Fill a Valid Connecticut Op 300 Template

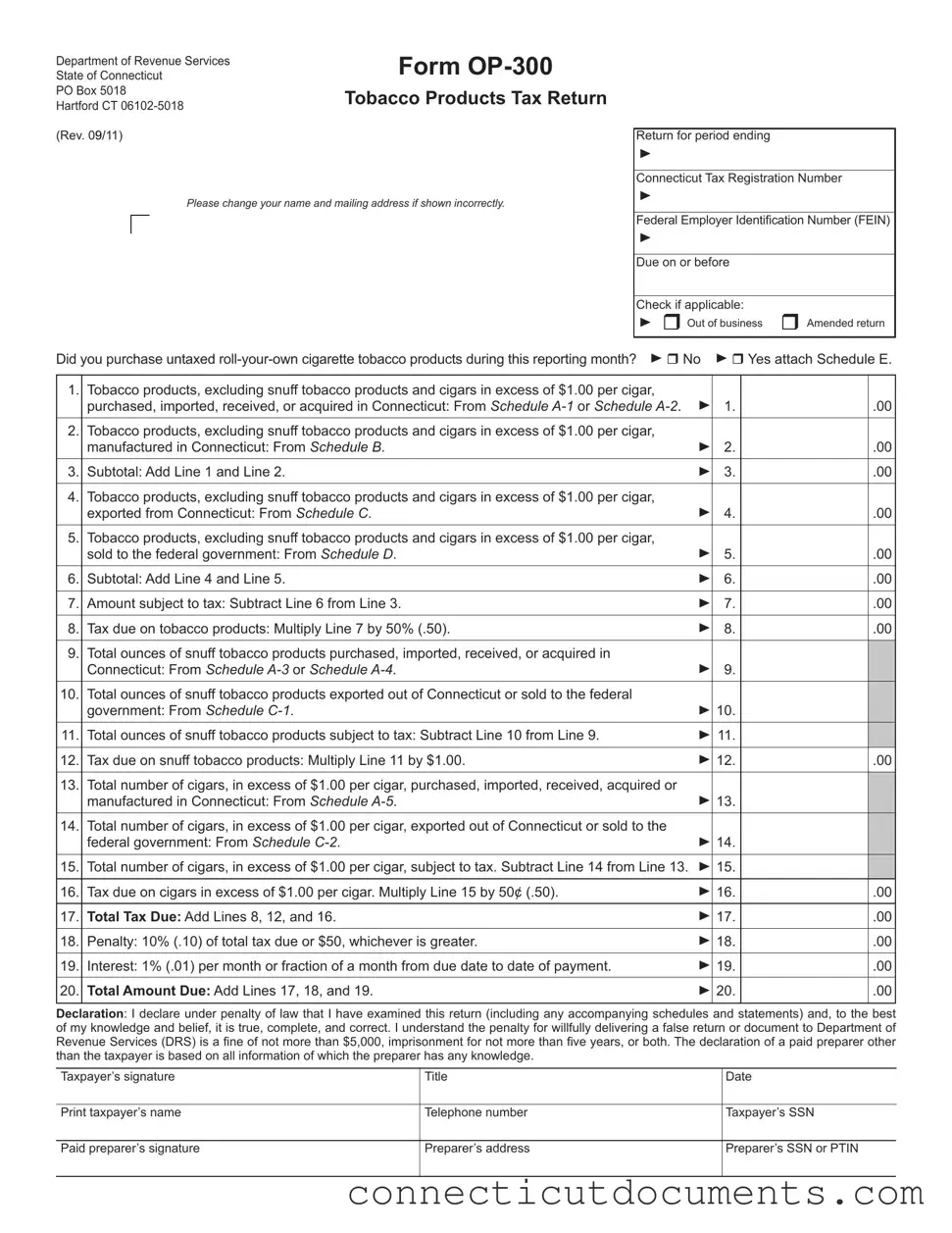

The Connecticut OP-300 form serves as the Tobacco Products Tax Return, a crucial document for businesses involved in the tobacco industry within the state. This form requires detailed reporting of various tobacco products purchased, imported, manufactured, or exported, ensuring compliance with state tax regulations. Taxpayers must provide their Connecticut Tax Registration Number and Federal Employer Identification Number (FEIN), along with a declaration of their business status—whether they are out of business or submitting an amended return. The form includes specific lines for reporting the wholesale sales price of tobacco products, excluding certain items like snuff and cigars priced over $1.00 each. It calculates the total tax due based on the subtotal of taxable products, with additional lines for penalties and interest if applicable. Notably, taxpayers must file the return monthly, even if no tax is due, and adhere to strict deadlines to avoid penalties. The form also emphasizes the importance of accurate reporting, as false declarations can lead to significant legal consequences. For those needing assistance, the Department of Revenue Services provides resources and support to facilitate the completion of this essential form.

Documents used along the form

The Connecticut OP-300 form is an essential document for reporting tobacco products tax in the state. However, it is often accompanied by several other forms and documents that assist in providing a complete and accurate tax return. Understanding these additional forms can help ensure compliance and facilitate the reporting process.

- Schedule A-1: This schedule details the wholesale sales price of tobacco products purchased, imported, received, or acquired in Connecticut by resident distributors.

- Schedule A-2: Nonresident distributors use this schedule to report the wholesale sales price of tobacco products imported into Connecticut.

- Schedule A-3: This document captures the total ounces of snuff tobacco products purchased or acquired in Connecticut.

- Schedule A-4: Similar to Schedule A-3, this form is for reporting snuff tobacco products imported into Connecticut.

- Schedule A-5: This schedule records the total number of cigars, each exceeding $1.00, that have been purchased or manufactured in Connecticut.

- Schedule B: This form is used to report the wholesale sales price of tobacco products that have been manufactured in Connecticut.

- Schedule C: This schedule accounts for tobacco products exported from Connecticut, detailing their wholesale sales price.

- Schedule C-1: This document is for reporting snuff tobacco products that have been exported out of Connecticut or sold to the federal government.

- California Form REG 262: This form is essential for the transfer of ownership of a vehicle or vessel in California and can be accessed at https://formcalifornia.com/editable-california-fotm-reg-262-form/.

- Schedule C-2: Similar to Schedule C-1, this schedule captures the total number of cigars, exceeding $1.00 each, exported or sold to the federal government.

- Schedule D: This form is used to report the wholesale sales price of tobacco products sold to the federal government that were imported or manufactured in Connecticut.

By utilizing these additional schedules and documents, taxpayers can ensure they are accurately reporting their tobacco products tax obligations. This comprehensive approach not only aids in compliance but also helps avoid potential penalties associated with incomplete or incorrect filings.

Additional PDF Templates

Ct Premium Pay Program Application - Scores sent directly by waiver candidates are not accepted.

Har 3 Connecticut - The form includes a checklist for various health concerns requiring parental input.

Understanding the necessary steps and documentation involved in child support cases can often be overwhelming. To assist individuals navigating this process in Texas, resources such as Texas PDF Forms provide valuable guidance and access to the required forms, ensuring that all legalities are observed and the needs of the children are prioritized.

Ct Change of Address Form - You can also contact DMV’s Phone Center for address label requests.

Similar forms

The Connecticut OP-300 form is similar to the IRS Form 941, which is used for reporting employment taxes. Both forms require taxpayers to report specific financial information related to their business activities. While the OP-300 focuses on tobacco product taxes, Form 941 deals with income taxes withheld from employee wages, Social Security, and Medicare taxes. Each form includes sections for total sales, tax calculations, and penalties for inaccuracies. Timely submission is crucial for both forms to avoid penalties, emphasizing the importance of compliance in tax reporting.

Another document that shares similarities with the OP-300 is the State of Connecticut Sales and Use Tax Return (Form ST-1). Like the OP-300, this form requires businesses to report taxable sales and calculate the tax due. Both forms are submitted monthly and require supporting schedules to detail specific transactions. Additionally, they both have penalties for late filing or payment, underscoring the necessity for businesses to maintain accurate records and timely submissions to state authorities.

Understanding the various forms involved in tax reporting is essential for compliance and can also afford individuals a level of protection similar to a https://nyforms.com/ that ensures their financial affairs are managed according to their wishes in times of need. Each form, from the Connecticut OP-300 to the CT-1040, serves a specific purpose and requires meticulous attention to detail to avoid penalties and ensure accurate reporting.

The Connecticut Corporation Business Tax Return (Form CT-1120) also resembles the OP-300 in its purpose of reporting tax liabilities. While the OP-300 is tailored for tobacco product distributors, the CT-1120 is for corporations operating in Connecticut. Both forms require detailed financial information, including revenue and deductions, to determine the tax owed. The importance of accurate reporting and adherence to deadlines is a common theme, as both forms are critical for compliance with state tax laws.

Lastly, the Connecticut Personal Income Tax Return (Form CT-1040) shares some structural similarities with the OP-300. Both forms require taxpayers to report income and calculate taxes owed based on specific criteria. While the OP-300 focuses on businesses dealing with tobacco products, the CT-1040 is designed for individual taxpayers. Each form requires a declaration of accuracy under penalty of law, highlighting the seriousness of providing truthful information to the state. Timeliness in filing and payment is essential for both forms to avoid additional fees.

Important Questions on This Form

What is the Connecticut OP-300 form?

The Connecticut OP-300 form is the Tobacco Products Tax Return that must be filed by distributors of tobacco products in Connecticut. It reports the purchase, importation, and sale of tobacco products and calculates the tax due on those products.

Who needs to file the OP-300 form?

Any distributor of tobacco products in Connecticut must file the OP-300 form. This includes both resident and non-resident distributors who purchase, import, or manufacture tobacco products within the state.

When is the OP-300 form due?

The form must be filed by the 25th day of the month following the reporting month. For example, the return for January must be submitted by February 25. Even if no tax is due, a return must still be filed.

How do I pay the tax due on the OP-300 form?

You can pay electronically through the Taxpayer Service Center (TSC) at www.ct.gov/TSC. Alternatively, if you choose not to pay electronically, make your check payable to the Commissioner of Revenue Services and mail it to the address listed on the form.

What if I made a mistake on my OP-300 form?

If you need to correct an error, check the box for "Amended return" on the form and submit the corrected information. Ensure that you provide accurate details to avoid penalties.

What happens if I do not file the OP-300 form on time?

If you do not file the form by the due date, you may incur penalties and interest on the amount due. The penalty is 10% of the total tax due or a minimum of $50, whichever is greater. Interest accrues at a rate of 1% per month from the due date until payment is made.

What information do I need to complete the OP-300 form?

You will need your Connecticut Tax Registration Number, Federal Employer Identification Number (FEIN), and details regarding your tobacco product purchases, sales, and any applicable schedules. Ensure all information is accurate and complete before submitting the form.

Where can I find additional resources or assistance regarding the OP-300 form?

For further information, you can contact the Excise Taxes Unit at 860-541-3224, Monday through Friday, from 8:30 a.m. to 4:30 p.m. You can also visit the Department of Revenue Services website at www.ct.gov/DRS for forms and publications.

Misconceptions

- Misconception 1: The OP-300 form is only for large tobacco businesses.

- Misconception 2: Filing the OP-300 is optional if no tax is due.

- Misconception 3: Only tobacco manufacturers need to fill out the OP-300.

- Misconception 4: The OP-300 can be submitted at any time during the month.

- Misconception 5: There is no penalty for late filing if no tax is due.

- Misconception 6: The OP-300 only applies to cigarettes.

- Misconception 7: You do not need to keep records if you file the OP-300.

- Misconception 8: The OP-300 can be filled out in any color ink.

- Misconception 9: You can submit the OP-300 electronically without a signature.

This form is required for all distributors, regardless of size. Even small operations must file it if they engage in the sale or distribution of tobacco products in Connecticut.

All taxpayers must file the OP-300 each month, even if no tax is owed. This ensures compliance with state regulations.

Any distributor who purchases, imports, or sells tobacco products must complete this form. This includes retailers and wholesalers.

The form has a strict due date of the 25th day of the month following the reporting period. Late submissions may incur penalties.

Late filings can still result in penalties and interest, regardless of whether any tax is owed. Compliance is crucial.

This form covers all tobacco products, including cigars, snuff, and other types of tobacco. It is not limited to cigarettes alone.

Taxpayers must maintain accurate records of all tobacco transactions. These records are essential for verifying the information provided on the form.

Taxpayers must use blue or black ink only when completing the form. This requirement helps ensure clarity and legibility.

The form must be signed by the taxpayer or an authorized individual. This signature attests to the accuracy of the information provided.

Dos and Don'ts

When filling out the Connecticut Op 300 form, it's important to follow certain guidelines to ensure accuracy and compliance. Here are some things you should and shouldn't do:

- Do use blue or black ink only when completing the form.

- Do check all boxes that apply, especially regarding the purchase of untaxed roll-your-own cigarette tobacco products.

- Do ensure that your name and mailing address are correct.

- Do file your return by the twenty-fifth day of the month following the reporting period.

- Don't leave any required fields blank; provide all necessary information.

- Don't forget to attach any required schedules, such as Schedule E if applicable.

- Don't submit your form without a signature from the taxpayer or an authorized representative.

- Don't ignore the penalties for late payment or incorrect filings; be aware of potential fines and interest.

Detailed Guide for Writing Connecticut Op 300

After completing the Connecticut OP-300 form, you will need to submit it by the due date. Ensure that you have filled in all required information accurately to avoid penalties. If you are filing electronically, follow the steps for online submission. If mailing, ensure your payment is included if applicable.

- Obtain the Connecticut OP-300 form from the Department of Revenue Services (DRS) website.

- Fill in your Connecticut Tax Registration Number and Federal Employer Identification Number (FEIN).

- Indicate the reporting period ending date.

- Check the applicable boxes for "Out of business" or "Amended return" if necessary.

- Answer the question about purchasing untaxed roll-your-own cigarette tobacco products. If "Yes," attach Schedule E.

- Complete Line 1 by entering the total from Schedule A-1 or A-2 for tobacco products purchased or imported in Connecticut.

- Complete Line 2 by entering the total from Schedule B for tobacco products manufactured in Connecticut.

- Add Lines 1 and 2 to get the subtotal on Line 3.

- Complete Line 4 by entering the total from Schedule C for tobacco products exported from Connecticut.

- Complete Line 5 by entering the total from Schedule D for tobacco products sold to the federal government.

- Add Lines 4 and 5 to get the subtotal on Line 6.

- Subtract Line 6 from Line 3 to find the amount subject to tax on Line 7.

- Multiply Line 7 by 50% to calculate the tax due on tobacco products and enter it on Line 8.

- Complete Line 9 by entering the total ounces of snuff tobacco products from Schedule A-3 or A-4.

- Complete Line 10 by entering the total ounces of snuff tobacco products exported or sold to the federal government from Schedule C-1.

- Subtract Line 10 from Line 9 for the total ounces of snuff tobacco products subject to tax on Line 11.

- Multiply Line 11 by $1.00 to find the tax due on snuff tobacco products and enter it on Line 12.

- Complete Line 13 by entering the total number of cigars in excess of $1.00 per cigar from Schedule A-5.

- Complete Line 14 by entering the total number of cigars exported or sold to the federal government from Schedule C-2.

- Subtract Line 14 from Line 13 for the total number of cigars subject to tax on Line 15.

- Multiply Line 15 by $0.50 to find the tax due on cigars and enter it on Line 16.

- Add Lines 8, 12, and 16 to get the total tax due on Line 17.

- Calculate the penalty on Line 18, which is 10% of the total tax due or $50, whichever is greater.

- Calculate the interest on Line 19 at 1% per month from the due date to the payment date.

- Add Lines 17, 18, and 19 for the total amount due on Line 20.

- Sign the declaration, providing your title, date, and printed name.

- Include your telephone number and Social Security Number.

- If applicable, have the paid preparer sign and provide their address and SSN or PTIN.

- Submit the completed form by the due date, either electronically or by mailing it to the provided address.