Fill a Valid Connecticut Reg 15 Template

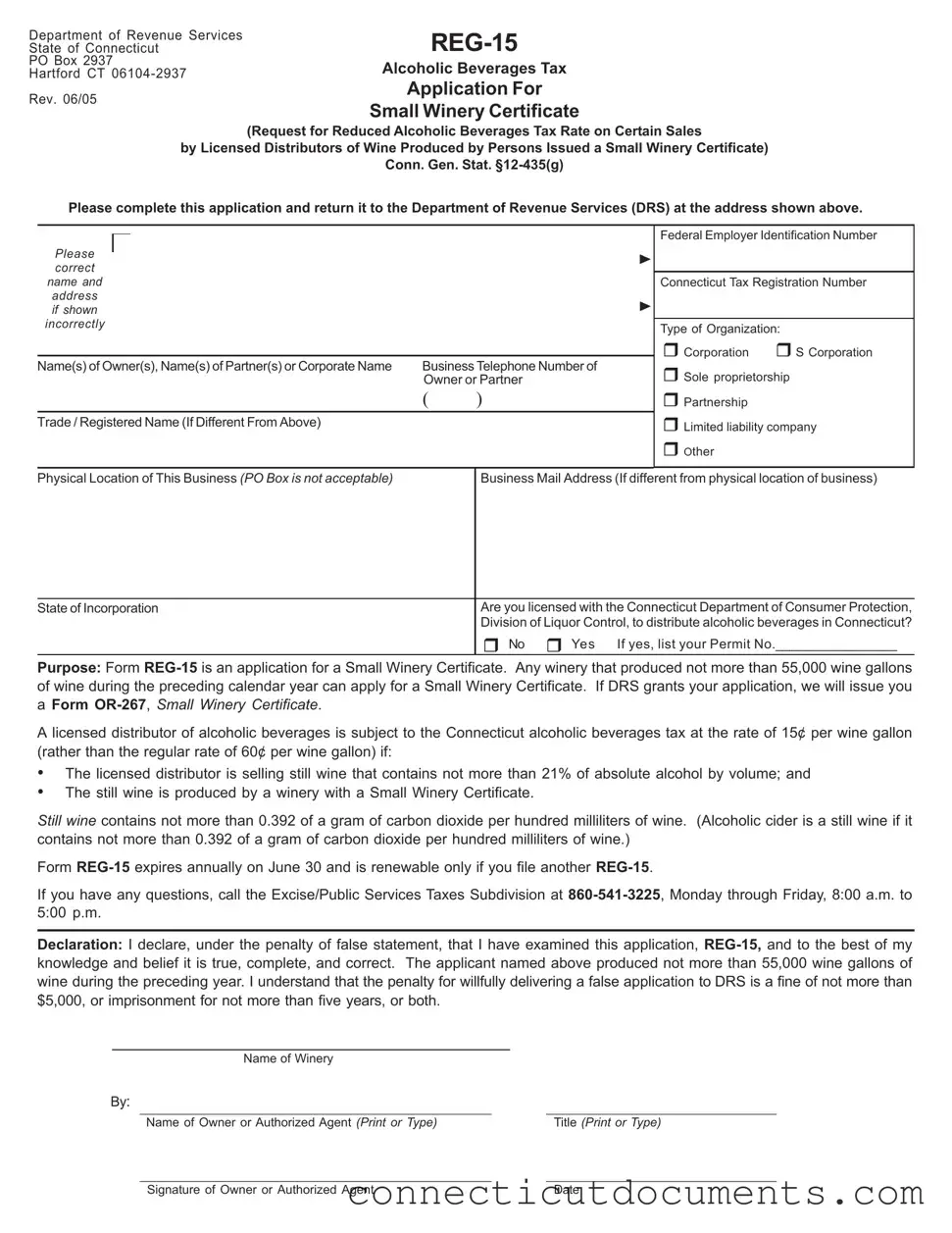

The Connecticut Reg 15 form plays a vital role for small wineries seeking to benefit from reduced tax rates on their wine sales. This application is specifically designed for wineries that produced no more than 55,000 gallons of wine in the previous calendar year. By completing the form, eligible wineries can apply for a Small Winery Certificate, which, if granted by the Department of Revenue Services (DRS), allows licensed distributors to sell their still wine at a lower tax rate of 15 cents per gallon, instead of the standard 60 cents. This reduced rate applies only to still wines with an alcohol content of no more than 21% by volume, ensuring that small producers can compete more effectively in the market. The form requires essential information such as the business name, contact details, and proof of licensing with the Connecticut Department of Consumer Protection. Additionally, it must be renewed annually, with a deadline of June 30 each year. Understanding the implications of this form and its requirements is crucial for small winery owners looking to navigate the regulatory landscape while maximizing their opportunities for growth.

Documents used along the form

The Connecticut Reg 15 form is an essential document for wineries seeking a Small Winery Certificate, which allows for a reduced alcoholic beverages tax rate. Along with this form, several other documents may be required or helpful in the application process. Below is a list of these related forms and documents.

- Form OR-267: This is the Small Winery Certificate itself, issued by the Department of Revenue Services (DRS) upon approval of the REG-15 application. It certifies that the winery qualifies for the reduced tax rate.

- Connecticut Tax Registration Number Application: This form is necessary for businesses to register for state taxes. A valid tax registration number is often required to complete the REG-15 form.

- Federal Employer Identification Number (EIN) Application: This document is needed to obtain an EIN from the IRS. It is essential for tax purposes and is typically required for the REG-15 form.

- Liquor Control Permit: Issued by the Connecticut Department of Consumer Protection, this permit is mandatory for any business involved in the distribution of alcoholic beverages. A valid permit number must be provided on the REG-15 form.

- Annual Financial Statements: While not always required, submitting financial statements can help demonstrate that the winery produced less than 55,000 wine gallons in the previous year, as required for the Small Winery Certificate.

- California Form REG 262: This form is necessary for the transfer of ownership of a vehicle or vessel in California, and can be found at formcalifornia.com/editable-california-fotm-reg-262-form/.

- Business Formation Documents: Depending on the type of organization, documents such as articles of incorporation or partnership agreements may be necessary to validate the business structure indicated on the REG-15 form.

In summary, the Connecticut Reg 15 form is part of a broader set of documents that support the application for a Small Winery Certificate. Each form and document plays a crucial role in ensuring compliance with state regulations and facilitating the application process.

Additional PDF Templates

Connecticut Op 300 - It requires basic business information, including a Tax Registration Number.

When entering into a Florida Commercial Lease Agreement, it's essential for both landlords and tenants to understand their obligations and rights, which can be found in detail at floridaforms.net/blank-commercial-lease-agreement-form/. This form will aid in ensuring clarity and legality throughout the leasing process, benefiting both parties involved in the agreement.

License Suspension Ct - Completion of the K 158 form is necessary before receiving a license from the DMV.

Similar forms

The Connecticut Reg 15 form is similar to the Application for a Small Business License, which is often required for various types of small enterprises. Like the Reg 15 form, this application seeks to verify the legitimacy of the business and its compliance with state regulations. Both forms require detailed information about the business owner, including names, contact information, and the type of organization. Additionally, both applications serve as a means to apply for a specific benefit or certification, ensuring that the applicant meets the necessary criteria established by the state.

The Connecticut Reg 15 form is similar to the Application for a Small Business License, which is often required for various types of small enterprises. Like the Reg 15 form, this application seeks to verify the legitimacy of the business and its compliance with state regulations. Both forms require detailed information about the business owner, including names, contact information, and the type of organization. Additionally, both applications serve as a means to apply for a specific benefit or certification, ensuring that the applicant meets the necessary criteria established by the state. For more detailed guidance on applications, you can refer to NY PDF Forms.

Another document that shares similarities with the Connecticut Reg 15 form is the Alcohol Beverage Control (ABC) License Application. This application is essential for businesses that wish to sell alcoholic beverages. Similar to the Reg 15, the ABC License Application requires detailed information about the business and its owners. Both forms also necessitate an understanding of the applicable laws and regulations governing alcohol sales. The ABC License serves as a prerequisite for businesses to operate legally in the alcoholic beverage market, just as the Small Winery Certificate allows for reduced tax rates on certain wine sales.

The Business Personal Property Declaration is another document akin to the Connecticut Reg 15 form. This declaration is used by businesses to report personal property to the local tax assessor. Like the Reg 15, this declaration requires specific information about the business, including its physical location and ownership details. Both documents aim to ensure that businesses comply with state tax regulations and provide accurate information to the relevant authorities. Additionally, they both play a critical role in determining the tax obligations of the business.

Finally, the Sales and Use Tax Permit Application bears resemblance to the Connecticut Reg 15 form. This application is necessary for businesses that wish to collect sales tax on their products or services. Similar to the Reg 15, it requires information about the business entity, including its structure and ownership. Both forms are designed to facilitate compliance with state tax laws, ensuring that businesses are properly registered and authorized to operate within Connecticut. The Sales and Use Tax Permit allows businesses to legally collect tax from customers, just as the Small Winery Certificate allows for a reduced tax rate on wine sales.

Important Questions on This Form

What is the Connecticut REG-15 form?

The Connecticut REG-15 form is an application for a Small Winery Certificate. This certificate allows licensed distributors of wine produced by small wineries to benefit from a reduced alcoholic beverages tax rate. Specifically, wineries that produced no more than 55,000 gallons of wine in the previous year can apply for this certificate.

Who is eligible to apply for the REG-15 form?

To be eligible, a winery must have produced not more than 55,000 wine gallons during the preceding calendar year. Additionally, the winery must be licensed with the Connecticut Department of Consumer Protection, Division of Liquor Control, to distribute alcoholic beverages in Connecticut.

What are the tax benefits associated with the Small Winery Certificate?

If your application is approved, your licensed distributor can sell still wine produced by your winery at a reduced tax rate of 15¢ per gallon, instead of the regular rate of 60¢ per gallon. This applies to still wines containing not more than 21% absolute alcohol by volume.

How do I complete the REG-15 form?

Fill out the form with the required information, including your name, business details, and federal employer identification number. Make sure to provide the correct physical location of your business, as a PO Box is not acceptable. After completing the form, return it to the Department of Revenue Services at the specified address.

What happens after I submit the REG-15 form?

Once you submit the REG-15 form, the Department of Revenue Services will review your application. If approved, you will receive a Small Winery Certificate (Form OR-267). This certificate must be renewed annually by submitting a new REG-15 form.

When does the REG-15 form expire?

The REG-15 form expires annually on June 30. To continue enjoying the benefits of the Small Winery Certificate, you must file a new REG-15 form before this expiration date.

What should I do if my application is denied?

If your application is denied, you may want to contact the Department of Revenue Services for clarification on the reasons for the denial. It may be possible to address any issues and reapply in the future.

Is there a penalty for providing false information on the REG-15 form?

Yes, providing false information can lead to serious consequences. The penalty for willfully delivering a false application includes a fine of up to $5,000, imprisonment for up to five years, or both. It’s crucial to ensure that all information submitted is accurate and complete.

How can I get assistance with the REG-15 form?

If you have questions or need assistance, you can call the Excise/Public Services Taxes Subdivision at 860-541-3225. They are available Monday through Friday, from 8:00 a.m. to 5:00 p.m., to help with any inquiries you may have regarding the form or the application process.

Misconceptions

Misconceptions about the Connecticut Reg 15 form can lead to confusion for applicants. Here are five common misunderstandings:

- Only large wineries can apply for the Small Winery Certificate. This is incorrect. Any winery that produced not more than 55,000 wine gallons of wine during the preceding calendar year is eligible to apply.

- The form must be submitted in person. While submitting in person is an option, applicants can mail the completed form to the Department of Revenue Services at the provided address.

- Once the form is submitted, the Small Winery Certificate is automatically granted. This is a misconception. The Department of Revenue Services reviews each application, and the certificate is issued only if the application meets all requirements.

- The form expires after one year, but it can be submitted at any time. The form does expire annually on June 30, and applicants must renew it by submitting a new REG-15 form before that date.

- All types of wine qualify for the reduced tax rate. This is not true. The reduced tax rate applies only to still wine containing not more than 21% absolute alcohol by volume, produced by a winery with a Small Winery Certificate.

Dos and Don'ts

When filling out the Connecticut Reg 15 form, it's important to follow certain guidelines to ensure your application is processed smoothly. Here’s a list of things you should and shouldn't do:

- Do provide accurate information regarding your name and business details.

- Do ensure your physical location is correct; a PO Box is not acceptable.

- Do include your Federal Employer Identification Number and Connecticut Tax Registration Number.

- Do verify that you have the necessary license from the Connecticut Department of Consumer Protection.

- Don't leave any sections blank; complete all required fields.

- Don't submit the form without checking for errors or inconsistencies.

- Don't forget to sign and date the application before submission.

- Don't submit the form after June 30 without renewing it for the next year.

Detailed Guide for Writing Connecticut Reg 15

Filling out the Connecticut Reg 15 form is a straightforward process, but it requires careful attention to detail. Once you have completed the form, you will need to submit it to the Department of Revenue Services. They will review your application and, if approved, issue you a Small Winery Certificate, which allows for a reduced tax rate on certain wine sales.

- Obtain the Connecticut Reg 15 form from the Department of Revenue Services or their website.

- Fill in the Name(s) of Owner(s), Name(s) of Partner(s) or Corporate Name at the top of the form.

- Provide the Business Telephone Number of Owner or Partner.

- Indicate the Trade / Registered Name if it differs from the name provided earlier.

- Enter your Federal Employer Identification Number.

- Input your Connecticut Tax Registration Number.

- Select the Type of Organization by checking the appropriate box (Corporation, S Corporation, Sole Proprietorship, Partnership, Limited Liability Company, or Other).

- Fill in the Physical Location of This Business (note that a PO Box is not acceptable).

- If applicable, provide a different Business Mail Address.

- State your State of Incorporation.

- Indicate whether you are licensed with the Connecticut Department of Consumer Protection, Division of Liquor Control, to distribute alcoholic beverages in Connecticut by checking "Yes" or "No".

- If you answered "Yes", list your Permit No..

- Review the declaration statement carefully and ensure that all information is accurate.

- Print or type the Name of Winery and sign the form.

- Print or type the Name of Owner or Authorized Agent and their Title.

- Write the Date of signing the form.

- Submit the completed form to the Department of Revenue Services at the address provided on the form.