Fill a Valid Connecticut Real Estate Template

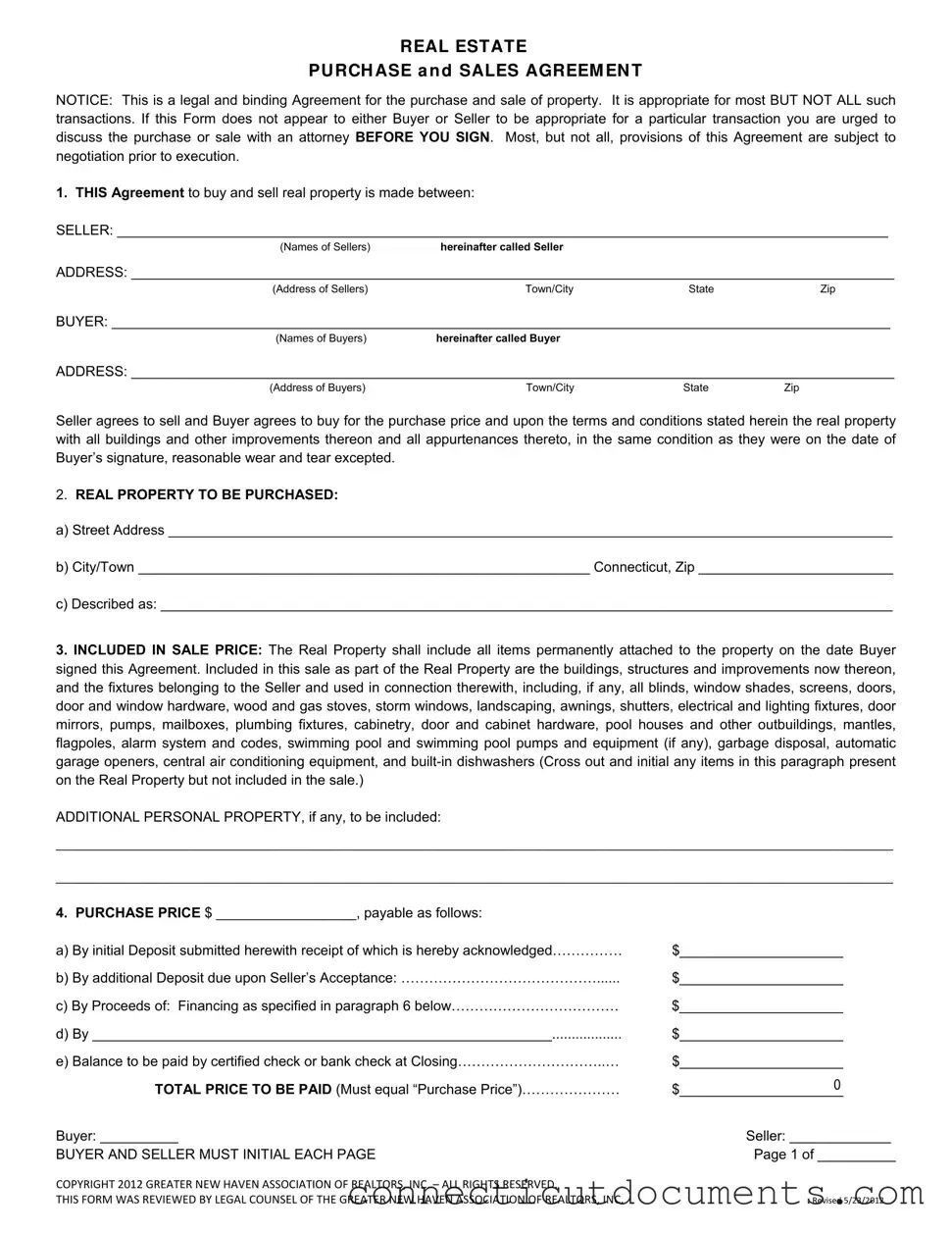

The Connecticut Real Estate Purchase and Sales Agreement is a crucial document in the home buying and selling process. It outlines the terms and conditions agreed upon by the buyer and seller for the transfer of property ownership. This form covers essential elements such as the identities of the buyer and seller, the specific property being sold, and the agreed-upon purchase price. Additionally, it details what is included in the sale, such as fixtures and improvements on the property, as well as any personal property that may be part of the transaction. The agreement also addresses important financial aspects, including deposit requirements and financing contingencies. Buyers and sellers must pay attention to the condition of the premises, inspection contingencies, and the obligations of each party during the sale process. Furthermore, the form emphasizes the importance of maintaining the property until the closing date and outlines the transfer of title, ensuring it is marketable. By understanding these key components, both parties can navigate the complexities of real estate transactions more effectively.

Documents used along the form

The Connecticut Real Estate Purchase and Sales Agreement is often accompanied by several other important documents. Each of these documents plays a crucial role in facilitating the transaction and ensuring that both parties are protected. Below is a list of commonly used forms and documents related to real estate transactions in Connecticut.

- Property Condition Disclosure: This document provides a detailed report of the property's condition, including any known issues or defects. It is required by law for residential transactions.

- Vehicle/Vessel Transfer and Reassignment Form: This form is necessary for transferring ownership of a vehicle or vessel in California. For detailed information, visit formcalifornia.com/editable-california-fotm-reg-262-form.

- Lead-Based Paint Disclosure: Required for homes built before 1978, this form informs buyers about potential lead hazards in the property and allows for inspections.

- Agency Disclosure: This document clarifies the relationship between the real estate agent and the parties involved, outlining the agent's duties and obligations.

- Consent for Dual Agency: If the listing agent also represents the buyer, this form must be signed to ensure both parties are aware of the dual representation.

- Financing Commitment Letter: This letter from a lender confirms the buyer's ability to secure financing for the purchase, detailing the terms of the loan.

- Closing Disclosure: Provided before closing, this document outlines the final terms of the mortgage, including closing costs and fees, ensuring transparency for the buyer.

- Title Insurance Policy: This policy protects the buyer and lender from any disputes regarding property ownership and any claims against the title.

- Home Inspection Report: A report generated by a professional inspector detailing the condition of the property, including any necessary repairs or maintenance issues.

- Settlement Statement: This document summarizes all financial transactions involved in the closing process, including the distribution of funds and any adjustments made.

Each of these documents is essential for a smooth real estate transaction in Connecticut. They help clarify responsibilities, protect interests, and ensure compliance with state laws. It is advisable for both buyers and sellers to review these forms carefully and seek legal guidance if needed.

Additional PDF Templates

Connecticut Withholding Employer Login - Reasons for testing are specified, such as STD-related or prenatal.

If I Lost the Title to My Car - A failure to comply with the form's requirements could jeopardize the transaction.

For those navigating the complexities of eviction processes, the important Notice to Quit guidelines provide essential insights into the necessary steps and legal requirements landlords must fulfill.

Connecticut 7B - Completing the affidavit in front of an authorized individual adds credibility to the application.

Similar forms

The Connecticut Real Estate Purchase and Sales Agreement shares similarities with the Residential Lease Agreement. Both documents outline the terms and conditions related to the use and transfer of property. In a lease agreement, the landlord grants a tenant the right to occupy a property for a specified period, while the purchase agreement details the terms for buying the property outright. Both documents include essential elements such as the identification of parties involved, property description, payment terms, and conditions for termination. Each serves as a binding contract, ensuring that both parties understand their rights and obligations.

A New York Quitclaim Deed form transfers property ownership rights from one person to another without any guarantee about the property's title. This form is often used among family members or to clear up title issues. Unlike other deed forms, it carries no warranties, making it crucial for the receiving party to conduct thorough due diligence. For those looking for a template, you can find one at NY PDF Forms.

Another document that resembles the Connecticut Real Estate form is the Option to Purchase Agreement. This agreement allows a potential buyer the right to purchase a property at a predetermined price within a specified timeframe. Similar to the purchase agreement, it details the terms of the transaction, including the purchase price and any conditions that must be met. Both documents require clear communication between the buyer and seller regarding their intentions and responsibilities. The option to purchase can serve as a preliminary step before entering into a full purchase agreement, making both documents crucial in the real estate process.

The Listing Agreement is also comparable to the Connecticut Real Estate Purchase and Sales Agreement. This document is used by property owners when hiring a real estate agent to sell their property. It outlines the terms of the agent’s representation, including commission rates, marketing strategies, and the duration of the agreement. Just like the purchase agreement, it establishes a legal relationship and sets expectations between the parties involved. Both documents aim to facilitate a smooth transaction, whether it be the sale of the property or the securing of a buyer.

Lastly, the Buyer’s Agency Agreement is another document that shares key features with the Connecticut Real Estate form. This agreement formalizes the relationship between a buyer and their real estate agent. It specifies the agent’s duties and obligations to represent the buyer in their property search. Similar to the purchase agreement, it includes details such as the scope of services provided and the compensation structure. Both documents are essential in ensuring that the buyer’s interests are protected throughout the real estate transaction process.

Important Questions on This Form

What is the Connecticut Real Estate Purchase and Sales Agreement?

The Connecticut Real Estate Purchase and Sales Agreement is a legal document used for buying and selling property in Connecticut. It outlines the terms and conditions of the sale, including the purchase price, property description, and the responsibilities of both the buyer and seller. This agreement is binding once signed, so it's important to ensure it fits the specific transaction. If you have any doubts, consulting an attorney before signing is advisable.

What should I include in the Purchase Price section?

The Purchase Price section details how the buyer will pay for the property. It includes the total price and breaks it down into deposits and any financing. Each payment method should be clearly stated, including the initial deposit, any additional deposits, and the balance due at closing. Make sure the total matches the purchase price to avoid confusion.

What happens if the Buyer cannot secure financing?

If the buyer is unable to obtain financing as outlined in the agreement, they must notify the seller in writing by a specific date. If this happens, the agreement becomes null and void, and any deposits made will be returned to the buyer. It's crucial for the buyer to act quickly and diligently in seeking financing to protect their interests.

What is the Inspection Contingency?

The Inspection Contingency allows the buyer to have the property inspected before finalizing the sale. The buyer must notify the seller of any concerns about the property's condition within a specified time frame. If the buyer is not satisfied, they can choose to terminate the agreement. This section helps protect the buyer by ensuring they are aware of any issues before closing.

What is the significance of the Lead-Based Paint disclosure?

If the property was built before 1978, federal law requires the seller to allow the buyer to inspect for lead-based paint hazards. The buyer has a 10-day period to conduct this inspection. If lead-based paint is found, the buyer must notify the seller, and both parties can negotiate a solution. If the buyer waives this right, they cannot later raise concerns about lead-based paint.

What should I know about the Closing Process?

The closing process is when ownership of the property is officially transferred from the seller to the buyer. The buyer typically receives possession on the closing date. The seller must maintain the property in good condition until closing. A final walk-through inspection is recommended within 48 hours before closing to ensure everything is as agreed. All financial adjustments, such as taxes and fees, will be settled at this time.

Misconceptions

Understanding the Connecticut Real Estate Purchase and Sales Agreement is crucial for both buyers and sellers. However, several misconceptions can lead to confusion. Here are eight common misconceptions, along with clarifications for each:

- This form is suitable for every real estate transaction. Many believe that the Connecticut Real Estate form applies universally. In reality, it is designed for most transactions but not all. Specific situations may require tailored agreements.

- Signing the agreement is final and cannot be changed. Some assume that once signed, the terms are set in stone. In fact, many provisions are negotiable before execution, allowing for adjustments based on the needs of both parties.

- The seller is responsible for all repairs before closing. A common belief is that sellers must fix all issues prior to closing. However, the agreement allows buyers to conduct inspections and negotiate repairs, giving them a chance to address concerns.

- Deposits are non-refundable. Many think that once a deposit is made, it cannot be recovered. This is not entirely true; if the buyer cannot secure financing or if certain contingencies are not met, deposits may be returned.

- Buyers have unlimited time to conduct inspections. Some buyers believe they can take as long as they want to inspect the property. The agreement specifies a time frame for inspections, and failure to act within this period may waive the right to object to any defects.

- Lead-based paint inspections are optional for all properties. There is a misconception that lead-based paint inspections are optional regardless of the property's age. In fact, federal law mandates that buyers of homes built before 1978 must be allowed a period to conduct such inspections.

- All properties are sold in perfect condition. Buyers often assume that properties must be in pristine condition. The agreement states that properties are sold "as-is," meaning that reasonable wear and tear is expected, and buyers should conduct their due diligence.

- The agreement is a simple document without legal implications. Some individuals view the agreement as a straightforward form with no significant legal weight. However, it is a legally binding contract, and failure to adhere to its terms can lead to serious consequences, including potential litigation.

By dispelling these misconceptions, both buyers and sellers can approach their real estate transactions with a clearer understanding of their rights and responsibilities.

Dos and Don'ts

When filling out the Connecticut Real Estate form, it is essential to adhere to specific guidelines to ensure accuracy and compliance. Below is a list of actions to take and avoid.

- Do: Carefully read the entire agreement before signing.

- Do: Provide accurate names and addresses for both the Buyer and Seller.

- Do: Clearly specify the purchase price and payment terms.

- Do: Include any additional personal property that is part of the sale.

- Do: Initial each page of the agreement to confirm understanding and acceptance.

- Do: Consult an attorney if there are any uncertainties about the form.

- Don't: Leave any sections blank; all fields must be completed.

- Don't: Forget to cross out and initial any items not included in the sale.

- Don't: Ignore deadlines for deposits or financing commitments.

- Don't: Assume that verbal agreements are valid; everything must be documented in writing.

- Don't: Sign the agreement without fully understanding its terms and conditions.

- Don't: Rely solely on the form; consider seeking professional advice when necessary.

Detailed Guide for Writing Connecticut Real Estate

Completing the Connecticut Real Estate Purchase and Sales Agreement requires careful attention to detail. Each section must be filled out accurately to ensure that both the buyer and seller understand their rights and obligations. Following the steps below will help facilitate the process.

- Begin by entering the names of the Seller and their address in the designated fields.

- Next, fill in the names of the Buyer and their address.

- Provide the street address, city/town, and zip code of the property being purchased.

- List any items included in the sale that are permanently attached to the property. Be sure to cross out and initial any items not included.

- Specify the purchase price and outline the payment structure, including initial and additional deposits, financing proceeds, and the balance due at closing.

- Detail the financing contingency by entering the amount, interest rate, term, commitment date, and type of financing.

- Indicate whether the buyer has examined the property and if they are satisfied with its condition.

- Complete the inspection contingency section, including deadlines for inspections and notifications regarding any unsatisfactory conditions.

- If applicable, fill out the lead-based paint section, including any waivers or requests for inspection.

- Document the property maintenance agreement, specifying the closing date and conditions for possession.

- Ensure that the warranty deed and marketable title sections are completed, noting any conditions or exceptions.

- Address any adjustments related to real estate taxes and other fees due at closing.

- Review the terms related to buyer’s default and the risk of loss until the deed is delivered.

- Complete the sections related to common interest communities, property condition reports, and equal housing rights.

- List any attached addenda or additional terms and conditions that are part of the agreement.

- Sign and date the agreement in the designated signature fields for both the buyer and seller.

Once the form is filled out completely, both parties should review it carefully before signing to ensure all information is accurate and all necessary sections are completed. This will help to avoid any misunderstandings or disputes in the future.