Fill a Valid Connecticut K 158 Template

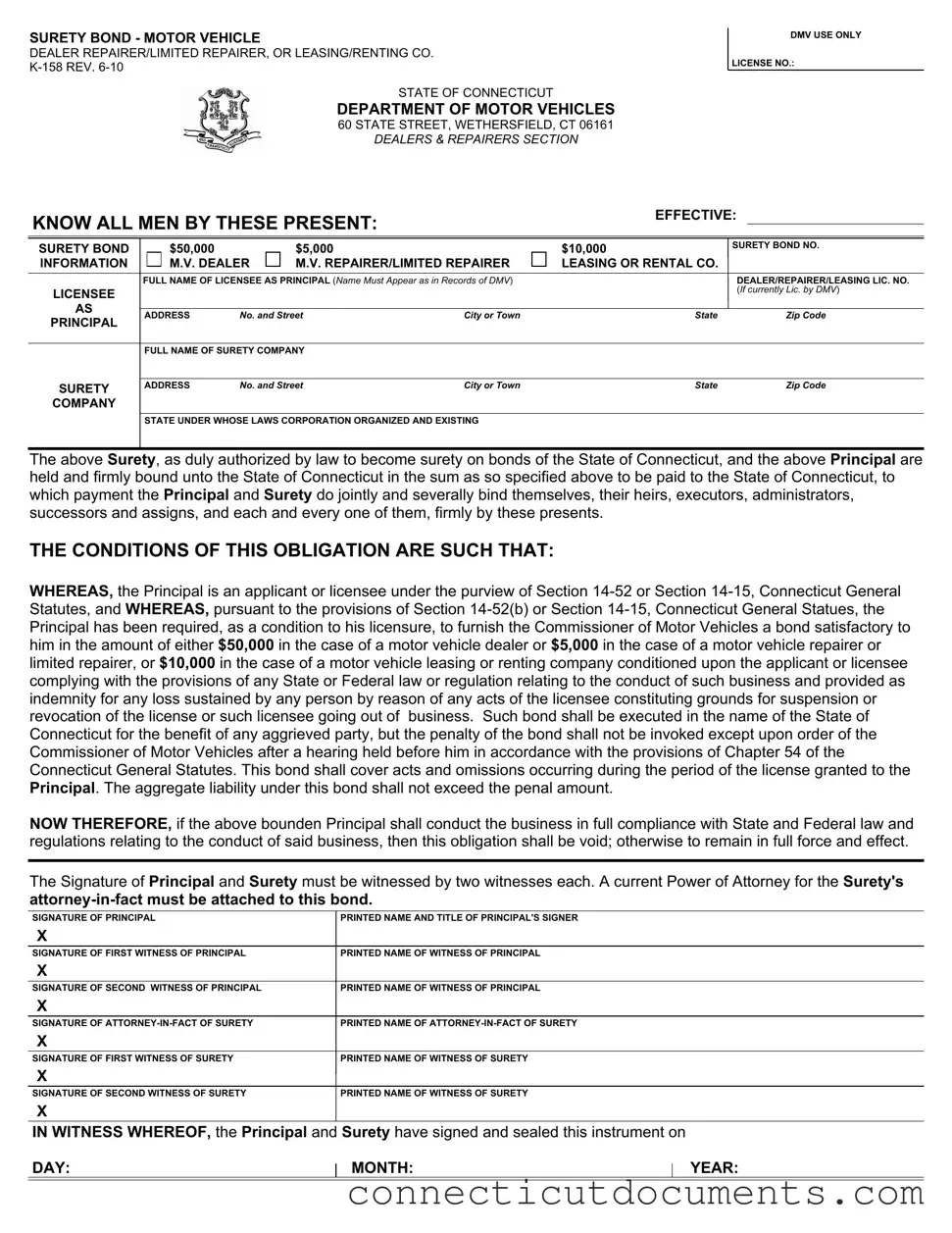

The Connecticut K 158 form serves as a crucial surety bond for motor vehicle dealers, repairers, limited repairers, and leasing or renting companies operating within the state. This bond is a legal requirement, ensuring that these businesses comply with state and federal laws governing their operations. The form outlines the specific bond amounts—$50,000 for motor vehicle dealers, $5,000 for repairers, and $10,000 for leasing companies—providing financial protection for consumers against potential misconduct. By signing this document, the principal (the business owner) and the surety company agree to be held liable for any violations that may arise, thereby safeguarding the interests of the state and its residents. The bond remains in effect throughout the licensing period, and its conditions stipulate that it will only be invoked following a formal hearing conducted by the Commissioner of Motor Vehicles. To complete the K 158 form, both the principal and the surety must provide signatures, and the document must be witnessed by two individuals to ensure its validity. Additionally, a Power of Attorney for the surety's attorney-in-fact must accompany the bond, reinforcing the legal obligations established within this important form.

Documents used along the form

The Connecticut K 158 form is a surety bond required for motor vehicle dealers, repairers, and leasing companies. This form serves as a guarantee that the licensee will comply with state and federal laws governing their business. Along with the K 158 form, several other documents may be necessary to complete the licensing process. Below is a list of related forms and documents often used in conjunction with the K 158 form.

- Power of Attorney: This document authorizes an individual to act on behalf of the surety company. It must be current and signed by the surety's attorney-in-fact. The Power of Attorney ensures that the surety company is legally represented in the bond agreement.

- Residential Lease Agreement: For those renting a property, a critical document is the Home Rental Agreement, which outlines the terms and obligations between the landlord and tenant.

- DMV License Application: This application is submitted to the Connecticut Department of Motor Vehicles (DMV) to request a license to operate as a dealer, repairer, or leasing company. It includes personal and business information, ensuring the applicant meets all necessary qualifications.

- Business Entity Registration: If the applicant is a corporation or limited liability company, they must register their business with the Connecticut Secretary of State. This document confirms the legal formation of the business entity and its compliance with state regulations.

- Financial Statements: These documents provide an overview of the business's financial health. They may include balance sheets, income statements, and cash flow statements. The DMV may require these to assess the applicant's ability to operate responsibly.

- Proof of Insurance: Applicants must show evidence of liability insurance coverage as required by state law. This document protects consumers and ensures that the business can cover potential damages or claims arising from its operations.

- Background Check Authorization: This form grants permission for the DMV to conduct a background check on the applicant. It helps ensure that the individual has a clean record and is fit to hold a license in the motor vehicle industry.

These documents collectively support the application process and ensure compliance with Connecticut's regulations for motor vehicle dealers, repairers, and leasing companies. Properly preparing and submitting these forms can facilitate a smoother licensing experience.

Additional PDF Templates

Har 3 Connecticut - This form is designed to enhance awareness of students' needs among school staff.

To facilitate the transfer of ownership in real estate transactions, utilizing the appropriate documentation is crucial. A Florida Quitclaim Deed serves this purpose, allowing parties who are familiar with one another to convey property rights without the need for title warranties. For those interested in learning more about the process and acquiring the necessary documentation, refer to the Quitclaim Deed form to ensure you have everything needed for a seamless transition.

Ct Registration Form - There’s no cost associated with filling out the form.

Connecticut Withholding Employer Login - It supports the mission of reducing the incidence of STDs.

Similar forms

The Connecticut K 158 form is similar to the Surety Bond for Contractors, which is required for construction businesses operating in the state. Just like the K 158, this bond serves as a guarantee that the contractor will comply with local laws and regulations. It protects clients from potential losses due to the contractor's failure to fulfill their obligations. Both documents require the contractor to provide a specified bond amount, ensuring that there are financial resources available for any claims that may arise during the project. The underlying purpose of both forms is to safeguard public interests by holding businesses accountable for their actions.

The New York Room Rental Agreement form is a vital legal document that defines the terms of the rental relationship and helps avoid misunderstandings between landlords and tenants. As with other important forms, such as the Connecticut K 158, it establishes clear obligations and rights for both parties involved. For those interested in the specifics of room rentals, resources like NY PDF Forms can provide valuable templates and guidance to ensure compliance and understanding of the regulations that govern this important aspect of housing.

Another document similar to the K 158 is the Motor Vehicle Dealer License Application. This application is a crucial step for businesses looking to operate as motor vehicle dealers. Like the K 158, it requires detailed information about the applicant and their business practices. Both documents are essential for ensuring that dealers meet state standards and regulations. The application process includes a review of the applicant's background, financial stability, and compliance with laws, much like the conditions outlined in the K 158 form that bind the dealer to legal obligations.

The Connecticut Insurance Producer License Application is also comparable to the K 158 form. This document is necessary for individuals seeking to become licensed insurance agents in Connecticut. Similar to the K 158, it requires the applicant to disclose personal and business information, ensuring that they meet the state's legal requirements. Both forms aim to protect consumers by ensuring that only qualified individuals operate within their respective industries. The obligation to adhere to state laws and regulations is a common theme in both documents, emphasizing accountability and consumer protection.

Lastly, the Connecticut Public Adjuster Bond is another document that shares similarities with the K 158 form. This bond is required for public adjusters, who help clients negotiate insurance claims. Like the K 158, the public adjuster bond serves to protect clients from potential misconduct or negligence by the adjuster. It requires the adjuster to maintain compliance with relevant laws and regulations, ensuring that they act in the best interest of their clients. Both documents highlight the importance of financial security and legal compliance in professional practices, reinforcing the need for accountability in the business environment.

Important Questions on This Form

What is the Connecticut K 158 form used for?

The Connecticut K 158 form serves as a surety bond for motor vehicle dealers, repairers, limited repairers, and leasing or renting companies. It ensures that these businesses comply with state and federal laws and regulations. By filing this bond, a business commits to conducting its operations responsibly and to compensating any aggrieved parties in case of violations that could lead to license suspension or revocation.

What are the bond amounts specified in the K 158 form?

The bond amounts required on the K 158 form vary depending on the type of business. For motor vehicle dealers, the bond amount is set at $50,000. If you are a motor vehicle repairer or limited repairer, the bond amount is $5,000. Lastly, motor vehicle leasing or renting companies must provide a bond of $10,000. These amounts are intended to protect consumers and ensure compliance with the law.

Who needs to sign the K 158 form?

How does the K 158 form protect consumers?

The K 158 form is designed to provide financial protection to consumers. If a licensed dealer, repairer, or leasing company fails to comply with laws or regulations, consumers can file a claim against the bond. This means that if a business goes out of compliance or ceases operations, the bond can help cover losses incurred by consumers due to the business's actions.

What happens if the business does not comply with the law?

If the principal fails to comply with state and federal laws, the surety bond remains in effect. The bond can only be invoked after a hearing conducted by the Commissioner of Motor Vehicles. This process ensures that any claims against the bond are handled fairly and in accordance with the law, protecting both consumers and businesses.

Is a Power of Attorney required for the K 158 form?

Yes, a current Power of Attorney for the surety's attorney-in-fact must be attached to the K 158 form. This document authorizes the attorney-in-fact to act on behalf of the surety company, ensuring that all legal responsibilities are properly managed and that the bond is executed correctly.

Misconceptions

Understanding the Connecticut K 158 form is crucial for anyone involved in the motor vehicle dealership or repair business. However, several misconceptions can lead to confusion and potential compliance issues. Here are five common misconceptions:

- It is only for motor vehicle dealers. Many believe the K 158 form is exclusively for motor vehicle dealers. In reality, it applies to motor vehicle repairers, limited repairers, and leasing or renting companies as well.

- The bond amount is fixed for all businesses. Some assume that the bond amount is the same regardless of the type of business. The K 158 form specifies different bond amounts: $50,000 for dealers, $5,000 for repairers, and $10,000 for leasing companies.

- Once submitted, the bond is permanent. There is a misconception that once the bond is filed, it remains valid indefinitely. The bond must be maintained and can be subject to renewal or replacement based on business changes or compliance issues.

- Only the principal needs to sign the form. It is often thought that only the principal's signature is necessary. However, the form requires signatures from the principal, surety, and witnesses, ensuring all parties are legally bound.

- The bond protects only the licensee. Many people believe that the bond only serves to protect the business owner. In fact, it is designed to protect consumers and any aggrieved parties in case of misconduct by the licensee.

Being aware of these misconceptions can help ensure compliance with state regulations and protect your business interests.

Dos and Don'ts

When filling out the Connecticut K 158 form, it is essential to follow specific guidelines to ensure accuracy and compliance. Here are ten important dos and don'ts to consider:

- Do read the entire form carefully before starting to fill it out.

- Do provide your full legal name as it appears in DMV records.

- Do include accurate and complete addresses for both the principal and surety company.

- Do ensure that the surety bond amount matches the requirements for your specific license type.

- Do have all signatures witnessed by two individuals as required.

- Don't leave any sections of the form blank; every field must be filled out.

- Don't use abbreviations or nicknames; stick to your legal name.

- Don't forget to attach the current Power of Attorney for the surety's attorney-in-fact.

- Don't rush through the process; take your time to avoid mistakes.

- Don't submit the form without double-checking for errors or omissions.

By adhering to these guidelines, you can help ensure that your application process goes smoothly and that you meet all necessary requirements. Taking the time to complete the form correctly can prevent delays and complications down the road.

Detailed Guide for Writing Connecticut K 158

Filling out the Connecticut K-158 form is an important step for motor vehicle dealers, repairers, or leasing companies to ensure compliance with state regulations. This form serves as a surety bond, providing financial protection to the state and consumers. Below are the steps to accurately complete the form.

- Obtain the Form: Download or request a copy of the Connecticut K-158 form from the Department of Motor Vehicles (DMV) website or local DMV office.

- Fill in License Information: Write the license number in the designated space at the top of the form.

- Enter Surety Bond Amount: Indicate the bond amount required for your business type: $50,000 for motor vehicle dealers, $5,000 for motor vehicle repairers or limited repairers, or $10,000 for leasing or renting companies.

- Principal Information: Fill in the full name of the licensee as it appears in DMV records. Include the dealer, repairer, or leasing license number and the complete address (number, street, city or town, state, and zip code).

- Surety Company Details: Provide the full name of the surety company and its address, including number, street, city or town, state, and zip code.

- State of Incorporation: Specify the state under which the surety company is organized and existing.

- Signatures: The principal must sign the form. Ensure the signature is witnessed by two individuals who will also sign and print their names.

- Surety Signature: The attorney-in-fact of the surety company must sign the form. This signature must also be witnessed by two individuals, who will print their names as well.

- Attach Power of Attorney: Include a current Power of Attorney document for the surety's attorney-in-fact with the completed form.

- Date the Document: Write the date of signing in the designated section (day, month, year).

Once you have completed the form, review it for accuracy before submitting it to the DMV. Ensure all signatures and required attachments are included to avoid delays in processing your bond.