Fill a Valid Connecticut 7B Template

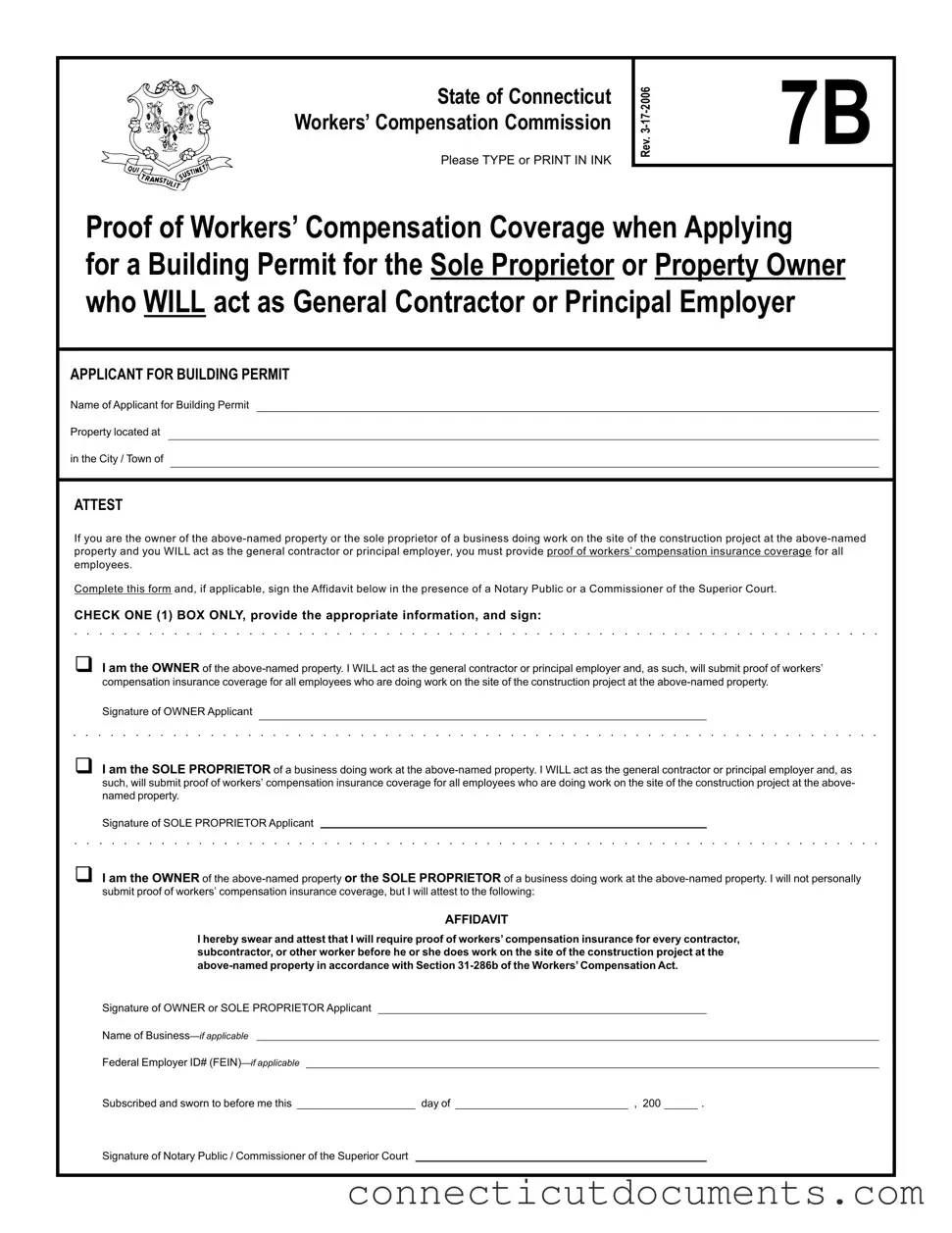

When embarking on a construction project in Connecticut, understanding the requirements for obtaining a building permit is crucial. One essential document in this process is the Connecticut 7B form, which serves as proof of workers' compensation coverage for those acting as general contractors or principal employers. This form is specifically designed for property owners or sole proprietors who will be directly involved in the construction work. It requires applicants to affirm their status as either the owner of the property or the sole proprietor of a business engaged in the project. Additionally, the form mandates that proof of workers' compensation insurance be provided for all employees involved in the construction. By completing this form, applicants not only comply with state regulations but also ensure that they are protected against potential liabilities associated with workplace injuries. The 7B form also includes an affidavit section, allowing applicants to attest that they will require proof of coverage from any contractors or subcontractors before work begins. This commitment to safety and compliance is a vital part of the construction process in Connecticut, reflecting the state's emphasis on protecting workers and property owners alike.

Documents used along the form

The Connecticut 7B form is essential for proving workers' compensation coverage when applying for a building permit. However, several other forms and documents may be required in conjunction with it. Below is a list of these forms, each serving a specific purpose in the application process.

- Workers' Compensation Insurance Certificate: This document serves as proof that the contractor or property owner has valid workers' compensation insurance coverage. It details the coverage limits and effective dates.

- Quitclaim Deed: This form transfers property ownership rights and is often used among family members or to clear up title issues. For more information, refer to the NY PDF Forms.

- Affidavit of Compliance: This affidavit is a sworn statement confirming that all contractors and subcontractors will have workers' compensation insurance before starting work on the project.

- Building Permit Application: This form is the primary application submitted to the local building department to request permission to begin construction or renovation on a property.

- Contractor Registration Form: This form registers the contractor with the state or local authority, ensuring that they meet all licensing and regulatory requirements.

- Site Plan: A detailed drawing that shows the layout of the proposed construction site, including buildings, parking, and landscaping. This helps assess compliance with zoning laws.

- Environmental Impact Assessment: Depending on the project, this document evaluates the potential environmental effects of the construction and outlines measures to mitigate any negative impacts.

- Zoning Permit: This permit confirms that the proposed construction complies with local zoning laws and regulations, ensuring that the project is permissible in the chosen location.

Each of these documents plays a critical role in ensuring compliance with state and local regulations during the building permit application process. Proper preparation and submission of these forms can facilitate a smoother approval process for construction projects in Connecticut.

Additional PDF Templates

Connecticut Ed 177 - Schools can request a reissuance, showing the need for the position remains unfilled.

The Arizona Notice to Quit form is crucial for landlords, enabling them to assert their rights while informing tenants of the need to vacate. For a deeper understanding, you may refer to the essential guide about the Notice to Quit details.

How to Transfer Ownership of a Car to a Family Member in Ct - Section B is used when ownership of the abandoned vehicle is transferred to a junkyard.

Ct Registration Form - Report filing is essential for insurance claims regarding stolen vehicles.

Similar forms

The Connecticut 7B form serves as proof of workers’ compensation coverage and is particularly relevant in the context of building permits. A similar document is the Certificate of Insurance (COI). A COI provides evidence that a business has the required insurance coverage, including workers’ compensation. This document is often requested by clients or project owners to ensure that contractors have adequate insurance before commencing work. Like the 7B form, it protects both the property owner and the contractor by confirming that employees are covered in case of workplace injuries.

Another comparable document is the Employer's Liability Insurance Policy. This policy is often bundled with workers’ compensation insurance and provides additional coverage for employers against lawsuits from employees. Just as the 7B form assures compliance with state laws regarding workers’ compensation, this policy offers peace of mind to employers by covering legal costs that may arise from employee claims.

For those navigating the complexities of child support in Texas, it's important to familiarize yourself with the relevant documentation needed for compliance. The Texas PDF Forms provide comprehensive resources to assist you in completing necessary forms, ensuring that all obligations are met efficiently and accurately.

The Affidavit of Workers’ Compensation Insurance is also similar in purpose to the 7B form. This document is often required by municipalities to confirm that a contractor has secured the necessary workers’ compensation insurance. Like the 7B form, it requires a sworn statement, providing a legal assurance that the contractor will comply with insurance requirements before beginning work.

The Application for a Building Permit itself shares similarities with the 7B form. When applying for a building permit, applicants must often demonstrate compliance with various regulations, including insurance coverage. The building permit application usually requires information about the contractor’s insurance, paralleling the need for proof outlined in the 7B form.

The Workers’ Compensation Policy Declaration Page is another document akin to the 7B form. This page summarizes the coverage provided under a workers’ compensation policy, including limits and exclusions. Like the 7B form, it serves to confirm that a business has the necessary coverage in place, ensuring compliance with state laws.

The General Contractor Agreement can also be compared to the 7B form. This contract often includes clauses requiring the contractor to maintain workers’ compensation insurance. Both documents emphasize the importance of insurance coverage in protecting all parties involved in a construction project.

The Subcontractor Agreement is similar in that it typically requires subcontractors to provide proof of workers’ compensation insurance. This agreement helps ensure that all workers on a project are covered, mirroring the requirements set forth in the 7B form for general contractors and property owners.

The Statement of Compliance with Workers’ Compensation Laws is another document that shares similarities with the 7B form. This statement is often required by government agencies to confirm that a business complies with all relevant workers’ compensation laws. Like the 7B form, it serves as a formal declaration of compliance and provides necessary documentation for projects requiring permits.

Lastly, the Independent Contractor Agreement can be likened to the 7B form. This agreement often stipulates that independent contractors must carry their own workers’ compensation insurance. Both documents aim to clarify responsibilities regarding insurance coverage and ensure that all parties are protected in the event of workplace injuries.

Important Questions on This Form

What is the Connecticut 7B form?

The Connecticut 7B form is a document required by the State of Connecticut Workers’ Compensation Commission. It serves as proof of workers’ compensation insurance coverage when applying for a building permit. This form is specifically for sole proprietors or property owners who will act as general contractors or principal employers on construction projects.

Who needs to fill out the Connecticut 7B form?

If you are the owner of a property or the sole proprietor of a business that will be working on that property, and you plan to act as the general contractor or principal employer, you must complete this form. It ensures that you have the necessary workers’ compensation insurance coverage for all employees involved in the project.

What information is required on the form?

The form requires basic information such as the name of the applicant, the property location, and a declaration of whether you are the owner or sole proprietor. You will also need to provide proof of your workers’ compensation insurance coverage, if applicable. Additionally, an affidavit must be signed, confirming that you will require proof of insurance from all contractors or workers before they begin work on the site.

What is the affidavit section about?

The affidavit section of the form is a declaration where you swear that you will ensure all contractors, subcontractors, or other workers provide proof of workers’ compensation insurance before starting any work on the property. This part is crucial for compliance with the Workers’ Compensation Act in Connecticut.

Do I need a notary to sign the form?

What happens if I do not provide proof of workers’ compensation coverage?

If you do not provide proof of workers’ compensation coverage, your building permit application may be denied. This requirement is in place to protect both the workers and the property owner from potential liabilities related to workplace injuries.

Can I submit the form electronically?

Currently, the Connecticut 7B form must be completed and submitted in hard copy. You should type or print the information clearly in ink to ensure that it is legible. Check with your local building department for any updates regarding electronic submissions.

Is there a fee associated with submitting the Connecticut 7B form?

There is no specific fee for submitting the Connecticut 7B form itself. However, other fees may apply when applying for a building permit. It's best to check with your local building authority for details on any applicable fees.

Where can I obtain the Connecticut 7B form?

The Connecticut 7B form can typically be obtained from the Connecticut Workers’ Compensation Commission’s website or your local building department. Ensure you are using the most recent version of the form to avoid any issues during your application process.

Misconceptions

Understanding the Connecticut 7B form is essential for property owners and sole proprietors engaged in construction projects. However, several misconceptions often arise regarding this important document. Below is a list of common misunderstandings and clarifications.

- Misconception 1: The 7B form is only necessary for large construction projects.

- Misconception 2: Only contractors need to provide proof of workers’ compensation insurance.

- Misconception 3: The form can be submitted after the building permit is issued.

- Misconception 4: There are no penalties for failing to submit the 7B form.

- Misconception 5: The affidavit section is optional.

- Misconception 6: The 7B form is only for residential properties.

- Misconception 7: You can sign the affidavit without a notary.

- Misconception 8: Once the form is submitted, no further action is needed.

This is incorrect. The 7B form is required for any building permit application where the applicant is acting as a general contractor or principal employer, regardless of the project size.

In reality, both property owners and sole proprietors must demonstrate proof of workers’ compensation coverage when they are acting in these roles. This ensures all workers on the site are protected.

This is not true. The 7B form must be completed and submitted as part of the building permit application process. It is crucial to provide this documentation upfront.

Failing to submit the 7B form can lead to delays in obtaining a building permit or even denial of the permit altogether. Compliance is essential to avoid these issues.

The affidavit is a mandatory part of the form if the applicant does not plan to submit proof of workers’ compensation insurance personally. It ensures that all contractors and subcontractors will have coverage.

This is misleading. The 7B form applies to any property where construction work is being done, including commercial properties.

This is incorrect. The affidavit must be signed in the presence of a Notary Public or a Commissioner of the Superior Court to be valid.

While submitting the 7B form is a critical step, ongoing compliance with workers’ compensation insurance requirements is necessary throughout the duration of the construction project.

Dos and Don'ts

When filling out the Connecticut 7B form, it is essential to follow specific guidelines to ensure accuracy and compliance. Here is a list of things you should and shouldn't do:

- Do type or print clearly in ink to ensure legibility.

- Do provide accurate information about the property and the applicant.

- Do check one box only to indicate your status as owner or sole proprietor.

- Do sign the form in the appropriate section before a Notary Public or Commissioner of the Superior Court.

- Do include your Federal Employer ID number if applicable.

- Don't leave any sections blank; all required fields must be filled out.

- Don't forget to provide proof of workers’ compensation insurance coverage for all employees.

- Don't sign the affidavit without understanding your responsibilities regarding workers’ compensation.

- Don't use correction fluid or tape on the form; if you make a mistake, start over.

- Don't submit the form without reviewing it for errors and ensuring all information is accurate.

Detailed Guide for Writing Connecticut 7B

Filling out the Connecticut 7B form is an essential step for property owners or sole proprietors planning to act as general contractors or principal employers. Once the form is completed, it must be submitted to the appropriate authorities along with proof of workers' compensation insurance coverage. Below are the steps to guide you through the process of filling out the form accurately.

- Begin by typing or printing your name in the section labeled "Name of Applicant for Building Permit."

- Next, provide the address of the property where the construction will take place in the "Property located at" section.

- In the "City/Town of" field, specify the city or town where the property is located.

- Check the box that corresponds to your status: either as the owner of the property or as the sole proprietor of a business doing work at the property.

- If you are the owner or sole proprietor, sign your name in the designated signature area.

- If you are not submitting proof of workers' compensation insurance personally, complete the affidavit section by swearing and attesting that you will require proof of workers' compensation insurance from every contractor or worker involved.

- Fill in the "Name of Business" section if applicable, along with your Federal Employer ID Number (FEIN) if you have one.

- Finally, have the affidavit signed by a Notary Public or a Commissioner of the Superior Court, and ensure the date is filled in.