Attorney-Verified Articles of Incorporation Form for the State of Connecticut

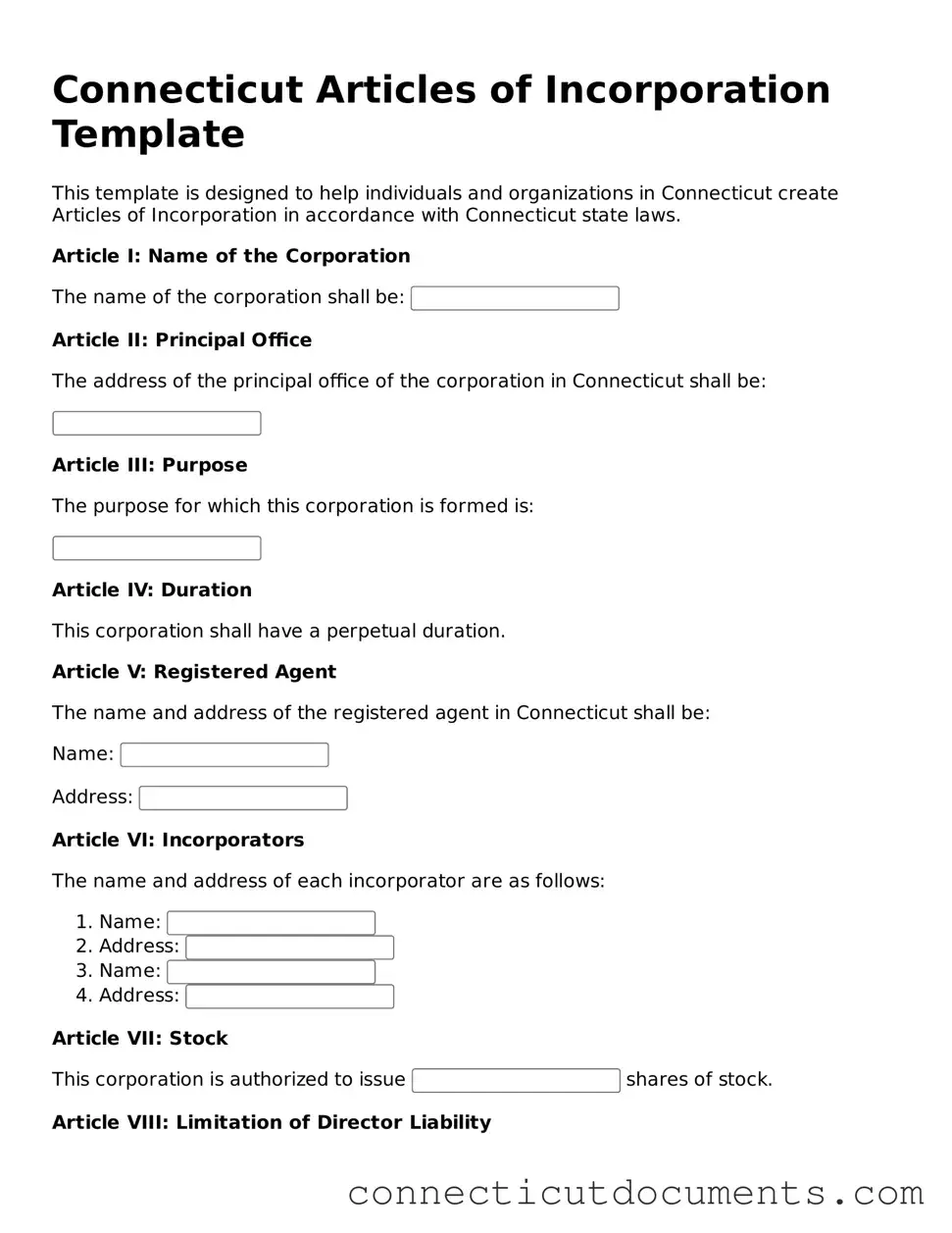

When starting a business in Connecticut, one of the first steps is to file the Articles of Incorporation. This essential document lays the groundwork for your corporation by outlining its basic structure and purpose. The form requires important details, such as the name of the corporation, which must be unique and not already in use by another entity in the state. Additionally, it includes the corporation's principal office address, the name and address of the registered agent, and the number of shares the corporation is authorized to issue. It also allows you to specify the purpose of your corporation, whether it's for profit or nonprofit activities. Filing this form is a critical step in ensuring your business is recognized legally, paving the way for future operations, compliance, and growth. Understanding the components of the Articles of Incorporation is vital for any entrepreneur looking to establish a solid foundation for their business in Connecticut.

Documents used along the form

When forming a corporation in Connecticut, several documents are essential alongside the Articles of Incorporation. Each document serves a specific purpose and contributes to the overall compliance and operation of the corporation. Below is a list of commonly used forms and documents.

- Bylaws: This document outlines the internal rules and procedures for managing the corporation. Bylaws govern the conduct of meetings, the roles of officers, and the rights of shareholders.

- Residential Lease Agreement: For those entering into a rental agreement, it is crucial to complete a Residential Property Lease Contract to ensure clarity regarding the terms of the lease.

- Initial Report: Connecticut requires an initial report to be filed shortly after incorporation. This report provides updated information about the corporation, including its address and principal officers.

- Employer Identification Number (EIN) Application: An EIN is necessary for tax purposes. This number is used to identify the corporation when filing taxes and opening bank accounts.

- Business Licenses and Permits: Depending on the type of business, various licenses and permits may be required at the local, state, or federal level to operate legally.

- Shareholder Agreements: This document outlines the rights and responsibilities of shareholders. It can include provisions on the transfer of shares, voting rights, and dispute resolution.

These documents are vital for establishing a solid foundation for your corporation. Ensuring that all necessary forms are completed and filed correctly will help facilitate a smoother operation and compliance with state regulations.

More Connecticut Templates

Durable Power of Attorney Ct - Some people create a General Power of Attorney as part of estate planning.

For those navigating their legal affairs, a reliable resource for understanding the necessary steps for creating a Power of Attorney is crucial. This document can empower individuals to designate trusted representatives for important financial or legal decisions.

Ct Quit Claim Deed - Clear identification of parties and property is crucial for validity.

Similar forms

The Articles of Incorporation form in Connecticut shares similarities with the Certificate of Incorporation, which is often used interchangeably in various states. Both documents serve as foundational legal instruments that establish a corporation’s existence. They typically include essential information such as the corporation’s name, purpose, registered agent, and the number of shares authorized. The primary difference often lies in the terminology used, but the underlying function remains the same: to formally register a corporation with the state.

Another document akin to the Articles of Incorporation is the Bylaws. While the Articles outline the basic framework and structure of the corporation, the Bylaws provide detailed rules and procedures for the internal governance of the corporation. This includes information about the roles of officers, the process for holding meetings, and how decisions are made. Together, these documents ensure that the corporation operates smoothly and in accordance with both state laws and its own internal policies.

The Operating Agreement is similar to the Articles of Incorporation, particularly for Limited Liability Companies (LLCs). While the Articles serve to create the LLC, the Operating Agreement outlines how the LLC will be managed and the rights and responsibilities of its members. It acts as a guide for operations, ensuring that all members are on the same page regarding management and profit distribution. This document is crucial for maintaining clarity and reducing conflicts among members.

The Statement of Information is another document that complements the Articles of Incorporation. This document provides updated information about the corporation, such as its principal office address and the names of its officers. While the Articles of Incorporation are filed once to establish the corporation, the Statement of Information is typically required to be filed periodically, ensuring that the state has current information about the corporation’s operations.

In some cases, a business may also need to file a Certificate of Good Standing. This document verifies that the corporation is legally registered and compliant with state regulations. It is often required for various business transactions, such as securing loans or entering into contracts. While the Articles of Incorporation initiate the corporation, the Certificate of Good Standing confirms its ongoing legitimacy and compliance with state laws.

The Partnership Agreement is another document that bears resemblance to the Articles of Incorporation, particularly for partnerships. This agreement outlines the terms of the partnership, including the roles of each partner, profit sharing, and dispute resolution. While the Articles of Incorporation establish a corporation, the Partnership Agreement serves a similar purpose for partnerships, ensuring that all parties understand their obligations and rights within the business structure.

Incorporating a business often requires a Tax Identification Number (TIN) application, which is similar in purpose to the Articles of Incorporation. While the Articles establish the legal entity, the TIN is essential for tax purposes. It allows the corporation to open bank accounts, hire employees, and file taxes. Both documents are critical for ensuring that the business operates within legal frameworks and fulfills its tax obligations.

When managing property, it's essential to consider various legal forms that can streamline processes for you and your beneficiaries. One such important document is the Transfer-on-Death Deed form, which allows property owners to designate beneficiaries to receive their real estate upon their death, thus bypassing the often burdensome probate process. Understanding how these documents work together can significantly simplify asset management and distribution.

Lastly, the Business License is a document that, while not directly similar, is necessary for legal operation. This license permits the corporation to conduct business within a specific jurisdiction. While the Articles of Incorporation create the corporation, the Business License ensures that it can legally operate in its chosen location. Both documents are vital for compliance with local laws and regulations.

Important Questions on This Form

What is the Connecticut Articles of Incorporation form?

The Connecticut Articles of Incorporation form is a legal document that establishes a corporation in the state of Connecticut. This form outlines essential information about the corporation, including its name, purpose, registered agent, and the number of shares it is authorized to issue. Completing this form is a critical step in the process of forming a corporation, as it officially registers the entity with the state.

Who needs to file the Articles of Incorporation?

Any individual or group wishing to start a corporation in Connecticut must file the Articles of Incorporation. This includes businesses of various types, such as for-profit corporations, non-profit organizations, and professional corporations. It's important to ensure that the chosen business structure aligns with the intended operations and goals of the organization.

What information is required on the form?

The form requires several key pieces of information. You will need to provide the corporation's name, which must be unique and distinguishable from other registered entities in Connecticut. Additionally, you must include the corporation's purpose, the address of its principal office, the name and address of the registered agent, and the number of shares the corporation is authorized to issue. Other optional details may also be included, depending on the specific needs of the corporation.

How do I submit the Articles of Incorporation?

To submit the Articles of Incorporation, you can file the form online through the Connecticut Secretary of State’s website or submit a paper form by mail. If filing online, follow the prompts on the website to complete the submission process. For paper submissions, ensure that the form is filled out completely and accurately, and send it to the appropriate address along with the required filing fee.

What is the filing fee for the Articles of Incorporation?

The filing fee for the Articles of Incorporation in Connecticut varies depending on the type of corporation being formed. As of October 2023, the fee for a standard for-profit corporation is typically around $250. Non-profit corporations may have different fees. It's advisable to check the Connecticut Secretary of State's website for the most current fee schedule before submitting your application.

How long does it take for the Articles of Incorporation to be processed?

The processing time for the Articles of Incorporation can vary. Generally, if you file online, you may receive confirmation of your filing within a few business days. Paper submissions may take longer, often up to several weeks, depending on the volume of applications being processed. To expedite the process, ensure that all information is complete and accurate before submission.

What happens after my Articles of Incorporation are approved?

Once the Articles of Incorporation are approved, your corporation is officially formed. You will receive a Certificate of Incorporation from the state, which serves as proof of your corporation's existence. After this, you should focus on obtaining any necessary business licenses, setting up your corporate governance structure, and fulfilling any ongoing compliance requirements to maintain your corporation in good standing.

Misconceptions

Understanding the Connecticut Articles of Incorporation form is essential for anyone looking to start a business in the state. However, several misconceptions can lead to confusion. Below is a list of common misunderstandings.

- All businesses must file Articles of Incorporation. Not every business entity requires Articles of Incorporation. Sole proprietorships and partnerships, for instance, do not need to file this document.

- The form is only for large corporations. This is not true. Small businesses and startups can also benefit from filing Articles of Incorporation to establish their legal identity.

- Filing Articles of Incorporation guarantees business success. While it is a necessary step for legal recognition, it does not ensure profitability or market success.

- Once filed, Articles of Incorporation cannot be changed. This is a misconception. Amendments can be made to the Articles of Incorporation if the business needs to change its structure or purpose.

- The filing process is the same for all states. Each state has its own requirements and procedures for filing Articles of Incorporation. Connecticut has specific guidelines that must be followed.

- Articles of Incorporation are the same as a business license. These documents serve different purposes. Articles of Incorporation establish a corporation's existence, while a business license permits operation within a jurisdiction.

- You can file Articles of Incorporation without a registered agent. This is incorrect. A registered agent is required to receive legal documents on behalf of the corporation.

- The form can be filed at any time. There are specific times when filing is most beneficial, such as at the start of a new business venture or when making significant changes.

- Filing is a one-time process. Businesses must keep their Articles of Incorporation up to date and file periodic reports as required by the state.

By clarifying these misconceptions, individuals can better navigate the process of incorporating a business in Connecticut.

Dos and Don'ts

When filling out the Connecticut Articles of Incorporation form, careful attention to detail is crucial. Here are five important do's and don'ts to consider:

- Do ensure that you have a clear understanding of your business structure before completing the form.

- Do include the correct name of your corporation, ensuring it complies with state naming requirements.

- Do provide accurate information regarding the registered agent and office address.

- Do review the form thoroughly for any errors before submission.

- Do file the form with the appropriate fee to avoid delays in processing.

- Don't leave any required fields blank, as this may result in rejection of your application.

- Don't use abbreviations or informal names that do not match your business's legal name.

- Don't forget to check for any additional documents that may be required for your specific type of corporation.

- Don't submit the form without verifying that all information is up to date and accurate.

- Don't overlook the importance of keeping a copy of the submitted form for your records.

Detailed Guide for Writing Connecticut Articles of Incorporation

Once you have the Connecticut Articles of Incorporation form in hand, you are ready to proceed with filling it out. Completing this form is an essential step in establishing your corporation. After submitting it, you will receive confirmation from the state, allowing you to move forward with your business activities.

- Start by providing the name of your corporation. Ensure it complies with state requirements, such as being unique and not misleading.

- Enter the principal office address. This should be a physical address where your corporation will conduct business.

- List the purpose of your corporation. Be clear and specific about the business activities you intend to pursue.

- Indicate the total number of shares the corporation is authorized to issue. Specify the par value of each share if applicable.

- Identify the name and address of the registered agent. This individual or business will receive legal documents on behalf of your corporation.

- Provide the names and addresses of the incorporators. These are the individuals responsible for filing the Articles of Incorporation.

- Sign and date the form. Ensure that the signatures are from the incorporators listed.

- Review the completed form for accuracy. Check that all required fields are filled out correctly.

- Submit the form to the Connecticut Secretary of State, along with any required fees. Confirm the submission method, whether online or by mail.