT may be eligible for a credit in subsequent years, which can significantly impact their tax liability. This form works in tandem with the CT-1040 to ensure that taxpayers receive the benefits of any credits they are entitled to, reinforcing the need for thorough tax preparation.

Schedule 1, which accompanies the CT-1040, is similar to various federal schedules that allow taxpayers to report modifications to their federal adjusted gross income. This schedule is crucial for Connecticut residents, as it helps adjust their income based on state-specific rules. Just as federal schedules provide additional detail for the IRS, Schedule 1 serves the same purpose for the Connecticut Department of Revenue Services, ensuring accurate income reporting.

Schedule 2, which addresses credits for income taxes paid to qualifying jurisdictions, parallels the federal tax credit forms. This schedule allows Connecticut taxpayers to claim credits for taxes paid to other states, which can reduce their Connecticut tax liability. Like its federal counterparts, this schedule highlights the importance of understanding multi-jurisdictional tax obligations and ensuring that taxpayers receive appropriate credits for taxes already paid.

When establishing a limited liability company, it is vital to properly complete the required documentation to ensure compliance with state regulations, as highlighted by the California LLC-1 form. This form is not only essential for naming your LLC and designating its operational structure, but it can also be completed and submitted electronically through resources such as https://formcalifornia.com/editable-california-llc-1-form, streamlining the process for new business owners.

Lastly, the Schedule 3 for property tax credits is similar to various federal forms that address property-related tax deductions. This schedule allows Connecticut residents to claim credits for property taxes paid on their primary residence or motor vehicles. While federal forms may provide deductions for property taxes, Schedule 3 focuses specifically on credits available to Connecticut taxpayers, emphasizing the state's commitment to providing tax relief for property owners.

Important Questions on This Form

What is Form CT-1040?

Form CT-1040 is the Connecticut Resident Income Tax Return. It is used by residents of Connecticut to report their income and calculate their state tax liability for a given tax year. The form must be completed using blue or black ink and requires the taxpayer’s signature on the reverse side. This form is essential for ensuring compliance with state tax laws.

Who needs to file Form CT-1040?

Any resident of Connecticut who earns income during the tax year is required to file Form CT-1040. This includes individuals who are single, married filing jointly, married filing separately, heads of household, or qualifying widow(er) with a dependent child. If you have a federal filing requirement, you will likely need to file this state form as well.

What information is required to complete Form CT-1040?

To complete Form CT-1040, you will need personal information such as your Social Security Number, your spouse's information if filing jointly, and your mailing address. Additionally, you must provide details about your income, including your federal adjusted gross income, any additions or subtractions to that income, and any tax credits or payments made. This includes W-2 forms, 1099 forms, and any applicable schedules that detail your tax situation.

What are the deadlines for filing Form CT-1040?

Form CT-1040 is typically due on April 15 of the year following the tax year. For example, for the 2009 tax year, the due date was April 15, 2010. If you cannot file by the deadline, you may request an extension using Form CT-1040 EXT, but you must still pay any taxes owed by the original due date to avoid penalties and interest.

How can I make sure my Form CT-1040 is processed quickly?

To ensure faster processing of your Form CT-1040, consider filing electronically. Electronic filing options are available and can expedite your refund. Additionally, if you expect a refund, using direct deposit can speed up the process even further. Make sure to double-check all entries for accuracy and completeness before submission.

What should I do if I made a mistake on my Form CT-1040?

If you realize you made a mistake after submitting your Form CT-1040, you should file an amended return using Form CT-1040X. This form allows you to correct any errors or omissions. Be sure to explain the changes you are making and provide any necessary documentation to support your corrections.

Misconceptions

Misconceptions about the CT-1040 form can lead to confusion among taxpayers. Here are five common misconceptions, along with explanations to clarify each point.

- Misconception 1: The CT-1040 form can be completed using any color of ink.

- Misconception 2: Signing the form is optional if a paid preparer is used.

- Misconception 3: Only income earned in Connecticut is taxable.

- Misconception 4: All taxpayers can file the CT-1040 form electronically.

- Misconception 5: The CT-1040 form is due on April 15 only if there is a tax due.

Taxpayers must complete the CT-1040 form in blue or black ink only. Using other colors may result in processing delays or errors.

Taxpayers must sign the declaration on the reverse side of the CT-1040 form, regardless of whether they used a paid preparer. This signature affirms the accuracy of the information provided.

While Connecticut taxes residents on their worldwide income, taxpayers may also claim credits for taxes paid to other jurisdictions. This means that income earned outside of Connecticut can still affect overall tax liability.

Not all taxpayers may qualify for electronic filing. Certain conditions, such as specific income levels or types of income, may restrict eligibility for e-filing. Taxpayers should consult the instructions for details.

The CT-1040 form is due on April 15 regardless of whether the taxpayer owes taxes or is expecting a refund. Failing to file by the deadline can result in penalties, even if no payment is required.

Dos and Don'ts

When filling out the CT-1040 Connecticut form, there are several important dos and don'ts to keep in mind. Following these guidelines can help ensure that your tax return is completed accurately and efficiently.

- Do use blue or black ink only when completing the form.

- Do sign the declaration on the reverse side of the form.

- Do attach all applicable schedules and forms to your return for proper processing.

- Do ensure that you enter your Social Security Number and your spouse’s information if filing jointly.

- Do double-check all calculations to avoid errors that could delay your refund.

- Don’t leave any required fields blank; incomplete information can lead to processing delays.

- Don’t forget to keep a copy of your completed return for your records.

- Don’t use forms that are not the most current version; always check for updates.

- Don’t forget to check the boxes for any applicable credits or deductions.

- Don’t mail your return without the correct postage or in an incorrect envelope, as this could result in lost documents.

Detailed Guide for Writing Ct 1040 Connecticut

Filling out the CT-1040 form is a crucial step in ensuring your tax obligations are met accurately. After completing the form, you will need to submit it to the Connecticut Department of Revenue Services along with any required schedules and payments. Below are the steps to help you fill out the CT-1040 form correctly.

- Use blue or black ink to complete the form.

- Fill in your filing status by checking the appropriate box. Options include Single, Married Filing Jointly, Married Filing Separately, Head of Household, and Qualifying Widow(er).

- Enter your name, Social Security Number, and address in the designated fields. If filing jointly, include your spouse's information as well.

- Provide your federal adjusted gross income from your federal Form 1040, Line 37 (or the equivalent line from other forms).

- List any additions to your federal adjusted gross income from Schedule 1, Line 39.

- Add the amounts from Lines 4 and 5 to get your Connecticut adjusted gross income.

- Calculate your income tax using the tax tables or Tax Calculation Schedule.

- Claim any credits for income taxes paid to qualifying jurisdictions from Schedule 2, Line 59.

- Subtract any credits from your income tax amount to determine your Connecticut income tax.

- Report any individual use tax from Schedule 4, Line 69.

- Add your Connecticut income tax and individual use tax to find the total amount due.

- Fill out the payment section, including any overpayments or estimated tax payments.

- Complete the declaration section by signing and dating the form. If filing jointly, your spouse must also sign.

- Attach any required schedules and forms, and ensure you have filled out all necessary sections.

- Mail the completed form to the appropriate address provided for refunds or payments.