Fill a Valid Connecticut Sba 2 Template

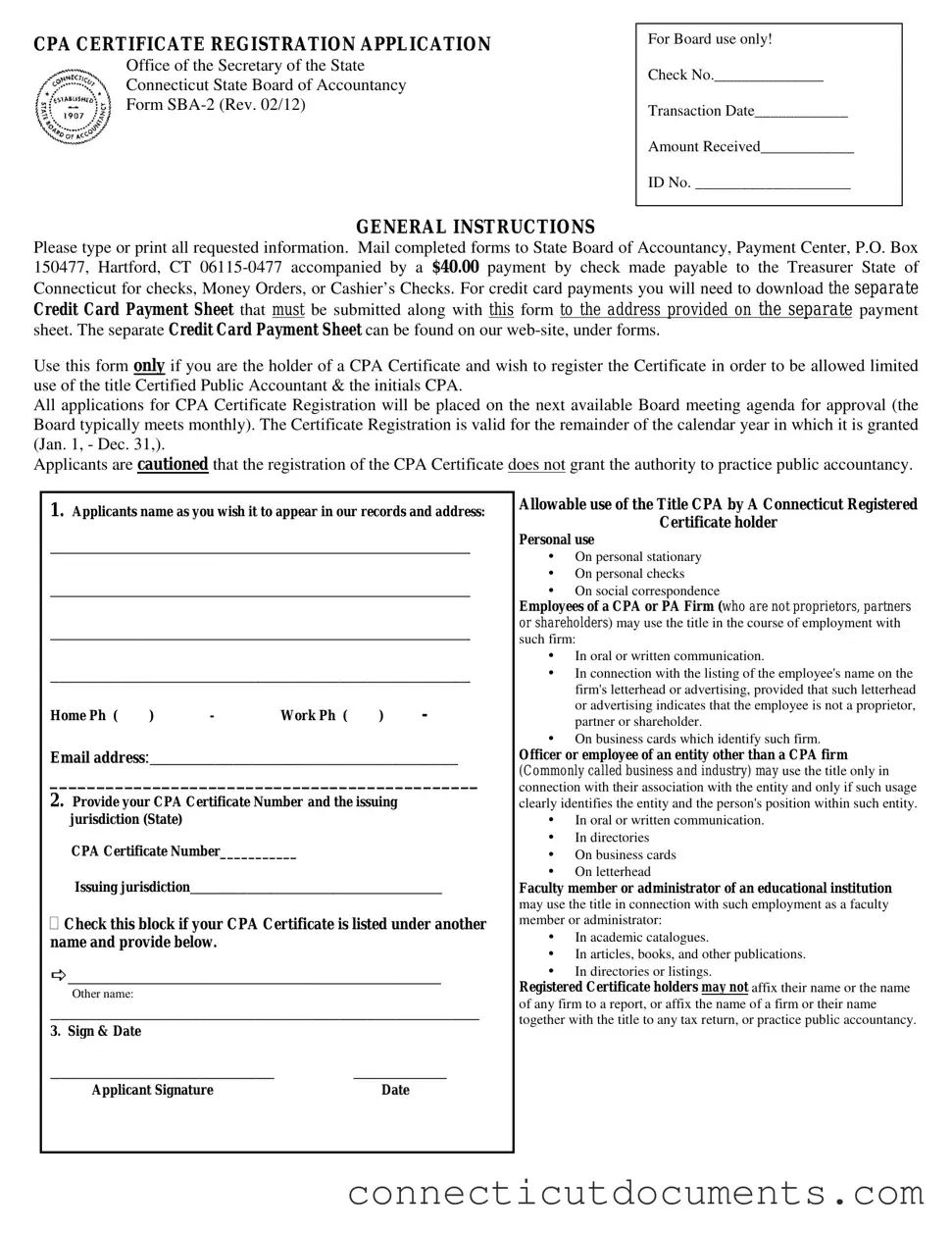

The Connecticut SBA 2 form is a crucial document for Certified Public Accountants (CPAs) who wish to register their CPA certificate in the state. This registration allows them to use the title "Certified Public Accountant" and the initials "CPA" under specific conditions. To initiate the process, applicants must fill out the form with their personal information, including their CPA certificate number and issuing jurisdiction. A fee of $40 is required, which can be paid by check, money order, or credit card, although a separate payment sheet is necessary for credit card transactions. It’s important to note that while registration permits limited use of the CPA title, it does not authorize the holder to practice public accountancy. The application will be reviewed at the next available Board meeting, typically held monthly, and the registration remains valid for the calendar year in which it is granted. Additionally, the form outlines the acceptable uses of the CPA title, such as on personal stationery, business cards, and in academic contexts, while clearly stating the restrictions against using the title in any income-generating activities. Understanding these aspects of the SBA 2 form is essential for CPAs looking to navigate their professional identity within Connecticut's regulatory framework.

Documents used along the form

When applying for the Connecticut CPA Certificate Registration using the SBA-2 form, there are several other forms and documents that may be required or helpful. Each of these documents serves a specific purpose in the registration process or in related activities. Here’s a brief overview of some commonly used forms.

- Credit Card Payment Sheet: This document is necessary if you choose to pay your registration fee using a credit card. It must be submitted along with the SBA-2 form.

- CPA Certificate: You need to provide a copy of your CPA Certificate issued by your state. This serves as proof of your qualifications.

- Employment Verification Form: If you are currently employed by a CPA firm, this form verifies your employment status and role within the firm.

- Continuing Education Documentation: Proof of completed continuing education courses may be required to show that you meet the ongoing education requirements for CPA certification.

- Background Check Authorization: Some states require a background check for CPA applicants. This form gives permission for the state to conduct the check.

- Application for License: If you wish to practice public accountancy, you may need to fill out this separate application for a license in addition to registering your CPA Certificate.

- Quitclaim Deed: This form is used to transfer property ownership rights without warranties and is often utilized among family members; for templates, you can refer to NY PDF Forms.

- Change of Name Form: If your name has changed since your CPA Certificate was issued, this form is necessary to update your records with the state board.

- Ethics Exam Certificate: Some states require completion of an ethics exam for CPA registration. This certificate shows you have successfully completed that requirement.

Each of these documents plays a crucial role in ensuring that your application process goes smoothly. Make sure to gather all necessary forms before submitting your registration to avoid any delays.

Additional PDF Templates

Foic Ct - Fill in a reliable phone number or email for potential follow-up.

Connecticut Tax Return - Evaluation of federal income can affect the Connecticut tax return process.

For those navigating legal agreements in Arizona, understanding the importance of the Non-disclosure Agreement is crucial for protecting sensitive information in business dealings. You can find more information about this essential document at this informative guide on Non-disclosure Agreement preparations.

How to File Injured Spouse - Timely submission of this form can lead to a quicker refund process.

Similar forms

The Connecticut CPA Certificate Registration Application (SBA-2) shares similarities with the Uniform CPA Exam Application. Both documents serve as essential steps for individuals pursuing a career in accounting. The Uniform CPA Exam Application is a formal request to take the CPA exam, while the SBA-2 form is used for registering a CPA certificate once the exam has been successfully completed. Both forms require personal information, including the applicant's name and contact details, and involve a review process by a governing body. Each form also includes a fee that must be paid for processing, ensuring that applicants are committed to their professional journey.

Another document similar to the SBA-2 form is the CPA License Application. This application is necessary for individuals who have passed the CPA exam and are seeking to obtain their official CPA license. Like the SBA-2, it requires personal information and proof of qualifications. Both documents serve as gateways to professional recognition in the accounting field. The CPA License Application also requires a fee and is subject to review by the relevant state board, similar to the process outlined in the SBA-2 form.

The Certificate of Good Standing application is another document that parallels the SBA-2 form. This certificate verifies that a CPA is in compliance with state regulations and has fulfilled all necessary requirements. Both forms require applicants to provide their CPA certificate number and the issuing jurisdiction. While the SBA-2 focuses on registration, the Certificate of Good Standing emphasizes the ongoing compliance necessary for maintaining professional status. Both documents are essential for ensuring that CPAs can practice legally and ethically within their state.

The Business Entity Registration form is akin to the SBA-2 form in that it is used to formalize the establishment of a business entity, such as a CPA firm. While the SBA-2 is focused on individual CPA registration, the Business Entity Registration is concerned with the legal formation of a business. Both documents require detailed information about the entity or individual, including names, addresses, and relevant identification numbers. Each form is critical for ensuring that the respective parties are recognized and authorized to operate within the accounting profession.

The Continuing Professional Education (CPE) Reporting Form is similar to the SBA-2 in that it plays a vital role in maintaining CPA credentials. CPAs must complete a certain number of CPE hours to keep their license active. The CPE Reporting Form documents these hours and ensures compliance with state requirements. Both forms require careful attention to detail and submission by a specified deadline. They are essential for maintaining professional standards and ensuring that CPAs remain knowledgeable in their field.

The Application for Reinstatement of CPA License has similarities with the SBA-2 form, as both involve processes for maintaining or restoring professional status. The reinstatement application is necessary for CPAs who have allowed their licenses to lapse. Like the SBA-2, it requires personal information and may involve a fee. Both documents ensure that individuals are held accountable for their professional responsibilities and that they meet the necessary criteria to practice in their state.

The CPA Firm Registration Application is another related document, as it is used by firms to register with the state board. Similar to the SBA-2, this application requires detailed information about the entity, including ownership and compliance with state regulations. Both forms are essential for ensuring that individuals and firms are recognized and can operate legally in the accounting profession. Each application involves a review process and may require a fee, reflecting the commitment to maintaining professional standards.

The Ethics Examination Application is akin to the SBA-2 form in that it is a requirement for obtaining or maintaining CPA status. This application is necessary for individuals who must pass an ethics exam as part of their licensing process. Like the SBA-2, it requires personal information and may involve a fee. Both documents are crucial for ensuring that CPAs adhere to ethical standards in their practice, reinforcing the integrity of the profession.

In the world of accounting, maintaining professional status requires a series of formal applications, each with its own specific requirements and processes. One such document is the California Form REG 262, known for its pivotal role in transferring vehicle or vessel ownership. It's essential to ensure compliance with state regulations, much like how CPAs must stay aligned with professional standards. For those looking for a comprehensive resource on this form, additional details can be found at formcalifornia.com/editable-california-fotm-reg-262-form, which serves as a guide for understanding the intricacies of vehicle and vessel documentation in California.

The Firm Permit Application is similar to the SBA-2 form as it is required for CPA firms to legally operate. This application requires detailed information about the firm and its owners, much like the personal details required in the SBA-2. Both forms involve a review by the state board and the payment of a fee. They ensure that firms comply with state regulations and maintain the standards necessary for providing accounting services.

Lastly, the Application for an Accounting Degree Evaluation is comparable to the SBA-2 form. This application is necessary for individuals who have obtained their accounting degree from an institution outside the United States and wish to pursue CPA licensure in Connecticut. Like the SBA-2, it requires personal information and documentation of educational qualifications. Both forms are critical for ensuring that all applicants meet the necessary educational standards to practice as CPAs, regardless of their educational background.

Important Questions on This Form

What is the Connecticut SBA 2 form?

The Connecticut SBA 2 form is the CPA Certificate Registration Application. It is used by individuals who hold a CPA certificate and wish to register it in Connecticut. This registration allows the holder to use the title "Certified Public Accountant" and the initials "CPA" under specific conditions. However, it does not grant the authority to practice public accountancy.

How do I submit the SBA 2 form?

You must complete the form by typing or printing all requested information. Once completed, mail it to the State Board of Accountancy at the specified address. Include a payment of $40 by check made payable to the Treasurer of the State of Connecticut. If you prefer to pay by credit card, download the separate Credit Card Payment Sheet from the website and submit it along with the SBA 2 form.

What is the fee for registering my CPA certificate?

The registration fee for the CPA certificate is $40. This payment must accompany your completed SBA 2 form. Ensure that the payment is made by check, money order, or cashier’s check. If you choose to pay by credit card, use the separate Credit Card Payment Sheet.

How long is the CPA certificate registration valid?

The registration of your CPA certificate is valid for the remainder of the calendar year in which it is granted. This means that if your registration is approved, it will be valid from January 1 to December 31 of that year.

Can I use the title "CPA" while working for a firm?

What limitations exist on the use of the title "CPA"?

While you may use the title "CPA" under certain conditions, there are strict limitations. You cannot affix your name or the name of any firm to a report or tax return, nor can you practice public accountancy without a license. The title can only be used in personal contexts or in connection with your employment, clearly indicating your position.

Misconceptions

Understanding the Connecticut SBA 2 form can be challenging due to several common misconceptions. Below is a list of nine misconceptions along with clarifications for each.

- Misconception 1: The SBA 2 form allows anyone to practice public accountancy.

- Misconception 2: Submitting the form guarantees immediate approval.

- Misconception 3: There are no fees associated with the SBA 2 form.

- Misconception 4: You can use the CPA title in any professional capacity.

- Misconception 5: The form is only for new CPA certificate holders.

- Misconception 6: The SBA 2 form can be submitted electronically.

- Misconception 7: The registration is valid indefinitely.

- Misconception 8: You can use the CPA title without any restrictions.

- Misconception 9: You can pay the fee with a credit card directly on the form.

This is incorrect. The registration of a CPA Certificate through the SBA 2 form does not grant the authority to practice public accountancy. It only allows limited use of the title "Certified Public Accountant" and the initials "CPA."

Approval is not guaranteed upon submission. All applications are placed on the agenda for the next available Board meeting, which typically occurs monthly.

A fee of $40.00 is required when submitting the form. This payment must be made by check, money order, or cashier’s check made payable to the Treasurer of the State of Connecticut.

The title can only be used in specific contexts, such as on personal stationery or in connection with employment at a CPA firm, provided the employee is not a proprietor, partner, or shareholder.

Existing CPA certificate holders who wish to register their certificate must also complete the SBA 2 form. It is not limited to new applicants.

The completed form must be mailed to the State Board of Accountancy's designated address. Electronic submissions are not accepted.

The registration is only valid for the remainder of the calendar year in which it is granted, from January 1 to December 31.

There are strict guidelines regarding the use of the title. For example, registered certificate holders cannot affix their name to reports or tax returns.

While credit card payments are accepted, they require a separate Credit Card Payment Sheet. This sheet must be submitted alongside the SBA 2 form.

Dos and Don'ts

Things to Do When Filling Out the Connecticut SBA-2 Form:

- Type or print all requested information clearly.

- Mail the completed form to the correct address: State Board of Accountancy, Payment Center, P.O. Box 150477, Hartford, CT 06115-0477.

- Include a payment of $40.00 by check made payable to the Treasurer of the State of Connecticut.

- Use the correct CPA Certificate Number and issuing jurisdiction.

- Sign and date the application form before submission.

- Check the block if your CPA Certificate is under a different name and provide that name.

- Review the form for accuracy before sending it in.

- Download and submit the separate Credit Card Payment Sheet if paying by credit card.

- Keep a copy of the completed form for your records.

Things Not to Do When Filling Out the Connecticut SBA-2 Form:

- Do not submit the form without the required payment.

- Do not use the title "Certified Public Accountant" or "CPA" unless you are registered.

- Do not provide incomplete or unclear information on the form.

- Do not affix your name to any reports or tax returns if you do not hold a license.

- Do not submit the form without signing and dating it.

- Do not send the form to an incorrect address.

- Do not forget to check if your CPA Certificate is listed under another name.

- Do not use the title in any income-generating activities unless allowed.

- Do not ignore the instructions regarding the use of the title in correspondence.

Detailed Guide for Writing Connecticut Sba 2

Completing the Connecticut SBA-2 form is essential for registering your CPA certificate. The process involves providing personal information, details about your CPA certificate, and signing the application. Following the steps below will help ensure that you fill out the form correctly.

- Type or print your name as you want it to appear in the records, followed by your address. Include your home phone number, work phone number, and email address.

- Enter your CPA Certificate Number and the issuing jurisdiction (state). If your CPA Certificate is under a different name, check the appropriate box and provide the other name.

- Sign and date the form in the designated area.

Once you have completed the form, mail it to the State Board of Accountancy at the provided address. Include a payment of $40.00, made out to the Treasurer of the State of Connecticut. If you prefer to pay by credit card, download the separate Credit Card Payment Sheet from the website and include it with your application. Ensure that all information is accurate to avoid delays in processing.