Fill a Valid Connecticut Au 738 Template

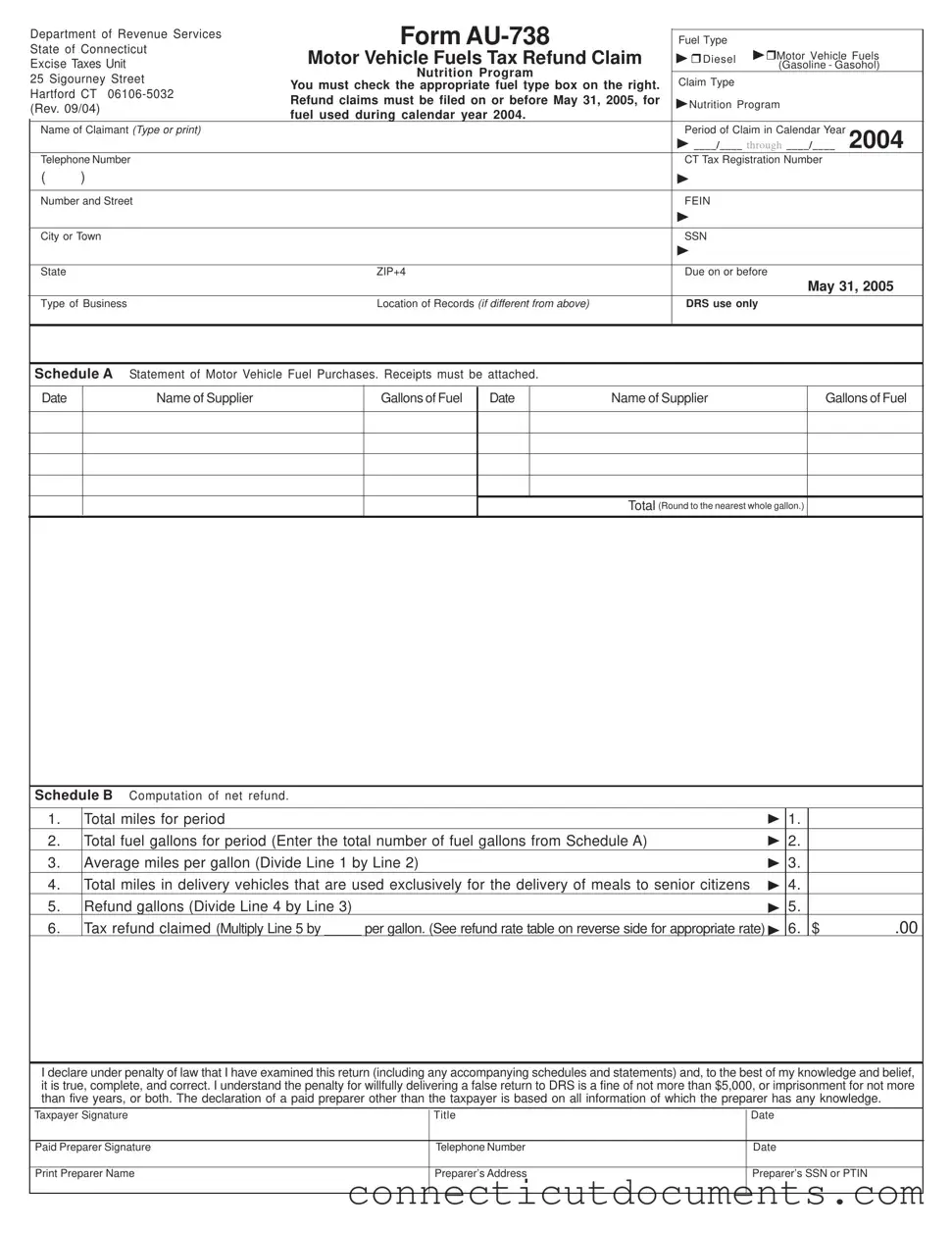

The Connecticut AU-738 form serves as a crucial document for individuals and businesses seeking a refund on motor vehicle fuels tax, specifically for fuel used in the Nutrition Program during the calendar year 2004. This form is designed for those who have utilized diesel or gasoline, including gasohol, in vehicles dedicated to delivering meals to senior citizens. To successfully file a claim, the claimant must check the appropriate fuel type box and provide specific details, including their Connecticut tax registration number or Social Security number, along with a comprehensive list of fuel purchases. Each claim must be accompanied by receipts, documenting the date of purchase, the seller's information, and the total gallons purchased. The form requires the claimant to compute the net refund based on total miles driven and fuel used, ultimately leading to a calculated tax refund amount. Importantly, claims must be submitted by May 31, 2005, and involve a minimum of 200 gallons of eligible fuel. Adhering to these guidelines ensures that the refund process is efficient and compliant with state regulations.

Documents used along the form

The Connecticut AU-738 form is used to claim a refund for motor vehicle fuels tax for fuel used in specific programs. When filing this form, several other documents may be required to support the claim. Below is a list of commonly used forms and documents that may accompany the AU-738 form.

- Schedule A: Statement of Motor Vehicle Fuel Purchases - This schedule details the purchases of fuel, including the date, supplier, and gallons purchased. Receipts must be attached to substantiate the claims made.

- Schedule B: Computation of Net Refund - This document is used to calculate the total refund amount. It includes sections for total miles driven, total fuel gallons, and the average miles per gallon.

- Fuel Purchase Receipts - These are the original or photocopied invoices from fuel purchases. They must show the date of purchase, seller and purchaser details, number of gallons, price per gallon, and total amount paid.

- Contract with Local Area Agency on Aging - A copy of this contract is necessary to prove eligibility for providing Title III-C meals to senior citizens, which is a requirement for the tax refund.

- Connecticut Tax Registration Number - This number identifies the taxpayer and must be included on the AU-738 form to process the claim correctly.

- California Fotm Reg 262 - This document is essential for the transfer of vehicle or vessel ownership in California. It can be accessed at formcalifornia.com/editable-california-fotm-reg-262-form/ to ensure compliance with state regulations.

- Social Security Number (SSN) or Federal Employer Identification Number (FEIN) - Either of these numbers may be required for identification purposes on the claim form.

- Additional Information Request - If further clarification or assistance is needed, a written request may be necessary to obtain specific guidance from the Department of Revenue Services.

It is essential to ensure all required documents are complete and accurate when submitting the claim. This will help facilitate a smoother processing of the refund request. Keeping copies of all submitted documents for your records is also advisable.

Additional PDF Templates

Ct Premium Pay Program Application - Be aware of the time limit for obtaining GRE score records.

How to Transfer Ownership of a Car to a Family Member in Ct - It also requires the vehicle identification number for accurate tracking.

In New York, creating a General Power of Attorney form is an important step for anyone looking to manage their financial affairs effectively. By appointing an agent through this document, individuals can ensure that their financial matters are handled according to their wishes, even when they are unable to do so themselves. For those interested in form templates and guidance, resources such as nyforms.com can be invaluable in navigating this legal process.

Substitute License Application - Applicants should ensure all sections are filled out completely before submission.

Similar forms

The Connecticut Form AU-738 is similar to the IRS Form 8849, which is used for claiming refunds of certain federal excise taxes. Both forms require detailed documentation of fuel purchases and usage. Claimants must provide receipts and calculate the refund based on the number of gallons used. Timely submission is crucial for both forms, as they have strict deadlines for filing. The penalties for inaccuracies are also significant, highlighting the importance of accuracy in both submissions.

Understanding the Notice to Quit process for Arizona landlords is essential for ensuring compliance with state eviction laws. This form serves as a critical step in the eviction process, informing tenants of their need to vacate the property within a specified timeframe. Landlords must carefully prepare this notice, as it outlines the grounds for eviction and protects their legal rights during proceedings.

Another comparable document is the California BOE-401-A, which serves as a claim for refund of sales and use tax. Like the AU-738, it requires the claimant to provide proof of purchase and a detailed account of the tax paid. Both forms necessitate that the claimant maintains records for a specified period to support their claims. The California form also emphasizes the need for accurate calculations and timely filing to avoid penalties.

The New York State Form FT-500 is another document that shares similarities with the AU-738. This form is used to claim refunds of fuel taxes paid on gasoline and diesel. Both forms require a breakdown of fuel purchases and the total amount of tax paid. Claimants must attach supporting documentation, such as invoices, to substantiate their claims. The deadlines for filing and the necessity for accurate reporting are critical components of both forms.

Form 2290 from the IRS is also relevant, as it pertains to heavy highway vehicle use tax. While it focuses on different tax types, it similarly requires detailed records of vehicle usage and timely submission. Both forms emphasize the importance of accuracy in reporting to avoid significant penalties. Additionally, both forms require a declaration under penalty of perjury, reinforcing the seriousness of the claims made.

The Texas Form 01-114 is another document that resembles the AU-738. This form is used to claim refunds for state motor fuel taxes. Similar to the AU-738, it requires claimants to provide a comprehensive account of fuel purchases and the total gallons used. Both forms mandate the inclusion of supporting documentation and have specific deadlines for submission, stressing the importance of compliance.

The Florida Form DR-26S is akin to the AU-738 in that it is used for claiming refunds on fuel taxes. Both documents require detailed information about fuel purchases and usage. Claimants must maintain records for a set period and provide proof of tax paid. The deadlines for filing and the necessity for accurate calculations are common elements that underscore the urgency of submitting these forms correctly.

The Pennsylvania Form REV-183 is similar as it pertains to the refund of fuel taxes. Both forms require claimants to provide a detailed account of fuel usage and attach relevant receipts. The importance of timely filing and accurate reporting is a shared characteristic. Both documents also require a declaration of truthfulness, highlighting the serious nature of the claims being made.

The Illinois Form CRT-61 is another relevant document, used for claiming refunds on certain fuel taxes. Like the AU-738, it requires detailed information about fuel purchases and usage. Claimants must attach supporting documentation and adhere to strict filing deadlines. The penalties for inaccuracies are significant, emphasizing the need for careful completion of both forms.

The Massachusetts Form ST-2 is comparable as it allows for refunds of sales tax paid on fuel purchases. Both forms require detailed records and supporting documentation to substantiate the claims. Timeliness in filing and accuracy in reporting are critical aspects shared by both documents. The penalties for false claims are also a common concern, reinforcing the importance of diligence in preparation.

Lastly, the Michigan Form 5080 is similar to the AU-738 in that it addresses fuel tax refunds. This form requires comprehensive details about fuel usage and the taxes paid. Both forms emphasize the need for supporting documentation and have strict deadlines for submission. The importance of accuracy and the potential penalties for errors are consistent themes in both documents.

Important Questions on This Form

What is the purpose of the Connecticut AU-738 form?

The Connecticut AU-738 form is used to claim a refund for motor vehicle fuel taxes. Specifically, it is for fuel used during the calendar year 2004, primarily for the delivery of meals to senior citizens under the Nutrition Program. Eligible claimants can receive refunds for diesel and gasoline fuel taxes paid.

Who is eligible to file the AU-738 form?

Eligibility to file the AU-738 form requires that the claimant must have used at least 200 gallons of fuel eligible for a tax refund during the calendar year 2004. Additionally, the claimant must be involved in delivering meals to senior citizens and must provide proof of eligibility, such as a contract with a local area agency on aging.

What are the filing deadlines for the AU-738 form?

The completed AU-738 form must be filed with the Department of Revenue Services (DRS) on or before May 31, 2005. Claims submitted after this date will not be processed, so it is crucial to adhere to this deadline.

What documentation is required to accompany the AU-738 form?

To support the claim, you must attach copies of all numbered slips or invoices for fuel purchases. Each document should include the date of purchase, the name and address of both the seller and purchaser, the number of gallons purchased, the price per gallon, and the total amount paid. If a discount was applied, proof of the discounted amount must also be provided.

How is the refund amount calculated on the AU-738 form?

The refund amount is calculated by first determining the total miles driven and the total gallons of fuel used during the claim period. You then calculate the average miles per gallon. After that, you identify the total miles driven in vehicles exclusively used for delivering meals to seniors. This figure is divided by the average miles per gallon to find the refund gallons. Finally, you multiply the refund gallons by the applicable tax refund rate to determine the total refund amount.

What should I do if I need assistance with the AU-738 form?

If you require additional information or assistance, you can contact the Excise Taxes Unit at the Department of Revenue Services. Their phone number is 860-541-3224, and they are available Monday through Friday from 8:00 a.m. to 5:00 p.m. You can also visit their website to download forms and find more information.

What happens if I do not retain records for my refund claim?

It is essential to retain records that substantiate your refund claim for at least three years after filing. Failure to maintain these records may result in difficulties verifying your claim or could lead to penalties if your claim is audited by the DRS.

Misconceptions

Misconceptions about the Connecticut AU 738 form can lead to confusion and mistakes in filing for a fuel tax refund. Here are four common misconceptions:

- Misconception 1: The form can be submitted at any time.

- Misconception 2: Only large businesses can claim a refund.

- Misconception 3: A single form suffices for multiple fuel types.

- Misconception 4: Receipt copies are optional.

Many believe that there is flexibility in the submission deadline. However, the form must be filed on or before May 31, 2005, for fuel used during the calendar year 2004. Missing this deadline means forfeiting the opportunity for a refund.

Some individuals think that only businesses with significant fuel purchases are eligible. In reality, any claimant who used at least 200 gallons of eligible fuel during the specified period can file for a refund, regardless of the size of their operation.

It is a common belief that one form can cover different fuel types. This is incorrect. A separate Form AU-738 must be filed for each motor vehicle fuel type to ensure accurate processing of the claims.

Some claimants think that attaching receipts is not necessary. However, the form requires that receipts be attached for all fuel purchases listed. This documentation is crucial for substantiating the refund claim and must be provided to avoid delays or denials.

Dos and Don'ts

When filling out the Connecticut AU-738 form, it’s important to ensure accuracy and completeness. Here’s a helpful list of dos and don’ts to guide you through the process:

- Do check the appropriate fuel type box on the front of the form.

- Do file your claim by the deadline of May 31, 2005, for fuel used in 2004.

- Do attach all required receipts or invoices showing your fuel purchases.

- Do provide a valid Connecticut tax registration number or Social Security Number.

- Don't forget to round off your total refund claim to the nearest whole dollar.

- Don't submit the form without ensuring all sections are filled out completely.

By following these guidelines, you can streamline your filing process and avoid potential pitfalls. Remember, attention to detail is key!

Detailed Guide for Writing Connecticut Au 738

Completing the Connecticut AU-738 form requires careful attention to detail. This form is essential for claiming a refund on motor vehicle fuels tax for fuel used during the calendar year 2004. Make sure to gather all necessary information and documentation before starting the process. Below are the steps to fill out the form accurately.

- Obtain the Connecticut AU-738 form from the Department of Revenue Services website or your local office.

- Mark the appropriate fuel type box on the front of the form.

- Enter the name of the claimant by typing or printing clearly in the designated space.

- Fill in the period of claim by indicating the start and end dates in the format ____/____ through ____/____.

- Provide a telephone number where you can be reached.

- Enter your Connecticut Tax Registration Number or Social Security Number in the appropriate section.

- Complete the address section, including number and street, city or town, state, and ZIP+4 code.

- Indicate the type of business and the location of records if it differs from the address provided.

- Proceed to Schedule A and list each fuel purchase. For each entry, include the date, name of the supplier, and gallons of fuel purchased. Attach receipts for all purchases.

- In Schedule B, compute the net refund. Start by entering the total miles driven during the period.

- Enter the total fuel gallons from Schedule A.

- Calculate the average miles per gallon by dividing the total miles (Line 1) by the total fuel gallons (Line 2).

- Document the total miles driven by delivery vehicles used exclusively for delivering meals to senior citizens.

- Calculate refund gallons by dividing the total miles for delivery vehicles (Line 4) by the average miles per gallon (Line 3).

- Determine the tax refund claimed by multiplying the refund gallons (Line 5) by the appropriate rate per gallon. Refer to the refund rate table for the correct amount.

- Sign and date the form, ensuring that all information is accurate and complete. If a paid preparer assisted you, they should also sign and provide their details.

- Mail the completed form, along with all attachments, to the Department of Revenue Services at the address provided on the form.