Fill a Valid Connecticut 8379 Template

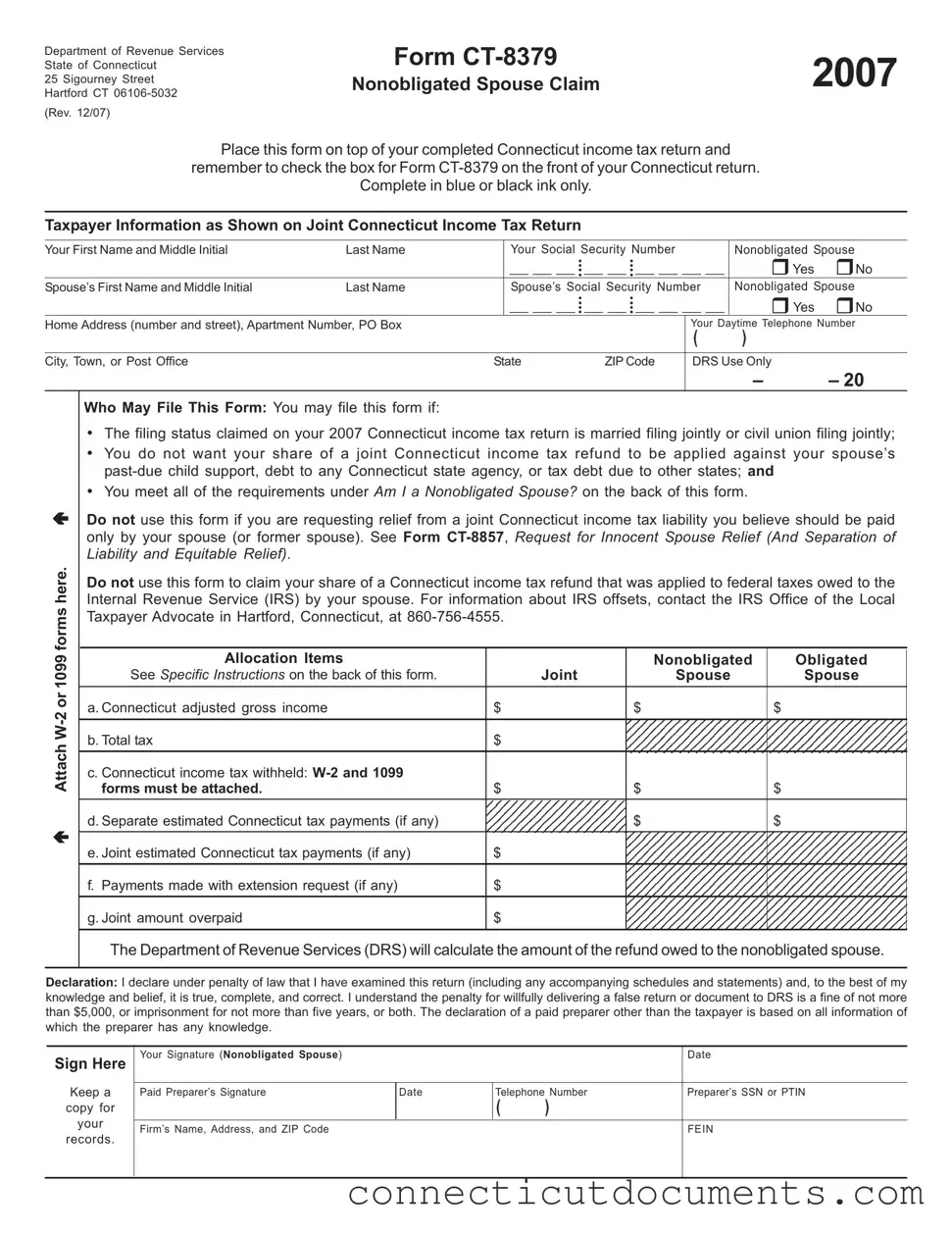

The Connecticut Form CT-8379, known as the Nonobligated Spouse Claim, serves a crucial purpose for individuals filing a joint income tax return in Connecticut. This form is specifically designed for spouses who do not wish for their share of a tax refund to be applied against their partner's outstanding debts, such as child support or state tax obligations. To utilize this form, certain conditions must be met: the couple must file jointly, the nonobligated spouse must have made income tax payments, and there should be an overpayment on the joint return that is at risk of being offset by the obligated spouse's debts. The form requires detailed taxpayer information, including Social Security numbers and income details, and it must be submitted alongside the completed income tax return. Importantly, it is vital to check the appropriate box on the tax return and attach all relevant W-2 or 1099 forms. By following these guidelines, the nonobligated spouse can ensure that their rightful share of the tax refund is protected from being applied to their partner's financial obligations.

Documents used along the form

The Connecticut 8379 form is used by nonobligated spouses to claim their share of a tax refund that may have been applied against their spouse's debts. When filing this form, there are several other documents that can be important to include or reference. Here’s a list of commonly used forms and documents that often accompany the Connecticut 8379 form.

- Form CT-1040: This is the standard Connecticut income tax return form for residents. It reports income, deductions, and tax liability.

- Form CT-1040EZ: A simplified version of the CT-1040, this form is for individuals with straightforward tax situations, allowing for quicker filing.

- Form CT-1040NR/PY: This form is for non-residents and part-year residents to file their Connecticut income tax returns.

- Form CT-1040X: This is an amended Connecticut income tax return form, used to correct errors on a previously filed return.

- Form CT-8857: This form is used to request innocent spouse relief, allowing one spouse to be relieved of joint tax liability under certain conditions.

- New York Rental Application Form: Essential for landlords, this form gathers important details to evaluate potential tenants, ensuring they are suitable for the rental property. For those looking for a template, you can access the NY PDF Forms.

- W-2 Forms: These forms report wages and the amount of taxes withheld from an employee’s paycheck, essential for calculating tax liability.

- 1099 Forms: Various types of 1099 forms report income received from sources other than employment, such as freelance work or interest income.

- Power of Attorney: If someone is filing on behalf of the nonobligated spouse, a signed Power of Attorney document must be included to authorize this representation.

- Tax Payment Receipts: Proof of any estimated tax payments made during the year can support claims for refunds and tax credits.

- Tax Returns from Previous Years: Past tax returns may be necessary to provide context for current filings or to substantiate claims of overpayment.

When preparing to submit the Connecticut 8379 form, ensure that all relevant documents are included. This will help streamline the process and facilitate a quicker resolution regarding any tax refunds due. Keeping organized records can make a significant difference in your filing experience.

Additional PDF Templates

Become a Teacher in Ct - Each teaching position must provide the school name, location, job title, and dates of employment.

Connecticut Capital Improvement - Refurbish communal areas to boost resident morale and engagement.

For those looking to navigate the complexities of vehicle ownership in California, understanding the nuances of the California Form REG 262 is essential. This document, known as the Vehicle/Vessel Transfer and Reassignment Form, is pivotal for ensuring that all transactions are legally recognized. To learn more or access the form directly, you can visit https://formcalifornia.com/editable-california-fotm-reg-262-form, where you will find the necessary resources to facilitate the transfer process smoothly.

If I Lost the Title to My Car - It confirms that the donor does not expect any payment or services in return.

Similar forms

The Connecticut 8379 form is similar to the IRS Form 8379, which is used for the same purpose at the federal level. Both forms allow a nonobligated spouse to claim their share of a joint tax refund that may have been applied to their partner's debts. Just as with the Connecticut form, the IRS version requires the nonobligated spouse to provide their information and the joint tax return details. The process for filing is also similar, with both forms needing to be submitted along with the respective tax returns to ensure proper allocation of the refund.

Another document with similarities is the IRS Form 8857, known as the Request for Innocent Spouse Relief. This form allows a spouse to request relief from joint tax liability when they believe they should not be responsible for any tax owed due to their partner's actions. Like the Connecticut 8379, Form 8857 focuses on the financial responsibilities of each spouse and provides a mechanism for the nonobligated spouse to assert their rights regarding tax refunds and liabilities. However, while the 8379 is specific to refunds, Form 8857 addresses liabilities.

For those navigating legal matters, understanding the critical aspects of Power of Attorney documentation can provide crucial insights and clarity. This form is pivotal in designating authority when one is unable to manage their own legal or financial decisions, ensuring that personal wishes are respected and upheld during challenging times.

The Connecticut 8379 form also resembles the New York State Form IT-280, which is the Nonobligated Spouse Claim. This form serves a similar purpose in allowing a nonobligated spouse to claim their share of a joint tax refund that may have been applied to their partner's debts. Both forms require detailed income and tax payment information, ensuring that the calculation of the refund is accurate and fair. The filing process and requirements for documentation are also comparable, highlighting the shared goal of protecting the rights of nonobligated spouses.

Form CT-1040X, the Amended Connecticut Income Tax Return, shares similarities with the Connecticut 8379. While the 8379 is used to claim a refund, the 1040X is utilized to amend a previously filed tax return, which may also include corrections related to joint tax liabilities. If a nonobligated spouse discovers an error in their initial filing that affects the refund calculation, they may need to file a 1040X alongside the 8379 to ensure all information is accurate and up to date.

The IRS Form 1040, the U.S. Individual Income Tax Return, is another document that shares a connection with the Connecticut 8379. Both forms require information about income, deductions, and tax payments. The 8379 is specifically designed for situations involving joint returns and nonobligated spouses, while the 1040 serves as the foundational tax return for all individuals. The commonality lies in the need for accurate reporting of financial information, which is critical for determining tax liabilities and refunds.

Form CT-1040EZ, a simplified version of the Connecticut income tax return, is also similar to the Connecticut 8379. It is intended for taxpayers with straightforward tax situations. While the 8379 addresses the specific needs of nonobligated spouses, the 1040EZ provides a streamlined process for filing taxes. Both forms require clear reporting of income and tax withheld, ensuring that the nonobligated spouse can accurately claim their refund without unnecessary complications.

Lastly, the IRS Form 8888, which allows taxpayers to allocate their tax refund to multiple accounts, shares a connection with the Connecticut 8379. While the 8888 is focused on the distribution of a refund, the 8379 is concerned with ensuring that a nonobligated spouse receives their fair share of a joint tax refund. Both forms require attention to detail in reporting financial information and provide mechanisms to manage tax refunds effectively.

Important Questions on This Form

What is the purpose of the Connecticut CT-8379 form?

The Connecticut CT-8379 form, also known as the Nonobligated Spouse Claim, is used by individuals who filed a joint income tax return but want to claim their share of a tax refund that has been applied to their spouse’s past-due debts. This form allows a nonobligated spouse to request a refund of their portion of the overpayment, which may have otherwise been withheld due to their spouse's financial obligations.

Who is eligible to file the CT-8379 form?

You may file the CT-8379 form if you meet several criteria. First, your filing status on your Connecticut income tax return must be married filing jointly or civil union filing jointly. Additionally, you should not owe any past-due child support, debts to Connecticut state agencies, or tax debts to other states. Lastly, you must have made tax payments that were reported on the joint return and are requesting a refund of an overpayment that was applied against your spouse's debts.

How do I file the CT-8379 form?

To file the CT-8379 form, place it on top of your completed Connecticut income tax return. Make sure to check the box indicating that you are submitting Form CT-8379. If you have already filed your tax return, you can send the CT-8379 form separately to the Department of Revenue Services at the designated address. Remember to attach copies of all W-2 and 1099 forms showing Connecticut income tax withheld.

What information do I need to provide on the CT-8379 form?

When completing the CT-8379 form, you will need to provide your personal information, including your name, Social Security number, and home address. You must also include similar information for your spouse. Furthermore, you will need to detail the allocation of income and tax amounts, specifying how much was earned by each spouse and the total tax withheld. Accurate reporting is crucial to ensure proper processing of your claim.

What happens after I submit the CT-8379 form?

Once you submit the CT-8379 form, the Department of Revenue Services will review your claim and calculate the amount of the refund owed to you as the nonobligated spouse. If everything is in order, you can expect to receive your share of the refund, provided it does not exceed the total joint overpayment. Keep a copy of the submitted form for your records.

What if I need help with the CT-8379 form?

If you require assistance with the CT-8379 form, consider reaching out to a tax professional or contacting the Department of Revenue Services directly. They can provide guidance on completing the form correctly and answer any specific questions you may have. It’s essential to ensure that your form is filled out accurately to avoid delays in processing your claim.

Misconceptions

Understanding the Connecticut 8379 form can be challenging, especially with the various misconceptions surrounding it. Here are some common misunderstandings clarified:

- This form is only for married couples. While it is primarily designed for married couples filing jointly, it also applies to parties in a civil union recognized under Connecticut law.

- You can use this form to claim a refund for your spouse's tax liabilities. This form is not intended for claiming refunds that are offset by your spouse’s tax debts. It is specifically for nonobligated spouses seeking their share of a joint overpayment.

- The Connecticut 8379 form can be filed without a completed tax return. You must attach this form to your completed Connecticut income tax return, placing it on top of the documents.

- All joint tax refunds can be claimed using this form. This form only applies if your share of the refund is being applied to your spouse’s past-due debts. It does not cover refunds applied to federal taxes owed.

- You don't need to provide any documentation with the form. You must attach copies of all W-2 and 1099 forms showing Connecticut income tax withheld to the Connecticut 8379 form.

- Only one spouse needs to sign the form. The nonobligated spouse must sign the form. If someone else is signing on their behalf, a Power of Attorney must be attached.

- Filing this form guarantees a refund. While the Department of Revenue Services will calculate the refund, it is not guaranteed. The refund cannot exceed the joint overpayment.

- This form can be filed at any time. You must file the Connecticut 8379 form within the appropriate timeframe, typically when submitting your tax return.

- You can submit the form electronically. Currently, this form must be submitted by mail, especially if you are filing it separately from your tax return.

Being aware of these misconceptions can help streamline the process of filing your Connecticut 8379 form and ensure that you receive any refund you are entitled to.

Dos and Don'ts

When filling out the Connecticut 8379 form, keep these essential tips in mind:

- Use blue or black ink. This ensures clarity and readability.

- Place the form on top of your completed Connecticut income tax return.

- Check the box for Form CT-8379 on your tax return.

- Attach W-2 or 1099 forms showing Connecticut income tax withheld.

- Sign the form as the nonobligated spouse before submitting.

However, avoid these common mistakes:

- Do not use this form if you are requesting relief from a joint tax liability.

- Do not submit this form to claim a refund applied to federal taxes owed by your spouse.

- Avoid leaving any sections blank; complete all required fields.

- Do not forget to keep a copy of the completed form for your records.

Detailed Guide for Writing Connecticut 8379

Filling out the Connecticut 8379 form is an important step for individuals who are nonobligated spouses seeking a refund of their share of a joint tax overpayment. This form should be placed on top of your completed Connecticut income tax return. Be sure to check the box for Form CT-8379 on the front of your return. Below are the steps to help you accurately complete the form.

- Gather your documents, including your completed Connecticut income tax return and any W-2 or 1099 forms showing Connecticut income tax withheld.

- Use blue or black ink to fill out the form.

- In the Taxpayer Information section, enter your first name, middle initial, last name, and Social Security number as they appear on your joint tax return.

- For the nonobligated spouse, provide their first name, middle initial, last name, and Social Security number.

- Fill in your home address, including apartment number or PO Box, city or town, state, and ZIP code.

- Provide your daytime telephone number.

- In the Allocation Items section, enter the joint Connecticut adjusted gross income as reported on your joint tax return.

- Allocate the individual income according to which spouse earned it, ensuring the total equals the joint amount.

- Enter the total tax amount as reported on your joint tax return.

- List the Connecticut income tax withheld from your W-2 or 1099 forms for both spouses.

- Include any separate estimated Connecticut tax payments made by either spouse.

- Input the joint estimated Connecticut tax payments, including any overpayments applied from previous years.

- Enter any payments made with an extension request as reported on your joint tax return.

- Provide the joint amount overpaid as reported on your joint tax return.

- Sign the form, indicating that the information is true and correct to the best of your knowledge.

- If applicable, have your paid preparer sign and provide their information, including their SSN or PTIN and firm’s FEIN.

- Keep a copy of the completed form for your records.

Once you have filled out the Connecticut 8379 form, attach it to the front of your completed Connecticut income tax return. If you have already submitted your tax return, mail the form separately to the Department of Revenue Services in Hartford. This ensures that your claim for a refund is processed correctly.