Attorney-Verified Bill of Sale Form for the State of Connecticut

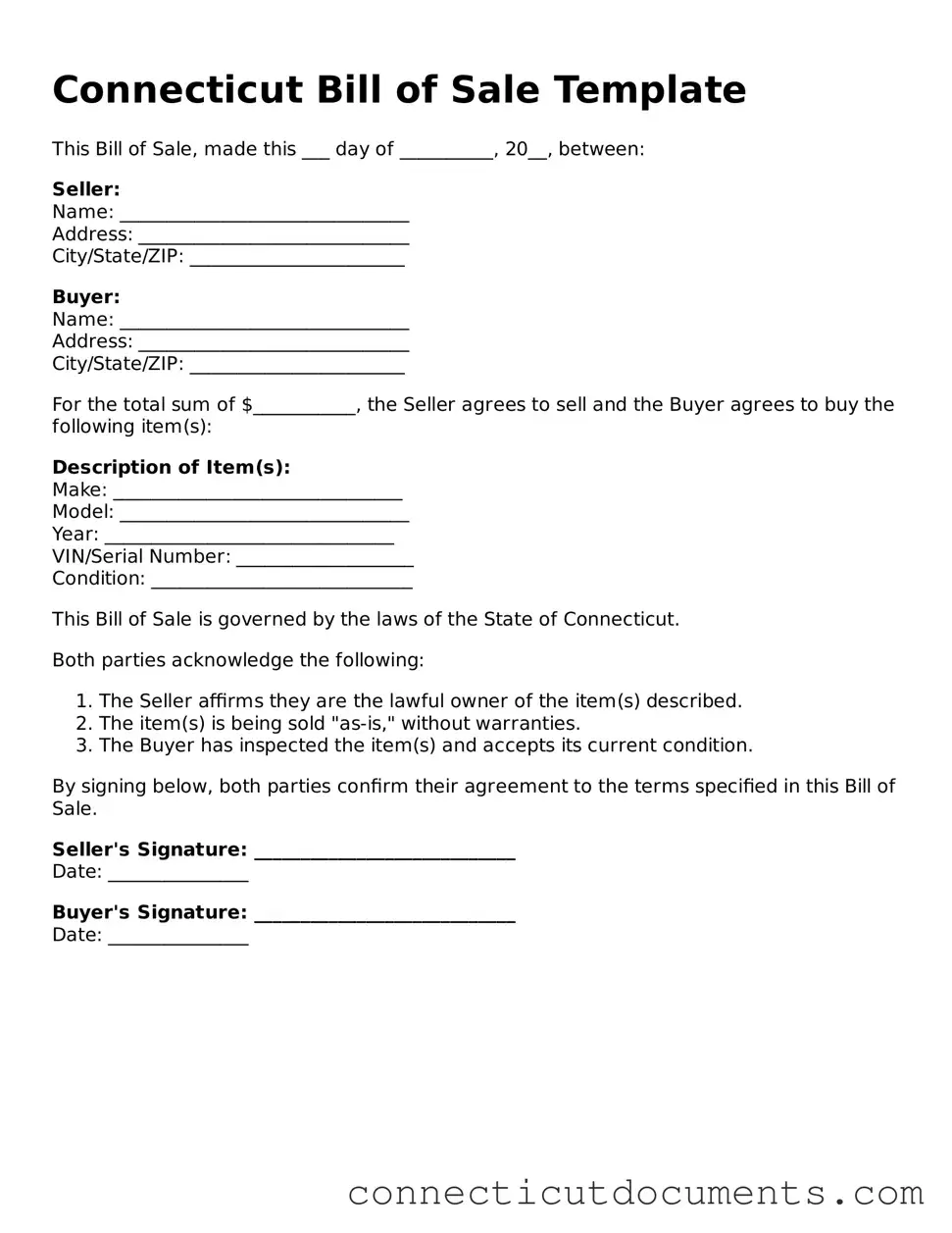

The Connecticut Bill of Sale form serves as a crucial document in the transfer of ownership for various types of personal property, including vehicles, boats, and equipment. This form not only provides a record of the transaction but also protects the rights of both the seller and the buyer. Essential details typically included in the Bill of Sale are the names and addresses of both parties, a description of the item being sold, the sale price, and the date of the transaction. Additionally, the form may include warranty information, indicating whether the item is sold "as-is" or with certain guarantees. Proper completion of the Bill of Sale can help prevent disputes and provide legal proof of ownership, making it an important aspect of personal property transactions in Connecticut. Understanding the components and significance of this form is vital for anyone engaging in the buying or selling of personal property within the state.

Documents used along the form

The Connecticut Bill of Sale form serves as a vital document in the transfer of ownership for various items, particularly vehicles and personal property. However, several other forms and documents are often utilized in conjunction with the Bill of Sale to ensure a smooth transaction. Below is a list of commonly associated documents.

- Title Transfer Form: This document is essential when transferring ownership of a vehicle. It officially records the change of ownership and is typically submitted to the Department of Motor Vehicles (DMV).

- Correction Document: To amend any errors in recorded transactions, it is important to use a reliable form such as the Affidavit of Correction form, ensuring accuracy in the public records.

- Vehicle Registration Application: After acquiring a vehicle, the new owner must register it with the DMV. This application provides necessary details about the vehicle and the new owner.

- Odometer Disclosure Statement: Required for vehicle sales, this statement certifies the mileage on the vehicle at the time of sale. It helps prevent fraud regarding the vehicle’s actual usage.

- Affidavit of Sale: This document serves as a sworn statement confirming the sale of an item. It may be used to clarify details surrounding the transaction and protect both parties.

- Purchase Agreement: This contract outlines the terms and conditions of the sale. It includes details such as the purchase price, item description, and any warranties or conditions agreed upon by both parties.

- Inspection Report: Particularly relevant for vehicles, this report documents the condition of the item at the time of sale. It can be beneficial for both the buyer and seller in addressing any pre-existing issues.

Utilizing these documents alongside the Connecticut Bill of Sale can provide additional clarity and legal protection for both buyers and sellers. Each document plays a crucial role in ensuring that the transaction is properly documented and compliant with state regulations.

More Connecticut Templates

Durable Power of Attorney Ct - Understanding the scope of the power granted is crucial for both the principal and agent.

Having a well-drafted lease agreement is crucial for both landlords and tenants, as it helps prevent disputes and provides clarity on various aspects of the rental agreement. For those seeking a reliable template, you can find one at NY PDF Forms, which can simplify the process of creating a residential lease agreement that complies with New York state laws.

Blank Promissory Note - In short, this note is a vital instrument in establishing loan agreements.

Similar forms

The Connecticut Bill of Sale form is similar to a Vehicle Bill of Sale. Both documents serve as proof of transfer of ownership for a vehicle from one party to another. They typically include details such as the vehicle's make, model, year, and Vehicle Identification Number (VIN). A Vehicle Bill of Sale is often required for registration and title transfer at the Department of Motor Vehicles (DMV). This document provides legal protection for both the buyer and seller by documenting the transaction and confirming that the seller has relinquished ownership.

Another document that resembles the Connecticut Bill of Sale is the Personal Property Bill of Sale. This form is used for the sale of tangible personal property, such as furniture, electronics, or equipment. Like the Connecticut Bill of Sale, it outlines the details of the transaction, including a description of the item, the purchase price, and the names of both the buyer and seller. This document is essential for establishing ownership and can be useful in case of disputes or claims regarding the property.

A third similar document is the General Bill of Sale. This form is broader in scope and can be used for various types of transactions involving personal property. It includes essential information such as the date of the sale, a detailed description of the item, and the agreed-upon price. The General Bill of Sale serves as a receipt and proof of ownership transfer, similar to the Connecticut Bill of Sale. It is beneficial for both parties to have a written record of the sale for their protection.

In addition to these forms, understanding the importance of a proper estate plan is crucial, which often includes a detailed Last Will and Testament. This document not only facilitates the distribution of assets but also ensures your personal wishes are honored after your passing.

Lastly, the Equipment Bill of Sale is comparable to the Connecticut Bill of Sale, specifically for transactions involving business equipment. This document details the equipment being sold, including its condition and any warranties or guarantees provided by the seller. Both documents aim to protect the interests of both the buyer and seller, ensuring that the transaction is clear and legally binding. The Equipment Bill of Sale is particularly important in commercial settings, where significant investments are made in machinery or tools.

Important Questions on This Form

What is a Connecticut Bill of Sale?

A Connecticut Bill of Sale is a legal document that records the transfer of ownership of personal property from one person to another. It serves as proof of the transaction and outlines details like the buyer and seller's information, the item being sold, and the sale price.

Do I need a Bill of Sale for every transaction?

While not every transaction requires a Bill of Sale, it is highly recommended for significant purchases. For items like vehicles, boats, or expensive equipment, having this document can protect both the buyer and seller in case of disputes.

What information should be included in a Bill of Sale?

A proper Bill of Sale should include the names and addresses of both the buyer and seller, a description of the item being sold, the sale price, the date of the transaction, and any warranties or conditions of the sale. This information helps clarify the terms of the sale.

Is a Bill of Sale required for selling a vehicle in Connecticut?

Yes, when selling a vehicle in Connecticut, a Bill of Sale is required. It helps establish proof of ownership transfer. Additionally, the seller must provide the buyer with the vehicle's title, which must be properly signed over.

Can I create my own Bill of Sale?

Yes, you can create your own Bill of Sale. Just make sure it includes all necessary information. Many templates are available online, which can help guide you in creating a document that meets your needs.

Do I need to notarize the Bill of Sale?

Notarization is not required for a Bill of Sale in Connecticut, but it can add an extra layer of security. Having the document notarized can help verify the identities of the parties involved and the authenticity of the signatures.

How long should I keep a Bill of Sale?

It’s a good idea to keep a copy of the Bill of Sale for at least three years after the transaction. This can be useful for tax purposes or in case any disputes arise regarding the sale.

What if there are issues after the sale?

If issues arise after the sale, the Bill of Sale can serve as a crucial piece of evidence. It outlines the terms of the agreement and can help resolve disputes over ownership or condition of the item sold.

Misconceptions

Understanding the Connecticut Bill of Sale form is crucial for anyone involved in buying or selling personal property in the state. However, several misconceptions can lead to confusion. Here’s a list of ten common misunderstandings:

- A Bill of Sale is not legally binding. Many believe that a Bill of Sale is just a formality. In reality, it serves as a legal document that can protect both the buyer and seller in case of disputes.

- Only vehicles require a Bill of Sale. While it's commonly associated with vehicle transactions, a Bill of Sale can be used for any personal property, including furniture, electronics, and more.

- A verbal agreement is sufficient. Some think that a handshake or verbal agreement is enough. A written Bill of Sale provides clear evidence of the transaction and its terms.

- All Bill of Sale forms are the same. People often assume that a Bill of Sale is a one-size-fits-all document. However, different types of transactions may require specific details tailored to the situation.

- Notarization is mandatory. While notarization can add an extra layer of security, it is not always required for a Bill of Sale in Connecticut.

- Buyers and sellers do not need to keep a copy. Some individuals believe that only one party needs a copy. Both parties should retain a copy for their records to avoid future misunderstandings.

- It is only necessary for used items. Many think that new items do not require a Bill of Sale. However, it is still a good practice to document any sale, regardless of the item's condition.

- The form must be filled out in person. Some assume that a Bill of Sale must be completed face-to-face. In fact, it can be completed remotely, as long as both parties agree to the terms.

- A Bill of Sale does not need to include a description of the item. It is a misconception that vague descriptions are acceptable. A detailed description helps clarify what is being sold and prevents disputes.

- Once signed, a Bill of Sale cannot be changed. Many think that the document is set in stone after signing. Amendments can be made if both parties agree, but it’s best to create a new document to avoid confusion.

By clearing up these misconceptions, individuals can navigate the process of buying and selling personal property in Connecticut with greater confidence and understanding.

Dos and Don'ts

When filling out the Connecticut Bill of Sale form, it's important to follow certain guidelines to ensure accuracy and compliance. Here’s a list of things you should and shouldn’t do:

- Do include all relevant details about the item being sold, such as make, model, year, and VIN if applicable.

- Do provide accurate information for both the buyer and seller, including full names and addresses.

- Do sign and date the form in the appropriate sections to validate the transaction.

- Do keep a copy of the completed Bill of Sale for your records.

- Don't leave any required fields blank; incomplete forms can cause issues later.

- Don't use white-out or erase any mistakes; instead, cross out errors neatly and initial them.

- Don't forget to check for any specific requirements or additional documentation needed for your transaction.

- Don't rush through the process; take your time to ensure everything is filled out correctly.

Detailed Guide for Writing Connecticut Bill of Sale

Once you have the Connecticut Bill of Sale form ready, it's time to fill it out accurately. This document is important for transferring ownership of an item, and ensuring all details are correct will help avoid any issues in the future.

- Begin by entering the date of the sale at the top of the form.

- Fill in the name and address of the seller. This identifies who is selling the item.

- Next, provide the name and address of the buyer. This shows who is purchasing the item.

- Describe the item being sold. Include details like make, model, year, and any identification numbers, if applicable.

- Indicate the purchase price of the item. This is the amount the buyer agrees to pay the seller.

- Both the seller and buyer should sign and date the form at the bottom. This confirms that both parties agree to the sale.

After completing the form, make sure both parties keep a copy for their records. This helps in case any questions arise later about the sale.