Fill a Valid Connecticut Au 463 Template

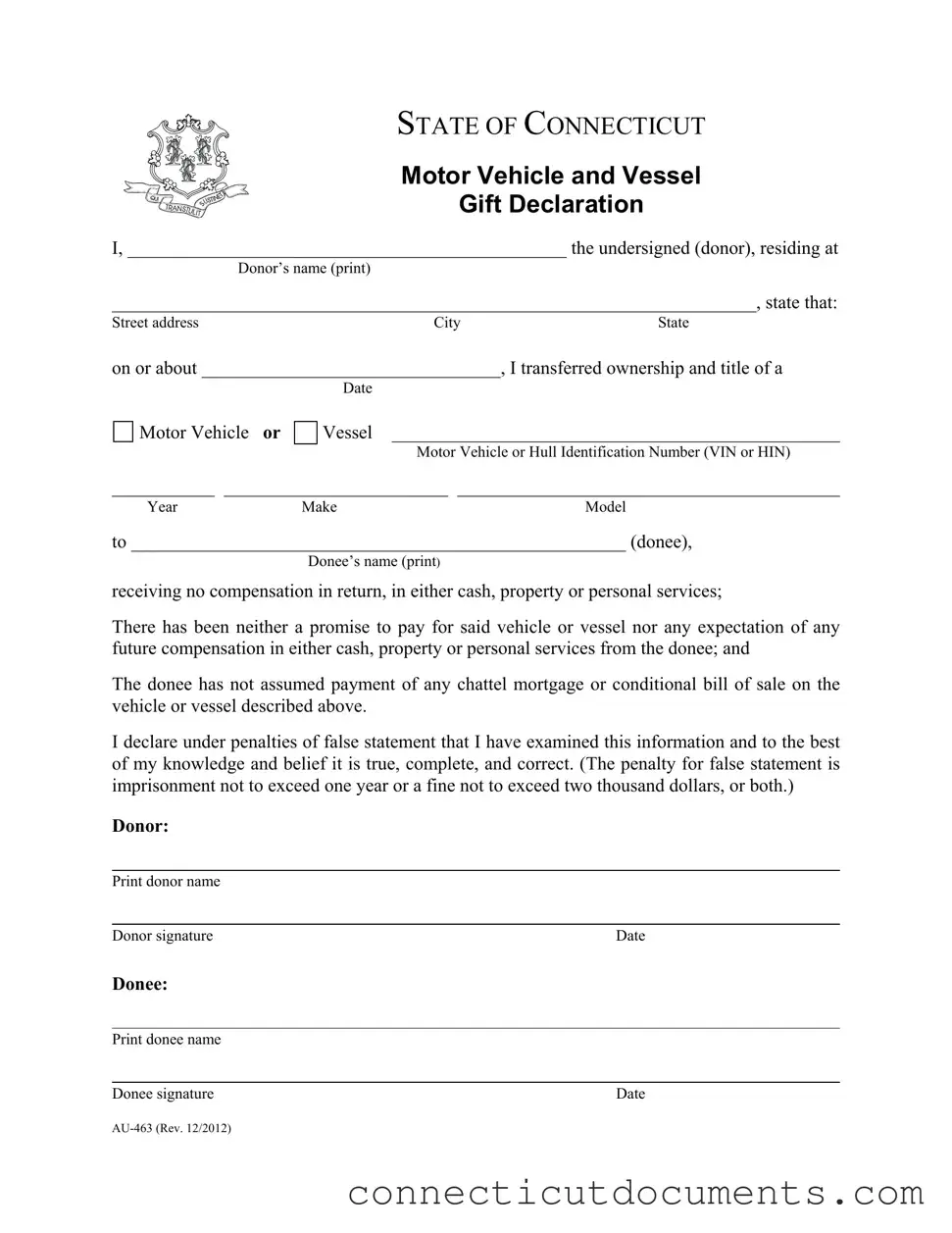

The Connecticut Au 463 form is a crucial document for anyone involved in the transfer of ownership of a motor vehicle or vessel without any exchange of payment. This declaration serves to formally acknowledge that a donor has willingly transferred their property to a donee, ensuring that no financial compensation or services were involved in the transaction. The form requires the donor to provide their name, address, and details about the vehicle or vessel, including its identification number, make, model, and year. It also necessitates the donee's information, confirming their acceptance of the gift. The donor must affirm that there is no expectation of future compensation and that the donee has not taken over any existing financial obligations related to the vehicle or vessel. Importantly, the donor is reminded of the legal consequences of providing false information, emphasizing the importance of accuracy and honesty in this declaration. Completing this form correctly is essential to avoid potential legal issues down the line, making it a key step in the gifting process.

Documents used along the form

The Connecticut Au 463 form is used to declare the gift of a motor vehicle or vessel. When completing this process, several other forms and documents may be necessary to ensure compliance with state regulations and to facilitate the transfer of ownership. Below is a list of documents commonly used alongside the Connecticut Au 463 form.

- Connecticut Vehicle Registration Application (Form H-13B): This form is used to apply for the registration of a vehicle in Connecticut. It includes information about the vehicle and the owner, and it must be submitted to the Department of Motor Vehicles (DMV) when registering a gifted vehicle.

- Connecticut Bill of Sale: A bill of sale provides proof of the transaction between the donor and the donee. Although no compensation is involved in a gift, this document can serve as a record of the transfer for both parties.

- Connecticut Title Application (Form H-6): This application is used to obtain a new title for a vehicle. It is necessary when the ownership of a vehicle changes, even if the vehicle is a gift.

- Connecticut Odometer Disclosure Statement: This form is required to disclose the vehicle's odometer reading at the time of transfer. It helps prevent fraud and ensures accurate mileage records.

- Connecticut DMV Gift Affidavit: This affidavit may be required by the DMV to confirm that the vehicle is indeed a gift. It serves to clarify the nature of the transfer and may include additional details about the transaction.

- Proof of Insurance: Before registering a vehicle, the donee must provide proof of insurance coverage. This document verifies that the vehicle will be insured after the transfer.

- Identification Documents: Both the donor and donee should provide valid identification, such as a driver's license or state ID. This helps verify the identities of both parties involved in the transfer.

- District of Columbia Transfer-on-Death Deed form: This form allows property owners to designate beneficiaries for their real estate, streamlining the transfer process without probate. For more information, visit the Transfer-on-Death Deed form.

- Connecticut DMV Transfer of Ownership Form: This form is used to officially record the transfer of ownership from the donor to the donee. It may be necessary to complete this form as part of the registration process.

- Connecticut Tax Exemption Form: If applicable, this form may be used to claim any tax exemptions related to the gift of the vehicle or vessel. It helps ensure that the donee is not taxed on the value of the gift.

Gathering these documents can help streamline the process of transferring ownership of a vehicle or vessel in Connecticut. Ensuring that all necessary forms are completed accurately can prevent delays and potential legal issues down the line.

Additional PDF Templates

Ct Coaching Certificate - Those with valid educator certificates can skip certain parts of the application.

For those looking to formalize the renting process, a Lease Agreement form is essential; it not only delineates the responsibilities of both the landlord and tenant but also sets clear expectations. To facilitate this process, you can find an editable document download that helps streamline the creation of your agreement, ensuring that all necessary terms are included and understood.

Connecticut Withholding Employer Login - It is a necessary tool for evaluating treatment success rates.

Similar forms

The Connecticut Au 463 form, which is used to declare the gift of a motor vehicle or vessel, shares similarities with the IRS Form 709, the United States Gift (and Generation-Skipping Transfer) Tax Return. Both documents serve the purpose of reporting the transfer of ownership without compensation. While the Au 463 focuses on the specifics of the vehicle or vessel being gifted, Form 709 requires a broader disclosure of gifts made throughout the tax year. Each form emphasizes the donor's intent not to receive any compensation, ensuring clarity in the transfer process and compliance with tax regulations.

In the realm of legal documents, understanding the purpose and requirements of various forms is crucial. For instance, the Limited Liability Company Agreement outlines essential governance and operational structures that are pertinent for maintaining transparency and compliance within an LLC. Just as the Connecticut Au 463 form serves to formalize the transfer of vehicles or vessels as gifts, the LLC Agreement plays a similarly pivotal role in promoting clear expectations among business members and ensuring that all operational duties are well defined.

Another document that resembles the Connecticut Au 463 form is the DMV Form REG 256, which is used in California for vehicle transfer as a gift. Similar to the Au 463, REG 256 is designed to document the transfer of vehicle ownership without any payment involved. Both forms require the identification of the donor and donee, as well as details about the vehicle. They serve as official records that help to prevent misunderstandings regarding the nature of the transfer and ensure that the transaction is legally recognized.

The Bill of Sale, often used in vehicle transactions, also shares characteristics with the Connecticut Au 463 form. While a Bill of Sale typically indicates a sale and includes compensation, it can be adapted to reflect a gift. Both documents require essential information about the vehicle, including its identification number, make, and model. They both serve to formalize the transfer of ownership, providing a written record that can be referred to in the future, should any questions arise regarding the ownership of the vehicle.

Similarly, the Connecticut Gift Tax Return can be compared to the Au 463 form. While the Au 463 is specific to vehicle or vessel gifts, the Gift Tax Return covers a broader range of gifts. Both documents require the donor to affirm that no compensation was received, ensuring transparency in the gifting process. The Gift Tax Return, however, may involve additional financial disclosures, reflecting the overall value of gifts made within a specific period, thus serving a different purpose in tax compliance.

Lastly, the Affidavit of Gift is another document that parallels the Connecticut Au 463 form. This affidavit serves as a sworn statement confirming that a gift has been made, typically used for various types of property, including vehicles. Like the Au 463, the Affidavit of Gift includes information about the donor and donee, as well as a description of the gifted item. Both documents aim to protect the interests of both parties and provide a legal basis for the transfer, ensuring that it is recognized by relevant authorities.

Important Questions on This Form

What is the purpose of the Connecticut Au 463 form?

The Connecticut Au 463 form is used to declare the gift of a motor vehicle or vessel. When someone transfers ownership of a vehicle or vessel without receiving any compensation, this form serves as an official record of that transaction. It ensures that both the donor and the recipient (donee) have a clear understanding of the nature of the transfer, confirming that it is a gift and not a sale.

Who needs to fill out the Connecticut Au 463 form?

The form must be completed by the donor, who is the person giving the gift. The donor needs to provide their name, address, and details about the vehicle or vessel being gifted. Additionally, the donee, or the person receiving the gift, must also sign the form. Both parties should ensure that the information is accurate to avoid any future complications.

What information is required on the Connecticut Au 463 form?

The form requires several key pieces of information. The donor must provide their name and address, along with the date of the transfer. Details about the vehicle or vessel, including the year, make, model, and identification number (VIN or HIN), must also be included. Both the donor and donee need to sign and date the form to validate the gift transaction.

What are the consequences of providing false information on the form?

Providing false information on the Connecticut Au 463 form can lead to serious legal consequences. The donor must declare that the information is true, complete, and correct. If found guilty of making a false statement, the donor could face imprisonment for up to one year, a fine of up to two thousand dollars, or both. It is crucial to ensure all details are accurate to avoid these penalties.

Misconceptions

When it comes to the Connecticut Au 463 form, there are several misconceptions that can lead to confusion. Understanding the truth behind these myths can help ensure a smooth transfer of ownership for vehicles and vessels. Here are ten common misconceptions:

- It's only for vehicles. Many believe the Au 463 form is exclusively for cars. In reality, it applies to both motor vehicles and vessels.

- Compensation is allowed. Some think they can receive compensation while using this form. However, the form explicitly states that no compensation can be exchanged.

- Only the donor needs to sign. A common misunderstanding is that only the donor's signature is required. The donee must also sign the form to validate the transfer.

- It's not legally binding. Some assume the form is just a formality. In truth, it holds legal weight and false statements can lead to serious penalties.

- It can be filled out after the transfer. Many people think they can complete the form after transferring ownership. The form should be completed at the time of the transfer.

- All vehicles and vessels qualify. Some believe any vehicle or vessel can be declared. However, the form is specifically for those being given as gifts, not sold or traded.

- There’s no need for additional documentation. Some think the Au 463 form is sufficient on its own. In many cases, additional documentation may be required for a complete transfer.

- It's only necessary for new owners. People often think only the donee needs this form. The donor must also provide accurate information and sign the declaration.

- It's a quick process. Many expect the form to be a quick task. However, ensuring all details are accurate can take time and attention.

- It’s the same as a bill of sale. Some confuse the Au 463 with a bill of sale. While both relate to ownership transfer, the Au 463 is specifically for gift declarations.

By clearing up these misconceptions, individuals can navigate the process of transferring ownership with greater confidence and clarity. Always remember that understanding the requirements is key to a successful transaction.

Dos and Don'ts

When filling out the Connecticut Au 463 form, it's important to get it right. Here are ten things to keep in mind:

- Do print clearly and legibly to ensure all information is easily readable.

- Don't leave any required fields blank; incomplete forms can lead to delays.

- Do double-check the donor's and donee's names for spelling errors.

- Don't forget to include the correct date of the transfer; it’s crucial for record-keeping.

- Do ensure the vehicle or vessel identification number (VIN or HIN) is accurate.

- Don't assume that verbal agreements are sufficient; everything must be documented.

- Do sign and date the form where indicated to validate the transfer.

- Don't use correction fluid or tape; it can make the form look unprofessional.

- Do keep a copy of the completed form for your records.

- Don't ignore the penalties for false statements; honesty is essential.

Following these guidelines will help ensure a smooth process when declaring a motor vehicle or vessel gift in Connecticut.

Detailed Guide for Writing Connecticut Au 463

Completing the Connecticut Au 463 form is an important step in officially declaring the transfer of ownership for a motor vehicle or vessel. This form must be filled out accurately to ensure that both the donor and donee are protected under the law. Follow these steps carefully to complete the form correctly.

- Print Your Name: In the first blank, write your full name as the donor.

- Provide Your Address: Fill in your street address, city, and state in the designated areas.

- Enter the Date of Transfer: Write the date when you transferred ownership of the vehicle or vessel.

- Describe the Vehicle or Vessel: Fill in the type of vehicle or vessel you are transferring, along with its Motor Vehicle or Hull Identification Number (VIN or HIN), year, make, and model.

- Print the Donee's Name: Write the full name of the person receiving the vehicle or vessel.

- Donor's Signature: Sign the form to confirm that the information provided is accurate and truthful.

- Date Your Signature: Write the date on which you are signing the form.

- Donee's Name and Signature: The donee must print their name and sign the form, along with the date of their signature.

Once you have completed the form, ensure that both parties have a copy for their records. This will help in maintaining clear documentation of the transfer and protect both the donor and donee in any future matters related to the vehicle or vessel.